Inflation in U.S. Builds With Biggest Gain in Prices Since 1990

This article for Bloomberg may be of interest to subscribers. Here is a section:

“We haven’t seen, I’ll say, any more resistance to our price increases than we’ve seen historically.” -- McDonald’s Corp. CFO Kevin Ozan, Oct. 27 earnings call

“Looking at Q4, we expect our selling price actions to continue to gain traction, as we work to mitigate the raw material and logistics inflationary pressures we have experienced throughout the year.” -- 3M Co. CFO Monish Patolawala, Oct. 26 earnings call

“We feel very comfortable that any inflation that is affecting our margin today, we have the ability to offset it.” - Chipotle Mexican Grill Inc. CFO John Hartung, Oct. 21 earnings

call

“We have now announced pricing in nine out of ten categories, so very broad based.” -- Procter & Gamble Co. CFO Andre Schulten, Oct. 19 earnings call

While most CPI categories rose, the cost of airfares declined for a fourth month and apparel prices were unchanged. Wages have strengthened markedly in recent months -- with some measures rising by the most on record -- but higher consumer prices are eroding Americans’ buying power.

Inflation-adjusted average hourly earnings fell 1.2% in October from a year earlier, separate data showed Wednesday.

The ability of companies to pass on inflation is a good reason why the stock market generally does well in the early portion of an inflationary cycle. The big question therefore is not whether they can successfully pass on one price increase but whether they can continue to pass on price increases should inflationary pressures trend higher.

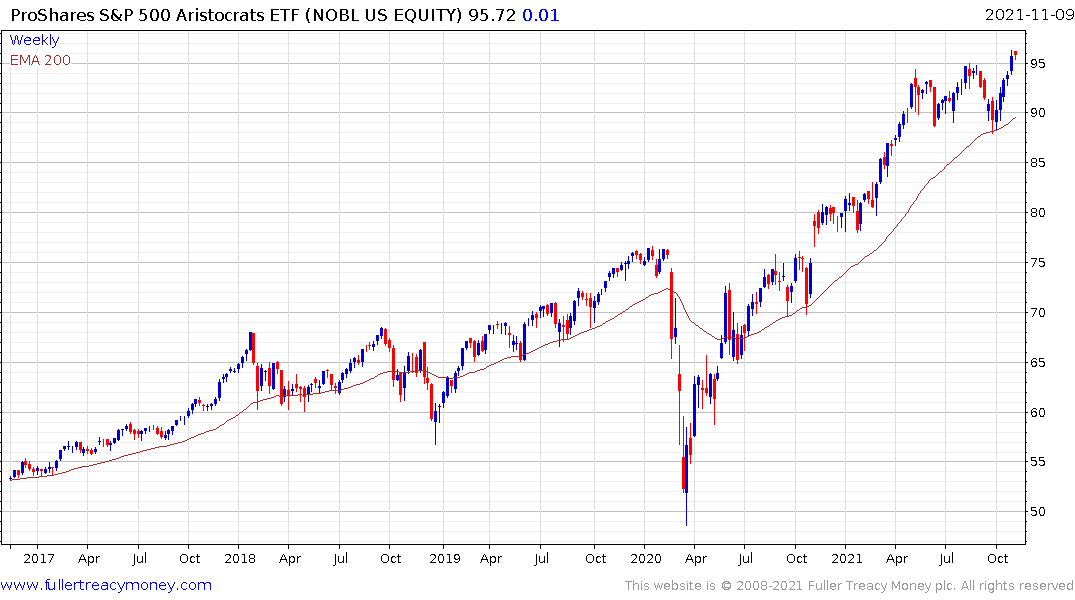

The ProShares S&P500 Dividend Aristocrats ETF broke out to new all-time highs last week.

Today’s downside key reversal on Brent crude oil, on increasing US supply, suggests energy price inflation may ease off over the next couple of months.

Today’s downside key reversal on Brent crude oil, on increasing US supply, suggests energy price inflation may ease off over the next couple of months.

Meanwhile, government bond investors remain nervous about inflation. The surge in 10-year yields today confirmed support in the region of the trend mean. A sustained move below 1.4% will be required to signal a return to demand dominance. Meanwhile there is a pronounced inclination to buy dips so inflationary pressures will need to remain elevated to sustain higher yields.

Meanwhile, government bond investors remain nervous about inflation. The surge in 10-year yields today confirmed support in the region of the trend mean. A sustained move below 1.4% will be required to signal a return to demand dominance. Meanwhile there is a pronounced inclination to buy dips so inflationary pressures will need to remain elevated to sustain higher yields.

The most interest rate sensitive portion of the market is likely to react most aggressively to any additional upward pressure on yields.