Email of the day - on gold, governance, trading, and uncertainty

A bad back currently prevents me golfing, walking the dog, or driving the car and, in my opinion justifiably, I am feeling a grumpy.

So here are a few gripes for you:

First gold:

For several years you taught us that the gold price follows an approximate 35-year cycle between highs, although the gold price could outpace stock indexes for short periods in between those highs. We’ve not heard too much about the 35-year cycle for a while, the message now being that it is not unusual for gold to trade in a boring range for up to 18 months or so before breaking out conclusively up or down. You believe it will break to the upside taking out previous highs (which runs contrary to your 35-year cycle theory). I hold a fair chunk of gold and silver miners in ETFs but regard the holding as a hedge rather than representing a belief that gold will imminently break to the upside. It might and it would be nice if it did but I doubt it. As David said, investment options are similar to a beauty parade and for the foreseeable future, many options are likely to look superior to gold.Second India v China:

You are very hard on China and its political system. Having lived most of my life in Asia I take a less severe view. Like most observers I was disappointed to see that XI, the reformer, had no intention of political reform but on reflection, I think he’s probably right to opt for political stability at a time when China is still struggling to bring modernity to all its people and regions; when lightening-speed technological change is taking place across the globe and when it finds itself in an inevitable struggle to assert what it regards as its rightful influence on global institutions and practices. On a smaller scale in Singapore Lee Kuan Yew did much the same thing and while there is now a little more political tolerance in Singapore than there was, the Government – and most of its people – believe that full-throated democracy would lead to economic and societal break-down. That would be Xi’s worst nightmare.My grouse is not so much with your view on China but with your uncritical view of India. I agree with you that India should do well given its demographic advantage and talents of its people. However, I think the Modi government is quite repugnant in its covert – and not so covert – support of extremist Hindu nationalism represented by terrorisation of the Muslim and Christian communities, and by its appalling failure to do much about the abuse of women, also fuelled by Hindu extremists. In the medium term, I fear this, together with over-dependence on coal, will limit India’s investment appeal and therefore its economic potential.

To declare my investment positions, I have reduced my exposure to India and wait for an opportunity to reinvest in China. My favourite Asian market currently is Vietnam.

Third, the purpose of your ‘service’:

Under David’s direction, Fuller Money provided objective macro oversights together with some trading suggestions/recommendations and some investment suggestions/recommendations. He often put his money where his mouth was and invested in his recommendations. Towards the end of his career, he stopped publishing his investment portfolio which I regarded as a pity. Under your direction, Fuller-Treacy Money continues to provide objective (if sometimes convoluted and long-winded) macro oversights, but I find it difficult to work out whether beyond that you are offering trading hints or investment hints. I use the word ‘hints’ rather than ‘suggestions’ because in this aspect you are far more non-committal on specifics than was David. The details you provide of your own investment activities suggest that you are a trader with long(ish) term investments in gold bullion, gold miners and Rolls Royce. I made several profitable purchases based on David’s recommendations but so far have identified none under your watch.Fourth Daily Audio and Video:

From emails you have referred to from other subscribers, I am confident that I am not alone in being irritated by several of your constant refrains. Three which particularly annoy me are ‘The big question is ….’ (to which we never get an answer); ‘[Gold (for example) has a lot of work to do’ (which is a nonsense, better to identify factors which might influence buying/selling decisions) and; ‘I can’t talk and chew gum at the same time’ (which sounds quite catchy heard for the first time, but grates increasingly after many repetitions).So, getting that off my chest makes me feel slightly less out of sorts. I shall be renewing my subscription in March. It’s been part of my routine for too long.

Thank you for this detailed email, your long-term support and I hope you back feels better soon. If it is muscular, rather than a herniation, I strongly recommend Yunnan Baiyao. I’ve pulled muscles in my lower back on several occasions either playing tennis or lifting. If it is taken quickly after injury, it provides a powerful, quick solution with no side effects I have experienced.

I began questioning the wisdom of relying on the Dow/Gold ratio during the early stages of the pandemic. Here is a link to Comment of the Day on April 24th 2020. It includes a large number of long-term ratios and concluded that the Dow Jones Industrials Average is no longer the best way to look at the long-term ratio, confirmed concentration of attention in the growth sector, predicted the recovery in oil prices, higher wages, and the return of inflation.

I was comfortable talking about the 35-year cycle in the Dow/Gold ratio for nearly a decade but as you point out, I have not mentioned it more recently. The pandemic has been a major catalyst for change and this raises more questions than answers I’m afraid.

I don’t feel the same confidence today in the stock market as I did when I recommended the autonomies in 2012, wrote Crowd Money and agreed to launch the Autonomies fund. I apologise if I am not more forthright in my views but I strongly believe markets are at a major multi-year inflection point. There is more uncertainty about the long-term outlook today than at any point in the last 20 years. That’s comes across in the video because there are more questions than answers.

Valuations are very high. Inflation continues to surprise on the upside, despite predictions to the contrary, and wage growth is ramping higher. In this environment commodities should do well and they are.

However, it is not like we need to find new oil. The strength in prices today is about a reluctance to invest in production of known reserves. This is a strong position for oil producers and highlights the gap between aspirations and delivery of renewable solutions. The large backwardation in crude oil reflects a short-term supply shortage so the risk remains on the upside.

Copper is a supply inelasticity market. We need to invest in a lot more exploration to find the supplies needed to achieve long-term development goals. Again, there is a gap between aspiration and delivery. The secular trend argument depends on political decisions to spend the money needed to enable an energy transition. A lot of promises were made at COP26 but so far there has been little in the way of spending plans announced.

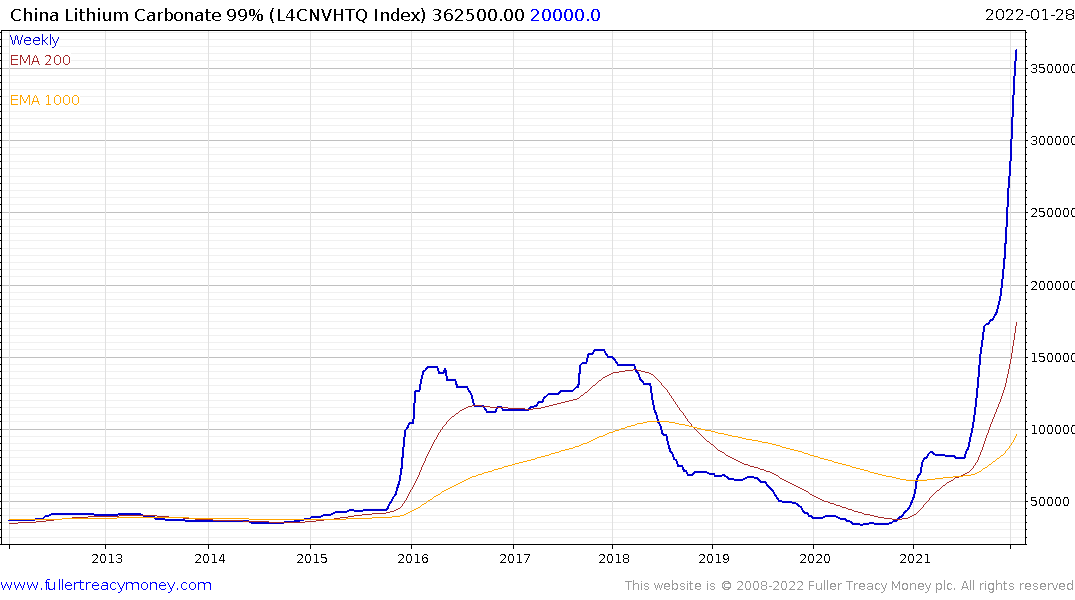

The lithium market initially surged in 2015 because of rising demand for batteries. Then supply overwhelmed demand because electric vehicle sales underwhelmed. Now lithium is surging against because of supply inelasticity. The market is delivering on the early promise, but after a six-year interval.

The big expectation is EVs will become cost competitive with internal combustion engines and the biggest cost is the battery. The cost of everything that goes into a battery is rising quickly so it begs the question whether EVs cost competition dates will need to be pushed back even further.

The answer to that question rests with technological innovation. Solid state batteries have a lot of promise but they do not appear ready for commercial reality yet. The clearest evidence of support for the energy transition is in the carbon emissions market. The EU wants higher prices to encourage substitution so they are forcing migration without having to pay for it upfront. That’s part of a long-term strategy. The wisdom of this transition will be judged by future generations but it is a reality.

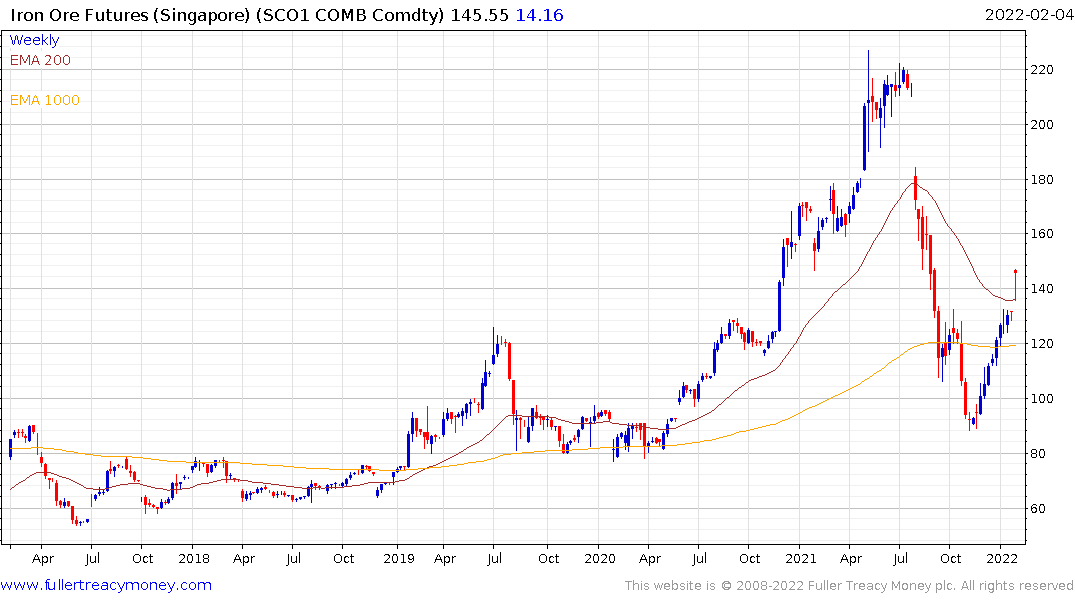

As the biggest consumer of industrial resources, what happens in China is going to be a big determinant of how the secular bull market for commodities plays out. Statements made by Xi Jinping before the Lunar New Year holiday suggests China is withdrawing from rapid reorientation of the power markets as they seek to ensure living standards are not impacted. That’s supporting iron-ore at present and should be positive for industrial resources after the Winter Olympics; which will bring the necessity for clean air over Beijing to an end.

As the biggest consumer of industrial resources, what happens in China is going to be a big determinant of how the secular bull market for commodities plays out. Statements made by Xi Jinping before the Lunar New Year holiday suggests China is withdrawing from rapid reorientation of the power markets as they seek to ensure living standards are not impacted. That’s supporting iron-ore at present and should be positive for industrial resources after the Winter Olympics; which will bring the necessity for clean air over Beijing to an end.

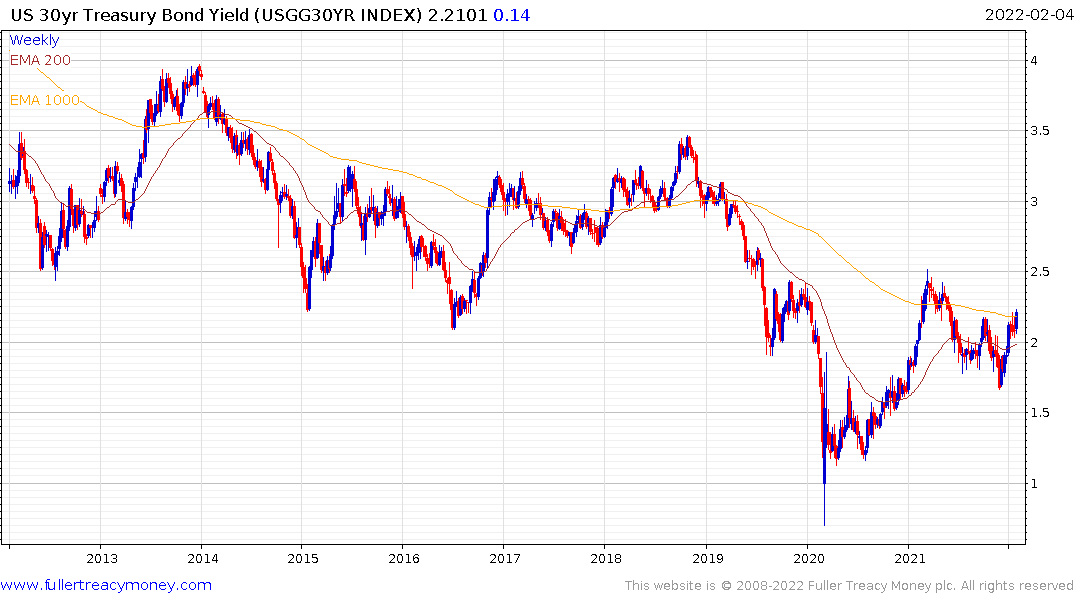

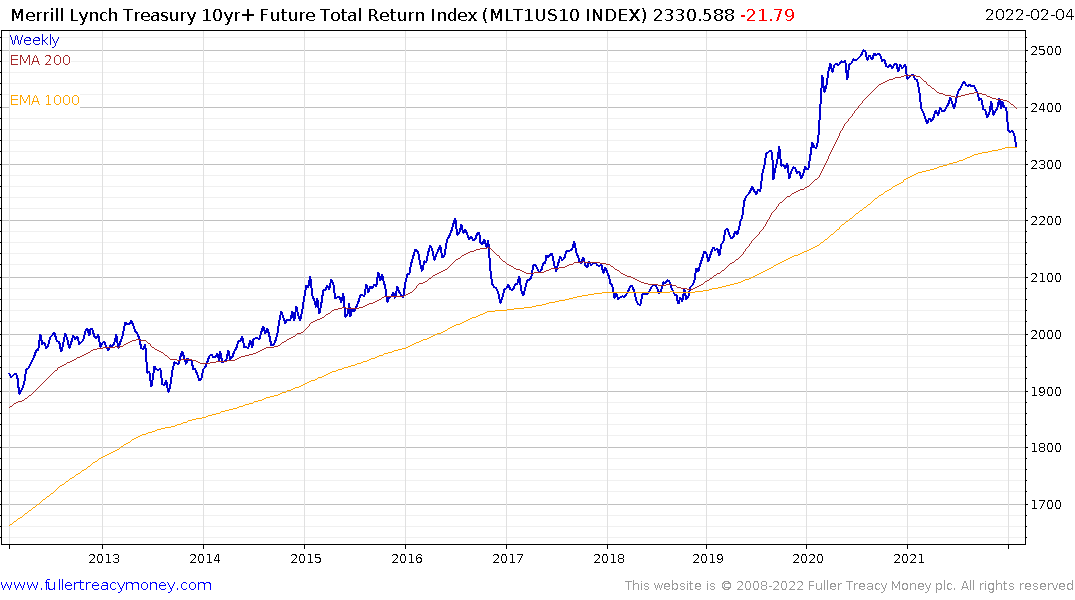

The simultaneous march of inflation is increasingly worrisome. 30-year Treasury yields are at 2.23% and the Japanese 30-year is trending towards the upper side of its base formation. The total return on the 10-year future is on the cusp of breaking its long-term 42-year uptrend. Every time it has come close to breaking in the past, it has rebounded. The outlook for the growth sector, zombie companies and fanciful valuations in private assets depends on yields turning lower soon.

Gold is in a bull market because we are in an uncertain environment and because the purchasing power of fiat currency is threatened with existential change. During gold bull markets lengthy consolidations and explosive breakouts are to be expected.

I agree, I am more of a trader than an investor. I like buying what I consider to be deep value when it is on sale. I bought investments in gold miners and Rolls Royce in the teeth of the pandemic because they were obviously on sale. I did not buy oil producers or India at the time because I did not know what was going to happen next with the pandemic.

I am short the Nasdaq-100 at present in my trading book. I view it as a hedge against the risk we see at least a 20% peak to trough decline on Wall Street, before the Federal Reserve changes its posturing about restricting liquidity and raising rates. If yields start to come back down, I will initiate long investment positions in oversold sectors. Hopefully, I will get attractive entry points in both India and copper miners.

Everything I see on the charts suggests we are in a new secular bull market for gold. That also implies we are in a period of financial repression where inflation will outstrip rises in interest rates over the lengthy medium term.

The stock market sectors that obviously do well in that environment skew towards real assets. There is always a place for innovative companies to provide solutions to the ills of the world, but not every company can fulfil that role. We are looking at a lot more dispersion in returns from the growth sector.

I concede I am harder on China’s governance than India’s. There is a good reason for that. China is a larger economy and further along in development. If the trend is to continue, governance needs to improve from here. The evidence over the last eight years has been that it is deteriorating.

India’s governance has taken a distinctly populist step. That is undeniable. However, it is coming from a lower stage of development and the trend of reform, infrastructure development and bureaucracy is positive over the last five years.

Governance is not an absolute, it’s a relative condition based on a country’s past trend. From an investment perspective India has been much more rewarding than China over the last 30 years. China has lots of innovative companies but one needs to tailor investments to the expected priorities of the government. That’s not conducive to long-term investing.

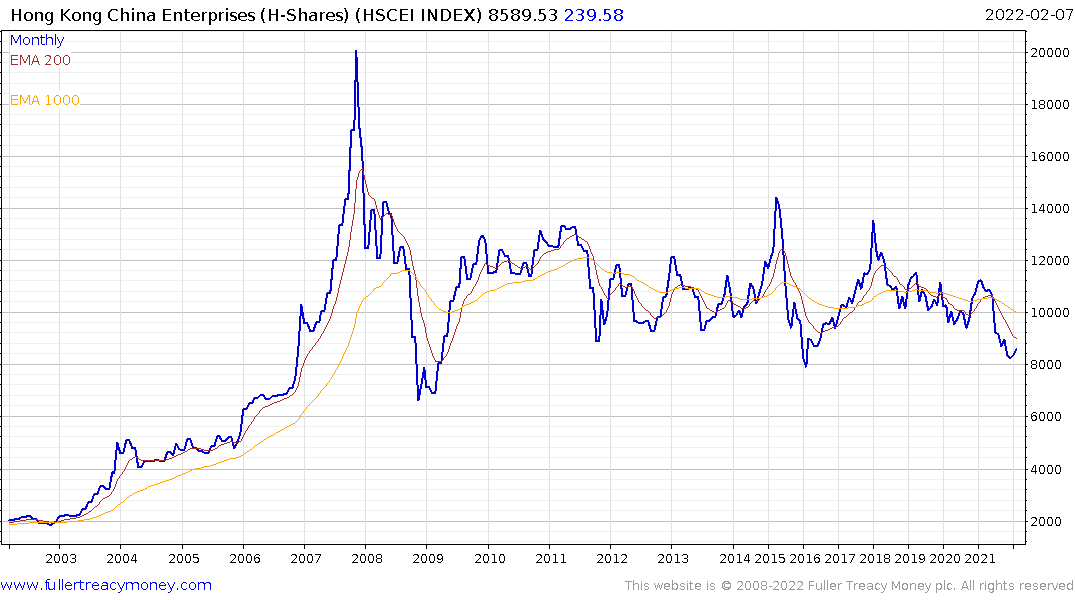

I continue to regard China as a trader’s market. From that perspective the H-share Index is at the lower side of its long-term range, so there is plenty of scope for a bounce. Lee Kwan Yew educated China’s Communist officials. He convinced them that opening up, and adopting good standards of governance are beneficial for everyone. Under Xi, the only lesson is economic development can work in service to sustaining single party rule.

I continue to regard China as a trader’s market. From that perspective the H-share Index is at the lower side of its long-term range, so there is plenty of scope for a bounce. Lee Kwan Yew educated China’s Communist officials. He convinced them that opening up, and adopting good standards of governance are beneficial for everyone. Under Xi, the only lesson is economic development can work in service to sustaining single party rule.

Singapore pioneered the big society goal. Every citizen is equal whether descended from Chinese, Malay, or Indian heritage. Can we say the same today in China?

It is looking increasingly likely that the pan-humanism of the post-Cold War era is over. We are all going to have to chose which sphere of influence we are most aligned with. That’s particularly relevant for Asia and Europe because they are politically aligned with the USA and economically aligned with China.

David only published new entries in his portfolio. In between, the most common complaint from subscribers was they did not know what we were trading or investing in. I maintain a running record of what my open positions are. I am not allowed by UK regulators to provide a full model or actual portfolio, without becoming subject to full compliance requirements. That is exceptionally expensive for an operation like ours. I feel some distress at the fact you have not found profitable opportunities from the commentary I provide over the last 3 years. I will endeavour to be clearer and more concise.

Back to top