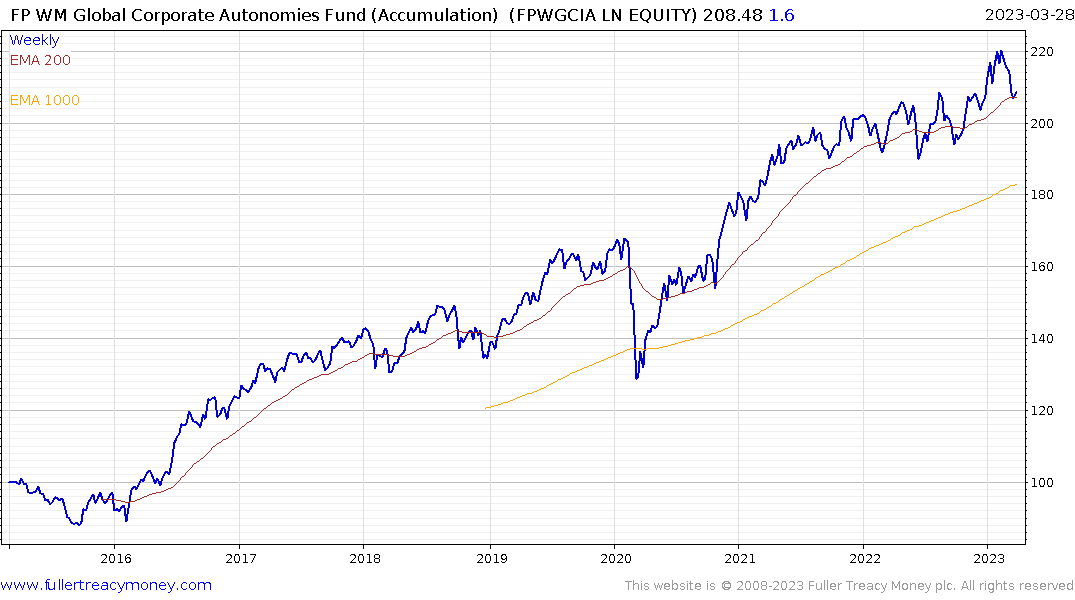

Autonomies reweight

I am reweighting the Autonomies portfolio as we are approaching the end of the quarter. It’s a tumultuous three months with banks and several retailers experiencing steep selling pressure. Meanwhile several luxury goods companies are at new highs. Technology companies have staged impressive rebounds and commodity stocks are very steady. The biggest surprise for me is how varied the performance of the financial sector is. That clearly suggests there will be big winners and losers from the unfolding market environment.

The Autonomies are big international companies with strong business niches that approach oligopoly status. The factor that most accurately represents the group is quality. That’s why the above graphic from Blackrock caught my attention. Quality tends to outperform following the end of a hiking cycle.

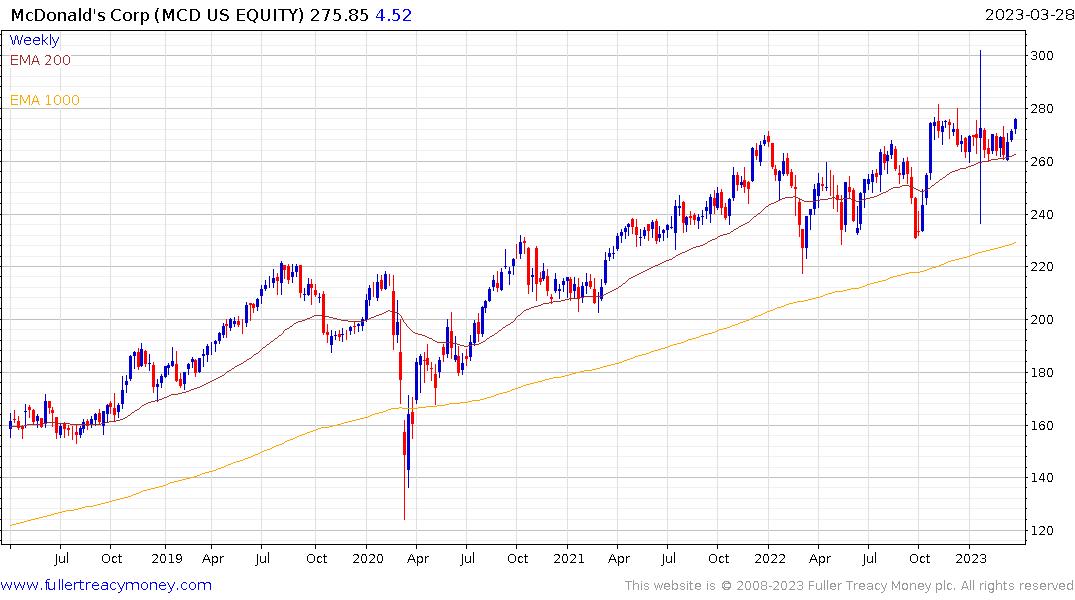

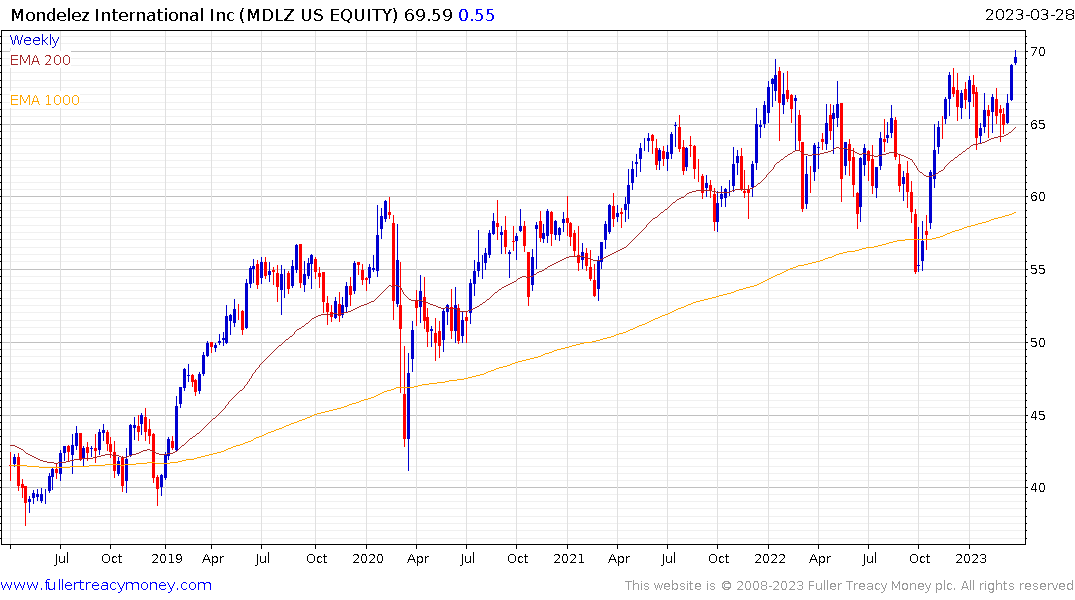

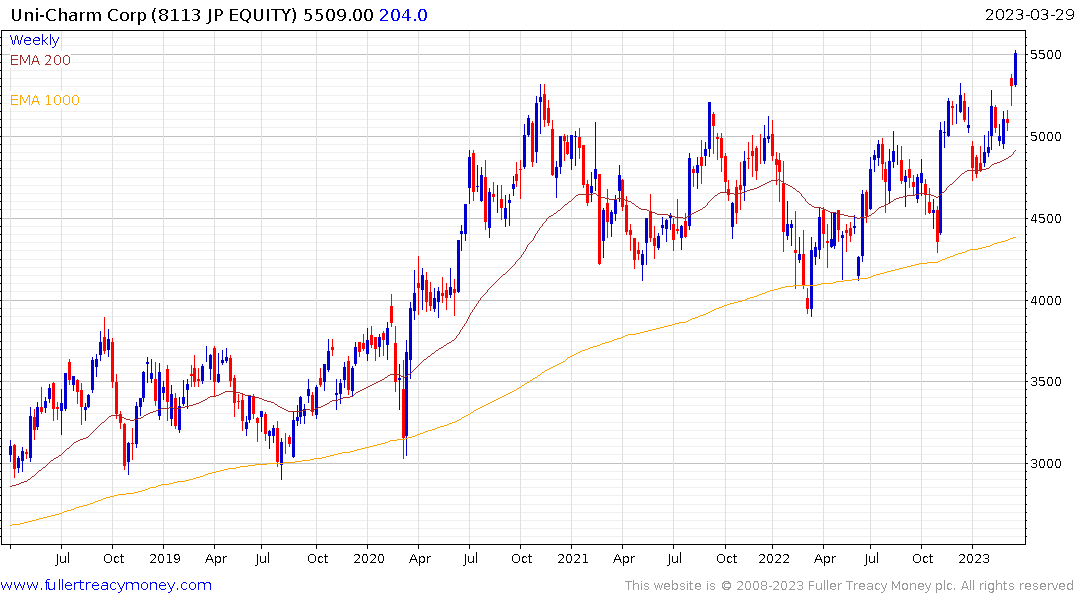

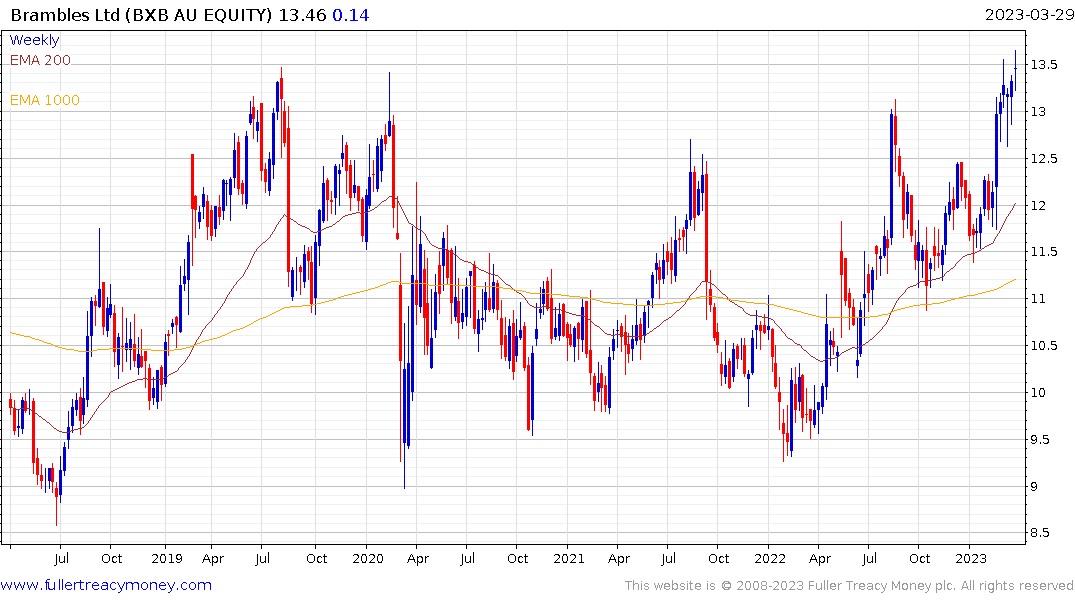

Companies like McDonalds, Mondelez International, Unicharm and Brambles are hitting new highs.

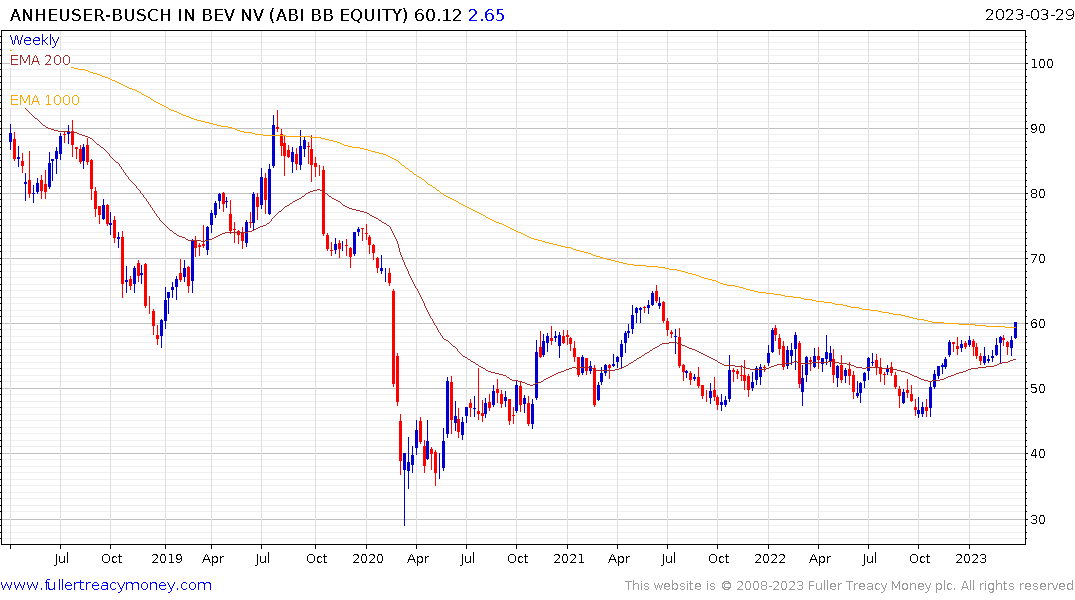

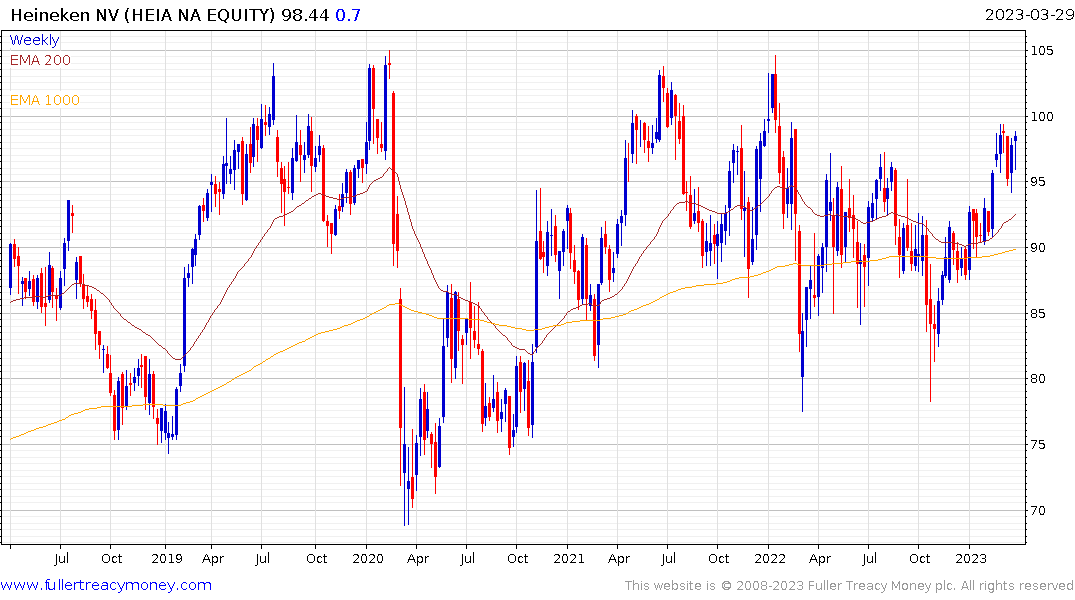

Anheuser-Busch and Heineken are testing the upper side of their respective multi-year ranges.

So is Ingredion.

Bayer is firming within its base formation.

BMW is testing the upper side of a seven-year range.

BMW is testing the upper side of a seven-year range.

Bridgestone is testing the upper side of an 18-month range.

Bridgestone is testing the upper side of an 18-month range.

Both Rolls Royce and GE are testing the upper side of their respective base formations.

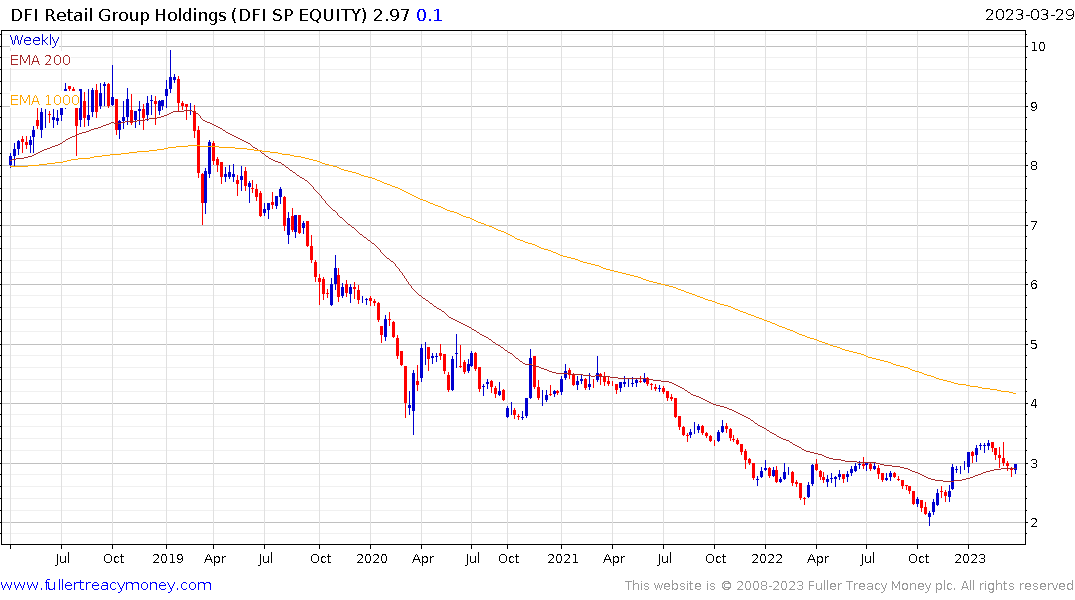

DFI has broken a medium-term downtrend and Hengan International posted higher reaction low with an upside weekly key reversal.

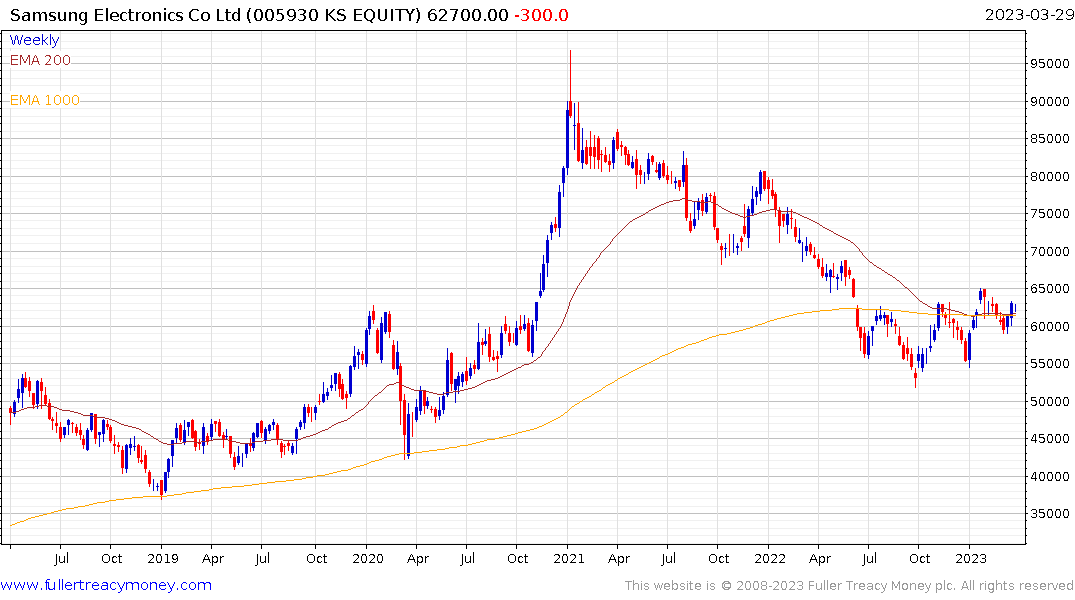

Samsung Electronics is now trending higher following a steep two-year downtrend.

Samsung Electronics is now trending higher following a steep two-year downtrend.