Powell Sees Solid Economic Outlook as Rates 'Just Below' Neutral

This article by Christopher Condon for Bloomberg may be of interest to subscribers. Here is a section:

Federal Reserve Chairman Jerome Powell said interest rates are “just below” the so-called neutral range, softening previous comments that seemed to suggest a greater distance and spurring speculation central bankers are increasingly open to pausing their series of hikes next year.

Treasuries and stocks rose, as Powell’s “just below” comment tempered remarks he made last month that markets had interpreted to mean that a larger amount of tightening was likely. Speaking at an event on Oct. 3, Powell said that “we may go past neutral. But we’re a long way from neutral at this point, probably.”

In his speech Wednesday to the Economic Club of New York, Powell said the Fed’s benchmark interest rate was “just below the broad range of estimates of the level that would be neutral for the economy -- that is, neither speeding up nor slowing down growth.”

If rates are closer to what policy makers ultimately judge is the neutral level, that could signal the Fed will tighten monetary policy less than previously projected. Eurodollar futures pricing reacted to Powell’s comments, reflecting even firmer expectations that the Fed will hike only once next year.

Investors are on tenterhooks at the prospect of central bank balance sheet unwinding persisting indefinitely. Therefore, they are highly alert to any sign the Fed’s appetite for additional tightening is waning.

Right now, the central bank is raising rates and reducing the size of its balance sheet at the same time. If they wish to moderate their influence on markets the simple answer is to hike once more in December since that is what was indicated to markets. Following that they could make an announcement that rate hikes are on hold but the run off on the balance sheet will persist.

In the meantime, we are at the most seasonally attractive period of the year and a large number of stocks exhibit short-term oversold conditions. Potential for reversionary rallies are looking more likely than not on the primary indices.

At this stage it is worth highlighting the relative performance of the S&P500 compared to the Nasdaq 100. The tech dominated Nasdaq hit a new reaction low this month while the broader measure posted another higher reaction low. That suggests the rotation out of mega-cap tech remains a feature of this market and we should look elsewhere for outperformance.

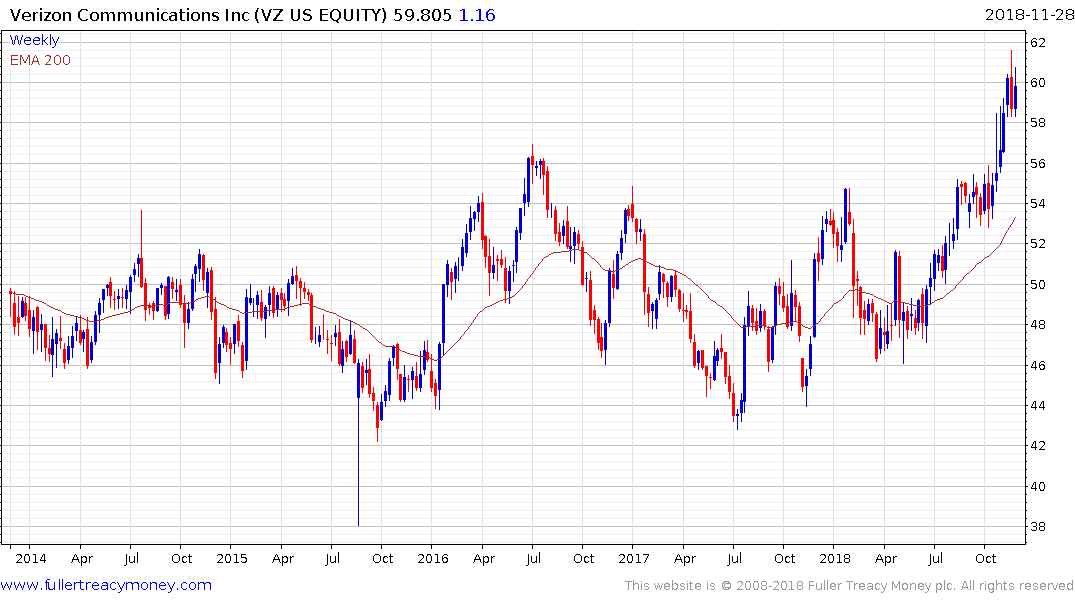

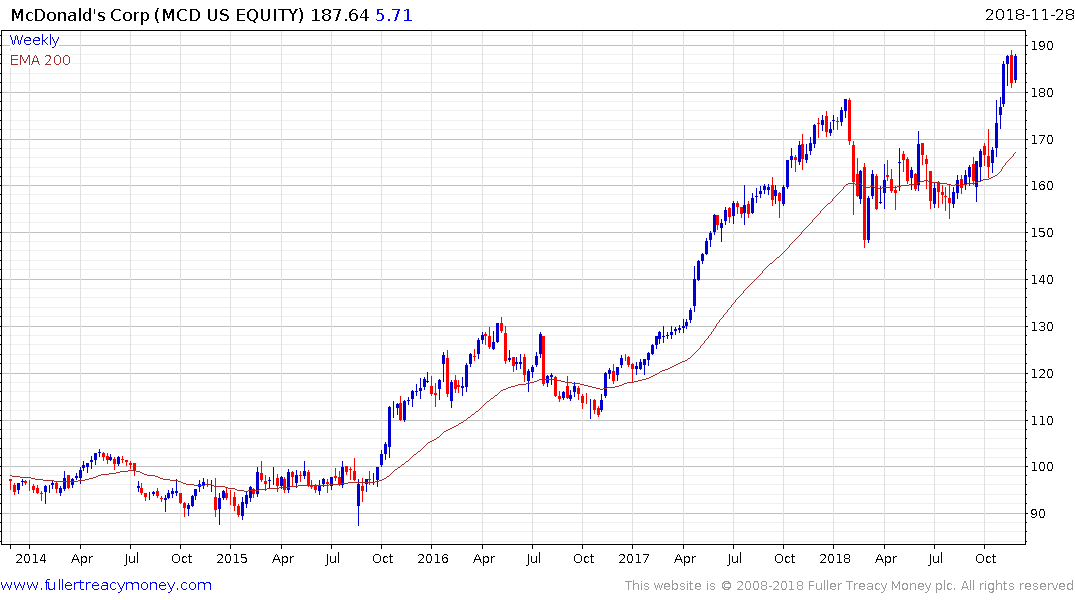

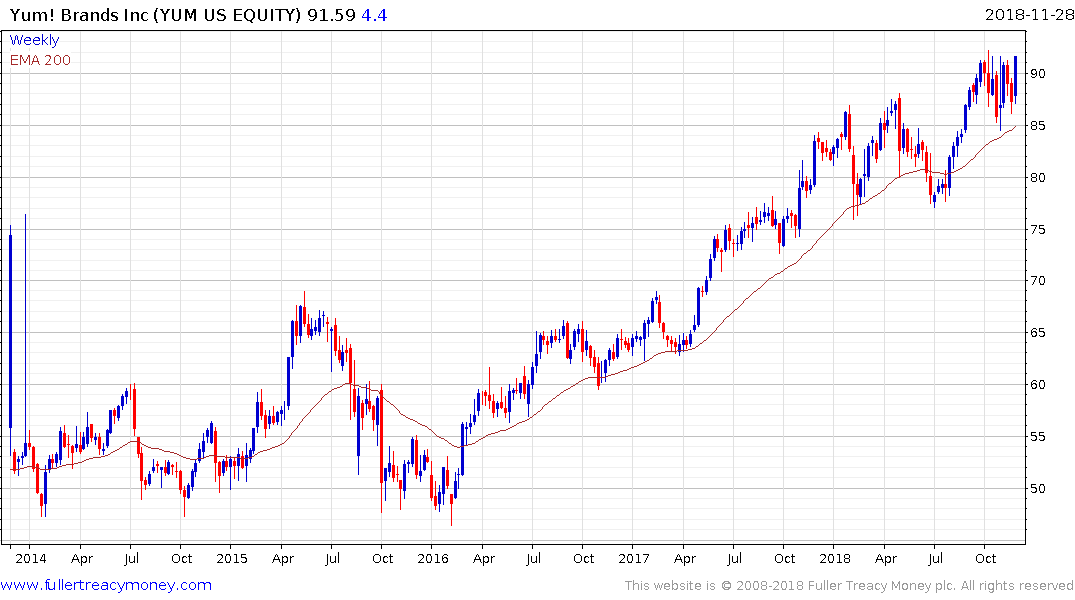

The ranks of companies making new all-time highs at present are heavily weighted by strong cash flow companies with solid records for increasing dividends like Verizon, Coca Cola, McDonalds, Yum Brands,

The 2-year Treasury yield looks likely to unwind is oversold condition relative to the trend mean.