Email of the day on investing in autocracies

Which firms have monopoly - pricing power?

Thank you for this question which may be of interest to the Collective. David and I pondered this same issue a decade ago. Globalisation was flourishing, the shale revolution promised US energy independence and companies were expanding enthusiastically to capture market share among the new vibrant emerging market middle classes. We also worried about inflation because central bank money printing money was so prolific.

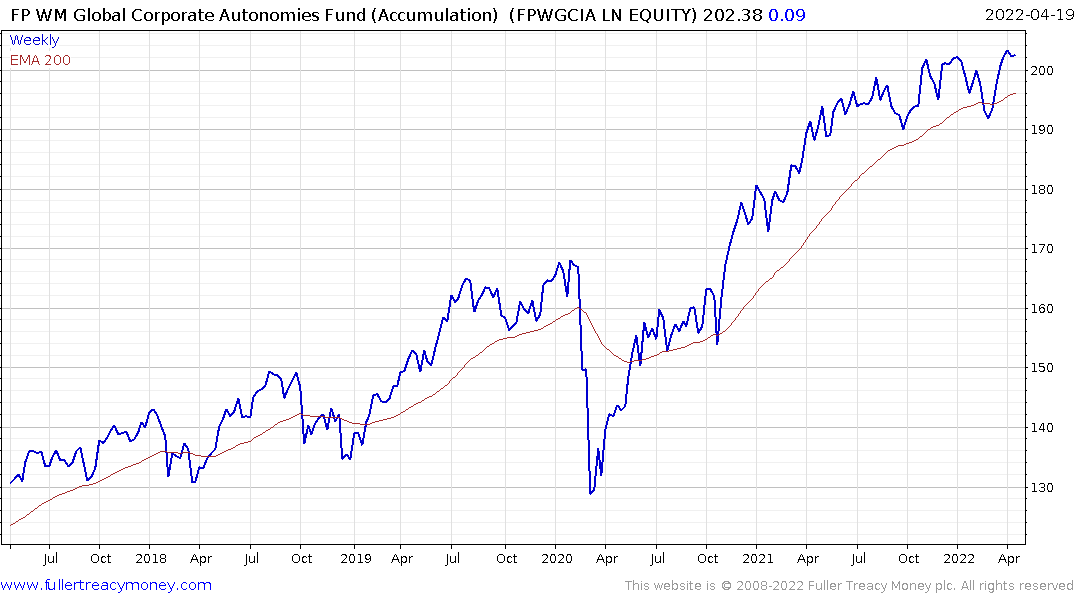

Identifying truly global companies that dominate their respective niches served the dual purpose of offering exposure to growing markets, a strong moat and inflation protection. The Autonomies classification arose out of that discussion. There is some crossover with the S&P Dividend Aristocrats but I avoided making reliable dividends a requirement so growth companies would be included. Afterall, successful technology companies have some of the best moats of any businesses.

.png)

The Dow Jones Industrials Average rebounded today in line with the S&P500 Dividend Aristocrats ETF and the Autonomies fund.

I also first created the total assets of central banks chart in 2012 because the bull market was predicated on access to cheap liquidity. Arguably that remains the case. $1 trillion billion has been now shaved off the total as bond prices declined, the dollar surged, and the Fed ended its buying program. That’s the background for the underperformance of the tech sector.