RBC Wealth Management 2019 Investment Stance

Thanks to a subscriber for this report which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

The corrections in 2018 exposed stresses in the global equity market but also reset valuations to more reasonable levels. We think the market has the capacity to absorb economic cooling, ongoing tariff risks, and monetary tightening, albeit with volatility. Our constructive view hinges on low recession risks for major economies, particularly the U.S., and the likelihood corporate earnings growth will persist. But 2019 returns could be modest and delivered unevenly; therefore, it is appropriate to trim equity exposure to a Market Weight level in global portfolios from a slight Overweight position.

Two factors that influence U.S. stock prices the most over time—economic and earnings growth—will likely be firm enough to push the market at least modestly higher in 2019. We think the economy has the potential to grow above the 2.3% average rate. All of our forward-looking indicators are signaling the expansion will persist for the next 12 months or beyond.

Earnings growth is set to slow in 2019 because the boost from tax cuts will fall out of the data, and year-over year comparisons to 2018’s white-hot growth rates will be challenging to jump over. Furthermore, higher input prices due to tariffs, wage growth, and a strong dollar could constrain profit margins. Even with these challenges, we think S&P 500 earnings can grow in the mid-to-high single digits due to strength in the economy.

A market shift toward value stocks and away from growth stocks seems likely, in our view. Value tends to outperform when the 10-year Treasury yield rises, inflation expectations move higher, and GDP growth strengthens, as well as during the latter stage of a bull market cycle.

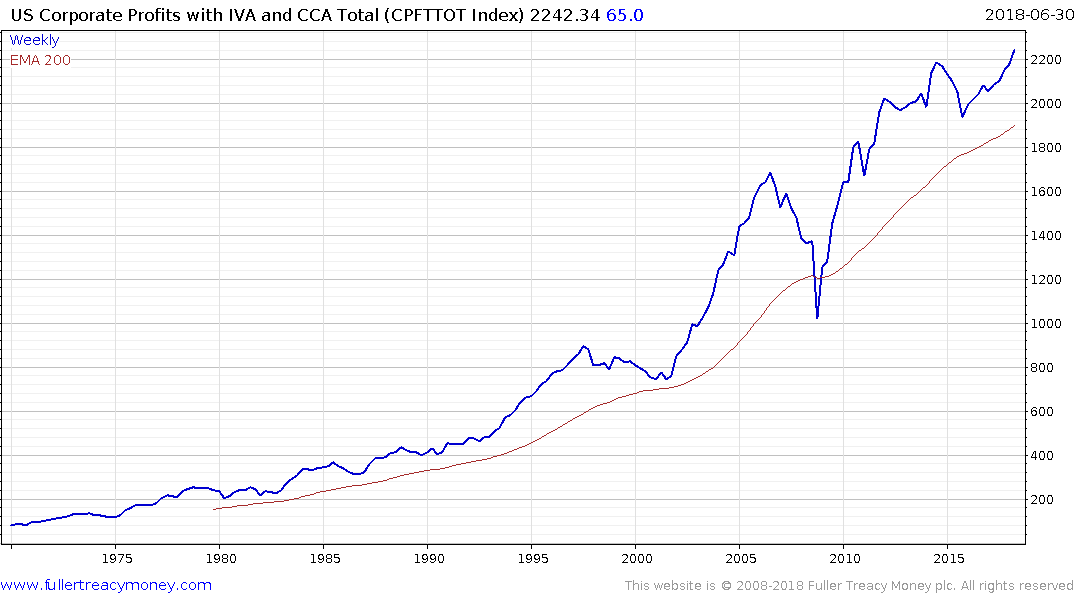

US Corporate Profits spent about four years ranging between 2012 and the end of 2016 and then broke out on the upside. The measure is reported in arrears with a one quarter lag so we will not have another reading until the end of this year and that will reflect the third quarter.

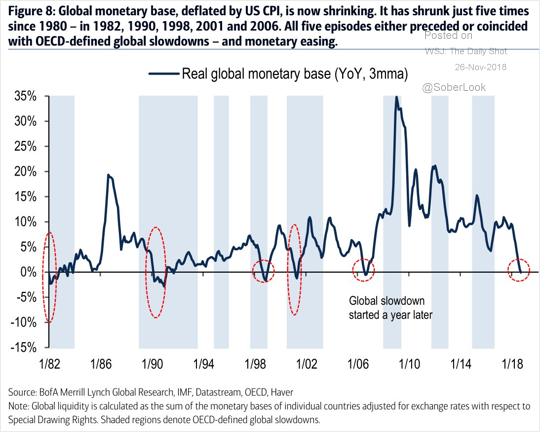

There is no doubt investors are expressing anxiety because they fear record corporate profits are about as good as can be expected. They are worried about the impact of trade wars intensifying and the slowdown in China, Europe and emerging markets against a background where global liquidity has been tightening. More than any other factor that highlights central banks are on the cusp of making a big mistake in tightening too much.

This video of Siril Sokoloff interviewing Stanley Druckenmiller makes a similar point. The global economy has gone from anticipating an additional $1 trillion a year in liquidity to seeing $1.5 trillion removed this year. That’s a big change and is a major contributing factor in the heightened volatility we have seen since February.

David has long said “monetary policy beats most other factors most of the time” and that is especially true today. That suggests the language attached to the December Fed statement is going to be a significant arbiter for investor sentiment.

In the meantime, it is worth considering that stock prices marched higher between 2012 and 2016 even though corporate profits did not trend higher; leading to valuation expansion. Today, corporate profits are trending higher and valuations are back where they were in 2016.

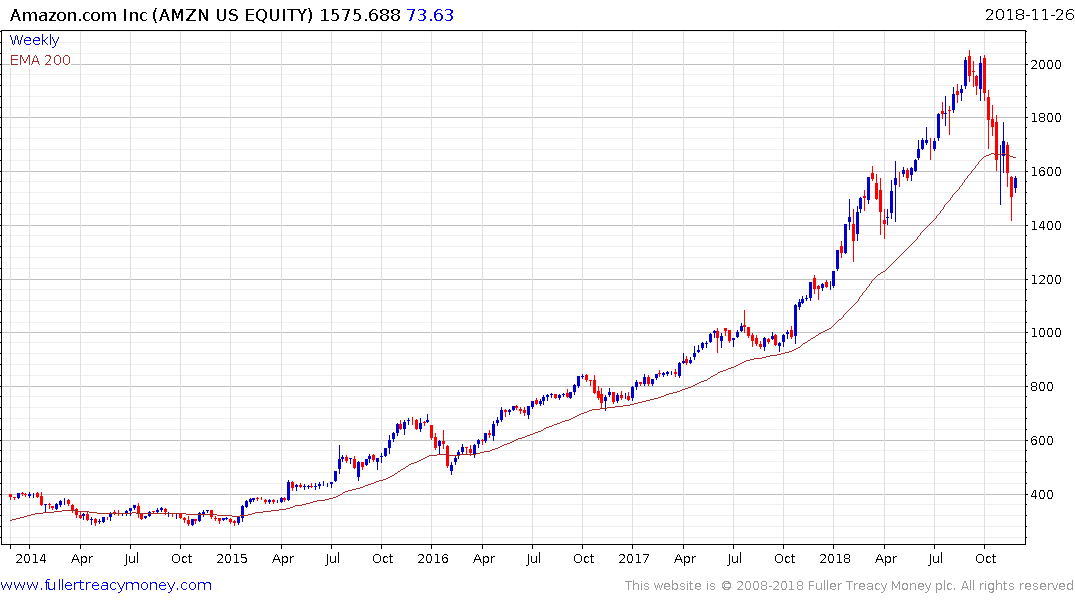

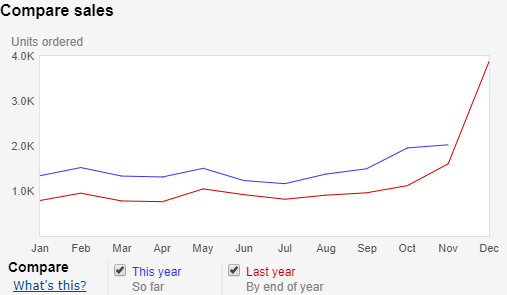

The decline in oil prices is going to put more money in people’s pockets heading into the holiday season and I can see from Mrs.Treacy’s Amazon business that this year is 40% ahead of last, with an acceleration in sales during October and so far in November. That suggests to me retailers are going to have a blowout 4th quarter. If the Fed comes out dovish that is likely to result in a significant rerating of related shares.