3. The words you should never say

Bill Mann: Do you think that there are opinions or beliefs in the market that you find to be particularly unhealthy for investors?

Howard Marks: The first thing (and I try to make this clear in the book, and it's essential if people are going to be able to deal with cycles) is everybody wants an easy answer. Everyone wants to know how long an upswing lasts. And the first step is you must dispense with any concept of regularity.

The whole book is based around Mark Twain's statement that history does not repeat but it does rhyme. When he says it doesn't repeat, in our case he wasn't talking about the market. He was talking about history. But the truth is market cycles vary one to the next in terms of their amplitude, their speed, their violence, their duration. It's all different. And so people want to know how long an upswing is and the answer is we absolutely can't tell them. So expecting regularity and, thus, predictability is wrong.

And then you can go from there to the whole concept of predictions. What makes the market go up and down? To a small extent it is what I call fundamental developments in the economy and the companies. But to a large extent it's psychology or, let's say, popularity. And it should be clear by now to everyone that the swings in popularity are unpredictable. And if they are, then most forecasts are not going to work.

So the next concept is that people say to me, "OK, when will the market turn down?" And I never answer a question that starts with the word "when." In the investment business, sometimes we know what's going to happen. We never know when. So I would dispense with that immediately.

You must accept the ambiguity in the situation and accept the need to live with uncertainty. And that's why in the book I say there are certain words that every good investor should drive out of his vocabulary. Things like never, always, must, can't, has to. These words are out. We can talk about likely events. We can talk about probabilities. More and less likely. But we can never say has to or won't.

Eoin Treacy's view - One of the biggest lessons from The Chart Seminar in my view is that it is senseless to tell the market what to do. It doesn’t listen. We need to foster the humility to allow the price action to unfold as it will and tailor our tactics accordingly. To do other than react to reality is to engage in fantasy.

At The Chart Seminar, we talk about distilling everything in the market down to two things. Money flows and crowd psychology. We use charts to monitor both. It is impossible to predict exactly where a top might appear but we can narrow the range down to when monetary policy is restrictive and investors are overenthusiastic.

The three primary trends are acceleration, a massive reaction against the prevailing trend and ranging, time and size. Let’s look at some examples.

Amazon has a history of accelerating. It’s half the reason people want to own the share. Every time it accelerates it has reverted to the mean so each of the accelerations is a minor trend ending. The primary consistency of the trend is it finds support in the region of the trend mean, consolidates for a while and rebounds. It has paused at big round numbers like $1000, $1500 and $2000 so the current pullback falls into the ‘normal’ category provided it finds support in the region of the trend mean.

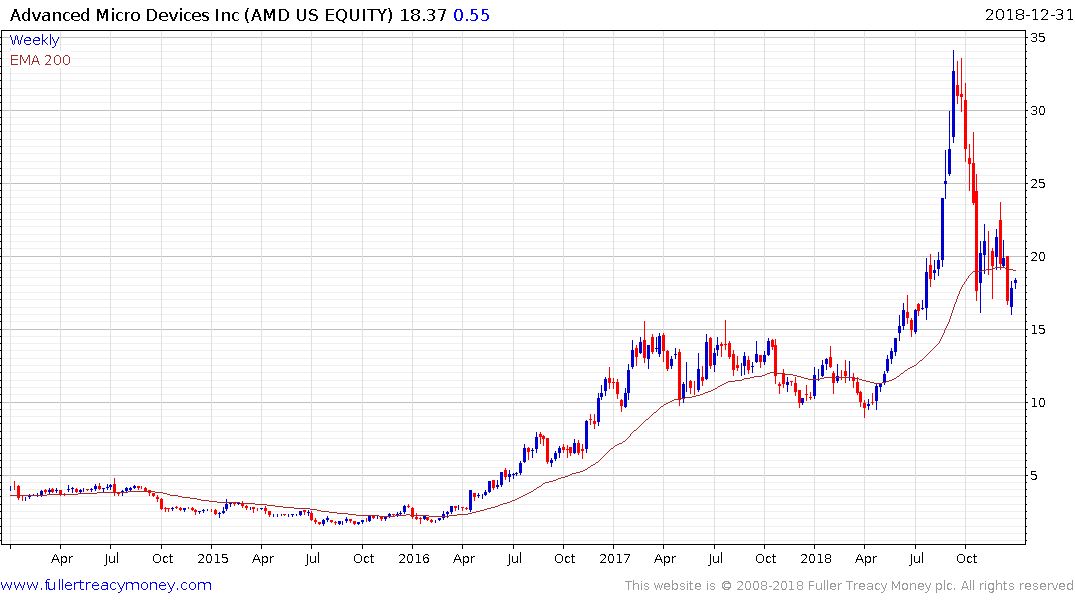

Microchip Devices has posted a massive reaction against the prevailing trend over the last few weeks. Prior to that it exhibited a loss of momentum, greater volatility and failed upside breaks which all constituted a lengthier range. The clear downward dynamic is a trend ending characteristic.

It is quite normal that after a Type-2 topping characteristic we see a range develop below the peak, which can be considered a period of right-hand extension or a first step below the top.

Oil ranged mostly between $100 and $120 between 2011 and the middle of 2014. That lengthy range corresponded with a high degree of confidence the $100 level would hold so when it declined below that level it triggered a lot stop and the price collapsed. The prior to formation was represented by ranging, time and size.

Meanwhile, Microsoft remains in a reasonably consistent medium-term uptrend, characterised by a succession of short-term ranges one above another. Provided the $100 level holds as an area of support during this reaction the trend can be considered consistent.

The next venue for The Chart Seminar will be in London on November 12th and 13th. Please contact Sarah at [email protected] to secure your place.

This section continues in the Subscriber's Area.

Back to top