Secular Themes Review April 4th 2022

In 2020 I began a series of reviews of longer-term themes which will be updated going forward on the first Friday or Monday of every month. These reviews can be found via the search bar using the term “Secular Themes Review”.

“Play along to get along” has been the default strategy for global peace over the past thirty years. The default proposition was that if we concentrate on commerce, and all grow wealthy together, there was no real need to focus on our political differences. Under that system globalization flourished.

A just in time global supply chain allowed components to be made in a host of different countries, assembled in China and exported to the world. The demise of subsidy regimes allowed commodities, particularly agriculture products, to be produced in the lowest cost regions and exported to the globe. The internet has allowed the dissemination of know-how and services like never before.

In attacking Ukraine, Russia expressed a willingness to risk being cut off from much of the global economy. Regardless, of any other motive, Russia’s invasion of Ukraine is a gamechanger for the global order. With evidence of war crimes emerging, the chances of Russia being welcomed back into the global trading community are growing progressively more distant. We are back in an “Us versus them” global environment.

That’s going to take time to get used to and many emerging markets will attempt to plot a route between them. As if that were not complicated enough there are significant cross currents from the technology, inflation and climate themes that muddy the outlook.

Throughout history gold was viewed as a store of value and was the basis for currency trading until quite recently. The evolution of the internal combustion engine, chemicals and plastics greatly enhanced the role of oil in the global economy. When the USA closed the gold window, the petrodollar system emerged soon afterwards. That substituted oil in as a store of value that was universally fungible.

Russia is now buying gold again and is willing to make purchases at RUB5000 an ounce. That’s helped support the ruble, so that it now sits at about the same as the cost of one gram. A major sovereign, like Russia, accumulating reserves is a tailwind for the gold price. The fact NATO sanctioned Russia’s reserves is also a wakeup call for other governments. They will be eager to both increase reserves outside Dollars and hold those assets domestically.

Gold continues to firm within its range as it consolidates below the all-time peak.

Gold shares continue to test the upper side of a first step above their base formation.

Gold shares continue to test the upper side of a first step above their base formation.

Inflation was running hot before the invasion because of the excessive money printing during the pandemic. It went into overdrive as commodity prices respond to the war. That’s forcing central banks to think about how they can control inflation without causing recessions. Russia’s primary bet is Western economies are ill prepared for hardship so they will be much more willing to negotiate if they experience recessions. By flexing its commodity/energy export dominance it is seeking to exert influence over the whole continent.

As a major commodity exporter, Russia’s products will find willing buyers, the only question is at what price? Egypt’s emerging food crisis is one of the first examples. They are not going to be picky about who they buy wheat from regardless of what Russia does in Ukraine.

India has one of the fastest growing economies in the world but also has to keep a lid on inflation. Oil costs are a perennial challenge for the economy, and they have an historically close relationship with Russia. That’s another example of how willing buyers will emerge for commodities trading at a discount.

That suggests tightness in some commodity markets is likely to be more of a local rather than a global problem.

China is, so far, attempting to plot a course between Russia and NATO. The overture to US regulators, allowing the SEC access to Chinese company audits, is a major concession which suggests China values access to the global capital markets.

.png)

The Nasdaq-100 continues to pause in the region of the 200-day MA; having unwound about half the decline from the November peak.

The Invesco Golden Dragon ETF posted an upside weekly key reversal early last month and is now testing the medium-term sequence of lower rally highs.

China currently has domestic issues that necessitate minimizing international uncertainty. The rising tide of COVID cases in Shanghai, Jilin and Fujian are a threat to the economy which is already suffering from demise of property developers.

The USA’s 2-year swap rate is above China’s. That suggests pressure is likely to come to bear on the Renminbi even before the government acts to preserve economic growth.

Ultimately, China is the major consumer of commodities. It makes sense for them to wish to price imports in Renminbi. That trend is already underway, and imports of Russia exports are likely to trend higher on a secular basis.

The Renminbi has been quite steady over the last few months but from an international perspective, the currency has been appreciating versus its main trading partners for decades. One of the primary reasons China does not wish to print aggressively is so they can ensure the currency remains steady.

The Renminbi has been quite steady over the last few months but from an international perspective, the currency has been appreciating versus its main trading partners for decades. One of the primary reasons China does not wish to print aggressively is so they can ensure the currency remains steady.

Inflation is becoming a political liability. Releasing one million barrels a day from the USA’s strategic reserve is one example of the action being taken to combat it. So is the willingness of the Federal Reserve to talk about aggressively hiking rates.

Since neither the ECB nor Bank of Japan are eager to remove accommodation in the hurry, the Dollar continues to trend higher. That will remain the case as long as quantitative tightening remains a purely US affair.

.png)

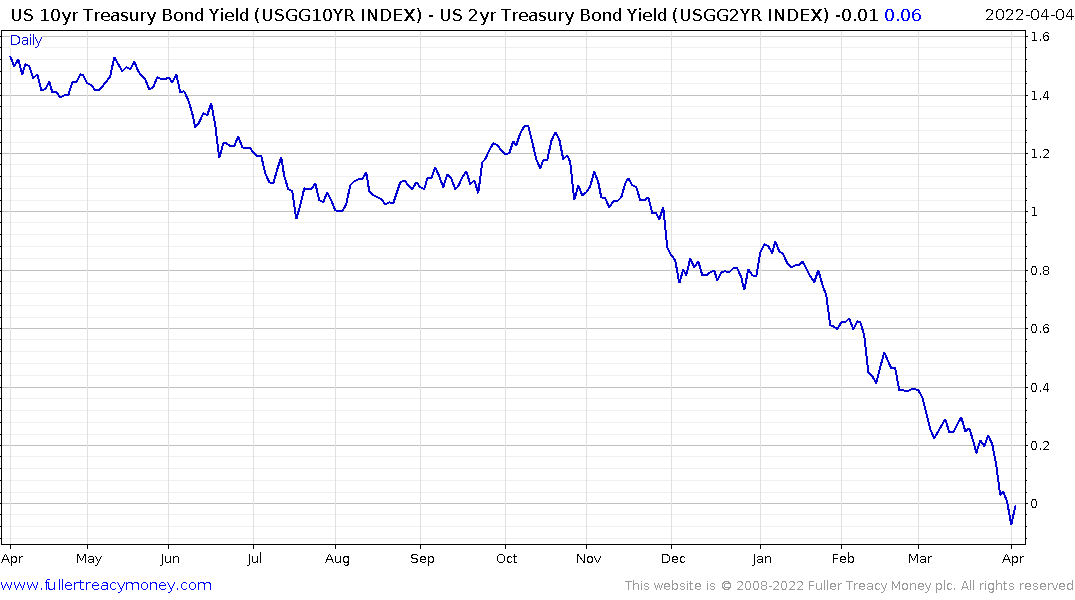

The 10-2-year yield curve has inverted. The 10-year – 3-month is still trending higher. Inflation has fueled demand for short-dated issues and compressed yields at the very short end of the curve. Interest hikes will be required to change that situation. That suggests the most interest rates can possibly rise is 175 basis points before a recession begins. Considering the quantity of debt outstanding, I believe the economy will buckle well before the Fed has raised rates by that much.

The Federal Reserve has talked itself into raising rates. They are likely to raise rates again in May unless there is a meaningful move lower in the stock market.

Japan went through an epic bull market and has been unable to get off the zero bound for decades. Europe did not write off the debts from the sovereign wealth crisis and has been unable to raise rates since. Considering how large the debts and unfunded liabilities are, the USA is now running the risk of Japanisation too.

The intensity of oil use in developed economies has been falling for decades. At the same time, the declining purchasing power of fiat currencies has reduced the influence of oil on the economy. Today’s service oriented digital economy runs largely independently of the energy sector. That raises an additional important question. Is data going to become commoditized to such an extent that it overwhelms oil’s dominance of the global economy?

That’s only going to be possible if energy independence becomes a global reality. The USA was able to achieve energy independence over the last decade. That has at least partially insulated the economy from recent energy market volatility. Europe now looks likely to do whatever is necessary to become energy independent.

NATO’s desire to become independent of Russian oil, gas and coal imports means they need to develop alternative supply and energy resources. That means boosting imports from other regions and substituting in copper, steel, lithium, nickel, cobalt, manganese, hydrogen, ammonia and uranium wherever possible.

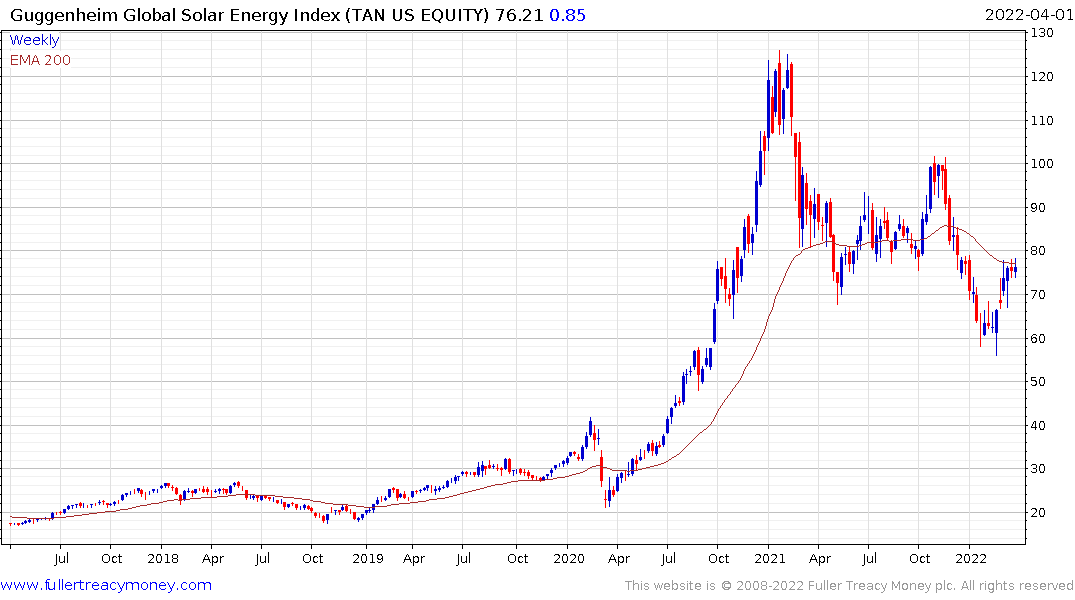

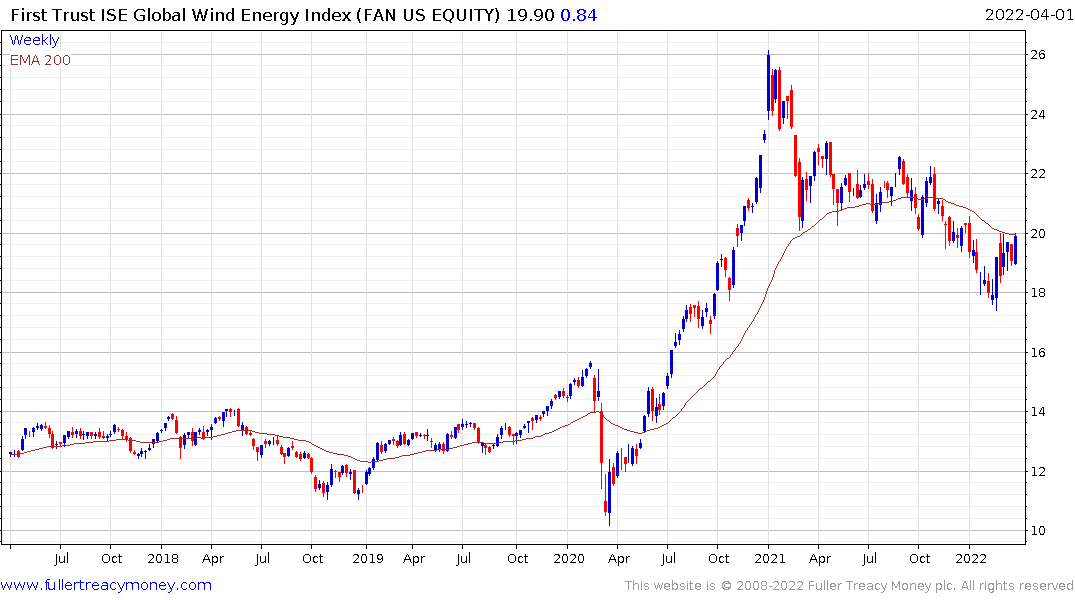

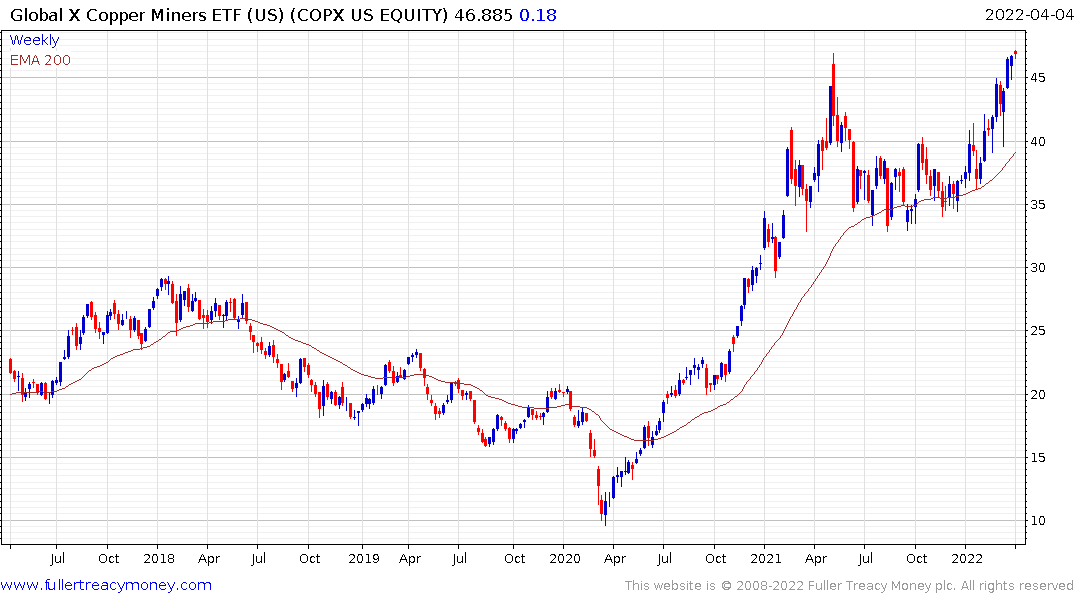

That’s the primary rationale for championing the secular demand growth story for copper, solar and wind.

Copper continues to consolidate in the region of the all-time peak and both wind and solar are on recovery trajectories.

Copper miners have a similar pattern.

Copper miners have a similar pattern.

.png) The Global X Uranium ETF continues to consolidation following its base formation completion.

The Global X Uranium ETF continues to consolidation following its base formation completion.

Coal is the big near-term beneficiary even because the infrastructure already exists and can easily be ramped up.

Arch Coal, Peabody Energy and others are breaking out.

.png) Bumi Resources went through a debt for equity swap in February. The share is now rebounding.

Bumi Resources went through a debt for equity swap in February. The share is now rebounding.

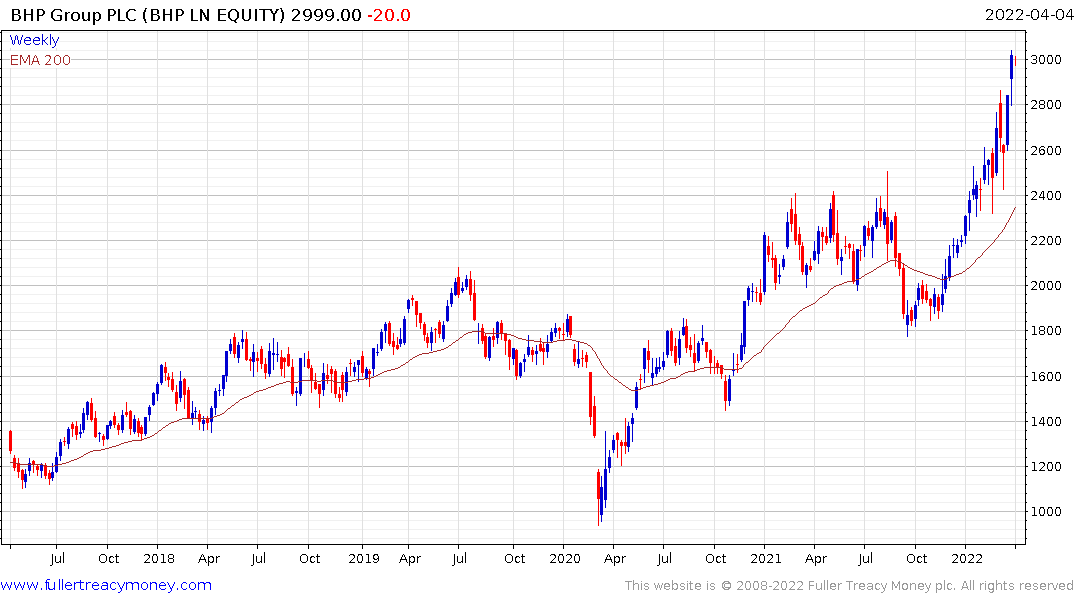

BHP Billiton continues to extend its breakout.

BHP Billiton continues to extend its breakout.

.png)

The Blackrock World Mining Trust is back testing its highs from back in 2008 and 2011. Some consolidation appears to be underway amid a short-term overbought condition.

.png)

Resources in friendly countries will be more attractive because of security of supply. Brazil has been aggressively raising rates and is a major exporter of everything the world needs. The Real has broken out of a two-year base formation to signal a return to medium-term demand dominance.

.png) Brazil enjoyed a decade of global acclaim and influence during the last commodity bull market. It’s quite likely to be a leader in the next one too.

Brazil enjoyed a decade of global acclaim and influence during the last commodity bull market. It’s quite likely to be a leader in the next one too.

.png)

Fertiliser companies continue to thrive. Mosaic, Nutrien and Bayer continue to extend their breakouts.

.png)

Bitcoin is championed by its advocates as a hard money instrument because it has limited supply and is not controlled by any government. It’s still the largest of the cryptocurrencies and the price is currently easing back from the region of the trend mean.

Every global hegemon ultimately wishes to control the currency. Digital currencies backed by the productive capacity of their respective economies and preserved from the willingness of politicians to print to fund pet projects are a viable solution somewhere out in the future. They are unlikely to be adopted voluntarily but will be forced on governments because of currency crises.

At present bitcoin is a liquidity barometer. Rising rates and quantitative tightening restrict the liquidity bitcoin needs to prosper. The total assets of central banks are now trending lower. That’s not great news for bitcoin and is a near-term headwind for stocks as well.

The Nasdaq remains firm Chinese tech companies are unwinding deep oversold conditions and Tesla’s deliveries surprised on the upside. Equities are also attracting interest because companies can raise prices, pay dividends and buyback stocks. They offer a hedge against inflation.

.png) The ARK Innovation ETF has bounced in line with renewed appetite for speculation.

The ARK Innovation ETF has bounced in line with renewed appetite for speculation.

The Total return on 10-year Treasury Futures broke downwards over the last month. Any semblance of a consistent trend is gone. Nevertheless, a short-term oversold condition is evident, so some steadier action is to be expected.

.gif)

The FANGMANT (Facebook/Meta Platforms, Apple, Netflix, Alphabet/Google, Microsoft, Amazon, Nvidia and Tesla) pulled back sharply for the first 10 weeks of 2022 and have staged an impressive rebound over the last month. This bull market will not end until these stocks lose their ability to surprise on the upside. A sustained move back below the trend mean will be required to signal a change of trend.

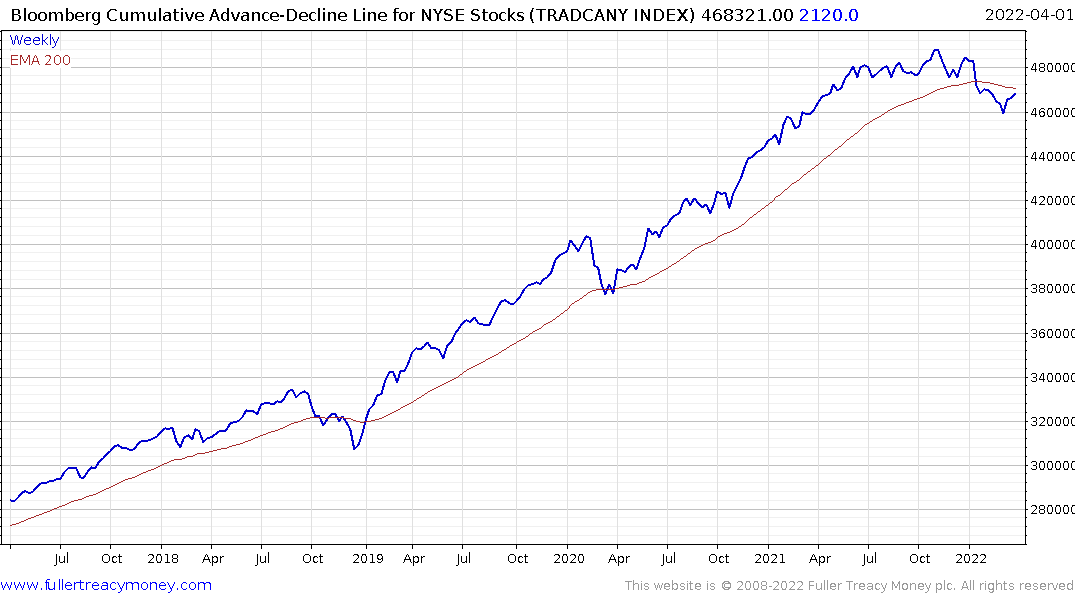

The Advance Decline Line for the NYSE broken below its 200-day MA for the first time since early 2019. This measure simply takes the number of falling stocks from the number of rising stocks on a cumulative basis every day. It has since rebounded to test the trend mean. It will need to sustain a move above it check supply dominance.

The Advance Decline Line for the NYSE broken below its 200-day MA for the first time since early 2019. This measure simply takes the number of falling stocks from the number of rising stocks on a cumulative basis every day. It has since rebounded to test the trend mean. It will need to sustain a move above it check supply dominance.

It’s important to monitor because when it is trending lower, most shares are posting negative returns on successive days. Its strength is often viewed as the backbone of a bull market. When it trends lower, it is warning that medium-term corrections can turn into meaningful peaks.

US banks are now underperforming. Banks are liquidity providers so when they underperform it is a signal that liquidity conditions are tightening.

US banks are now underperforming. Banks are liquidity providers so when they underperform it is a signal that liquidity conditions are tightening.

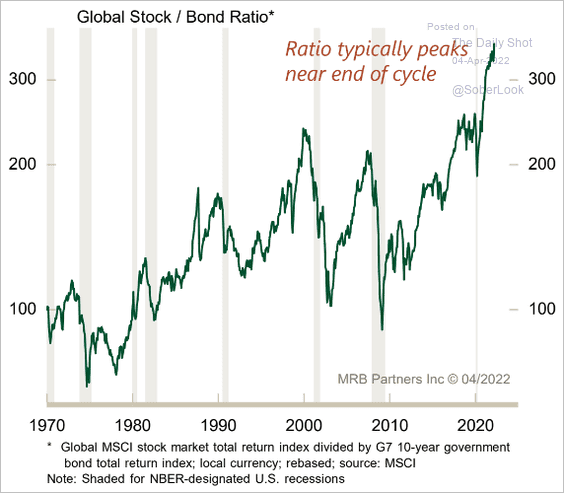

If we try to put this in context. There are many challenges on the global stage right now from geopolitics to inflation and debt. With an inverted yield curve, we can expect a recession at some point in the next 18 months. My guess is sometime in 2023.

Between now and then we can expect commodities to continue to lead on the upside. Large cap growth (FANGMANT) and bitcoin are important barometers of risk appetite, while banks are an additional indication that we are late in the cycle. That implies the economic/stock market cycles will be shorter and more volatile than we have been used to over the last couple of decades.

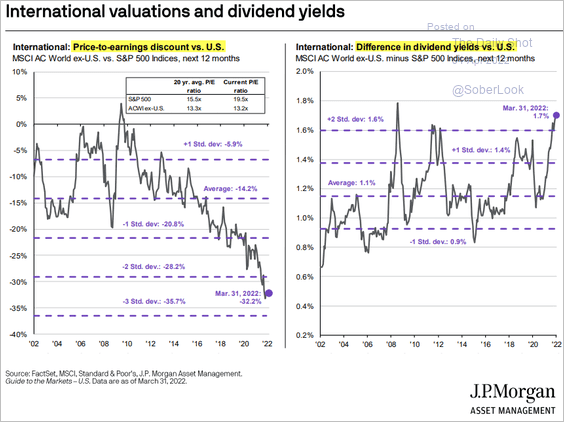

Europe and Japan are trading at historic valuation discounts relative to Wall Street. That’s a powerfully attractive factor but is unlikely to attract much attention until Wall Street definitively rolls over.