LVMH, Hermes Spark $30 Billion Luxury Stocks Rout on US Slowdown

This article from Bloomberg may be of interest to subscribers. Here is a section:

Confidence in that view has now been dented, however, with attendees at a luxury conference in Paris organized by Morgan Stanley flagging a “relatively more subdued” performance in the US, according to Edouard Aubin, an analyst at the investment bank. That reflects “weakness in the aspirational consumer in particular.”

That was counterbalanced by more buoyant demand elsewhere, according to Morgan Stanley. “Overall, we found corporate commentary resilient, pointing to an ongoing soft landing in the US largely offset by strength in other markets.”

Both Asia and the US are important markets for European luxury companies. Asia excluding Japan accounted for 30% of LVMH’s sales in 2022, while the US made up 27%, according to the company’s annual report.

Deutsche Bank AG analysts have also said that a slowdown in the US is now a growing concern. While the rebound in Chinese demand has been among the key drivers of strong sales, investors are likely to be picky from here on, they added.

Hermes doubled in less than a year. For a “limited supply” champion that’s an impressive performance. The share’s trend has been supported by the low float and its status as a vehicle for playing China’s post pandemic consumer rebound, without in fact investing in China.

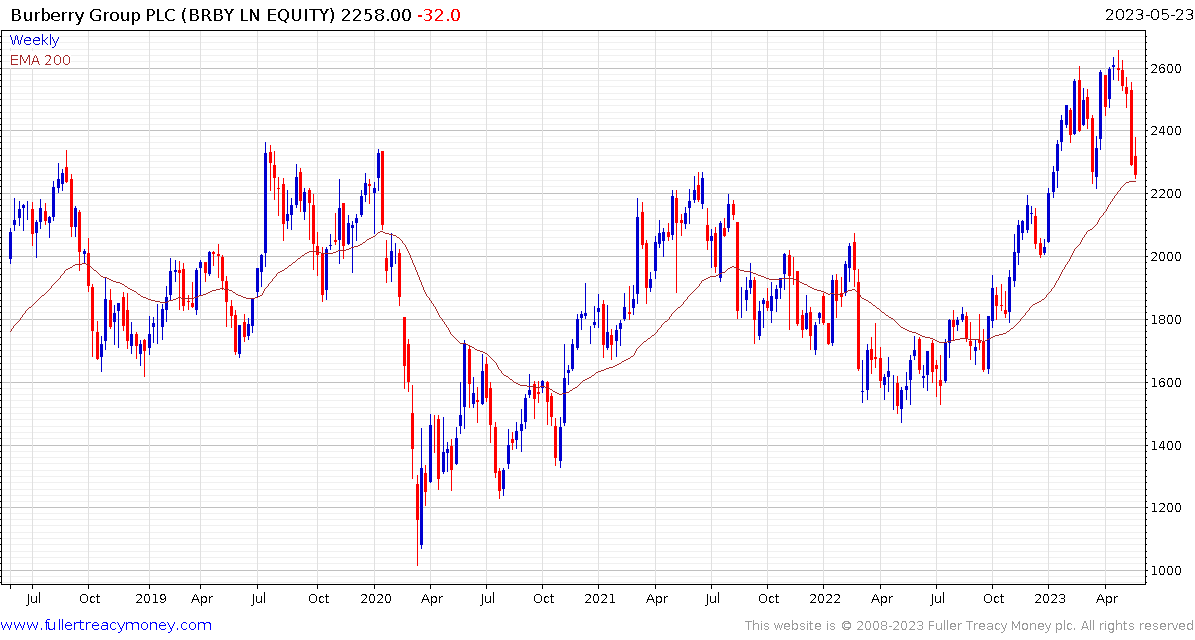

Today’s downward dynamic confirms a peak of at least near-term and probably medium-term significance. If held through the end of the week it will have formed a large downside weekly key reversal.

Today’s downward dynamic confirms a peak of at least near-term and probably medium-term significance. If held through the end of the week it will have formed a large downside weekly key reversal.

Sagging demand growth among “aspirational” shoppers suggests a pullback in the spending power of the middle classes. That’s a further sign the US economy is slowing down.

LVMH also pulled back in a dynamic manner today but is less overbought than Hermes.

LVMH also pulled back in a dynamic manner today but is less overbought than Hermes.

The luxury goods sector also offers a fresh example of narrowing breadth because most stocks are breaking lower. Kering, Richemont, Burberry, and Swatch all look susceptible to additional weakness for example.