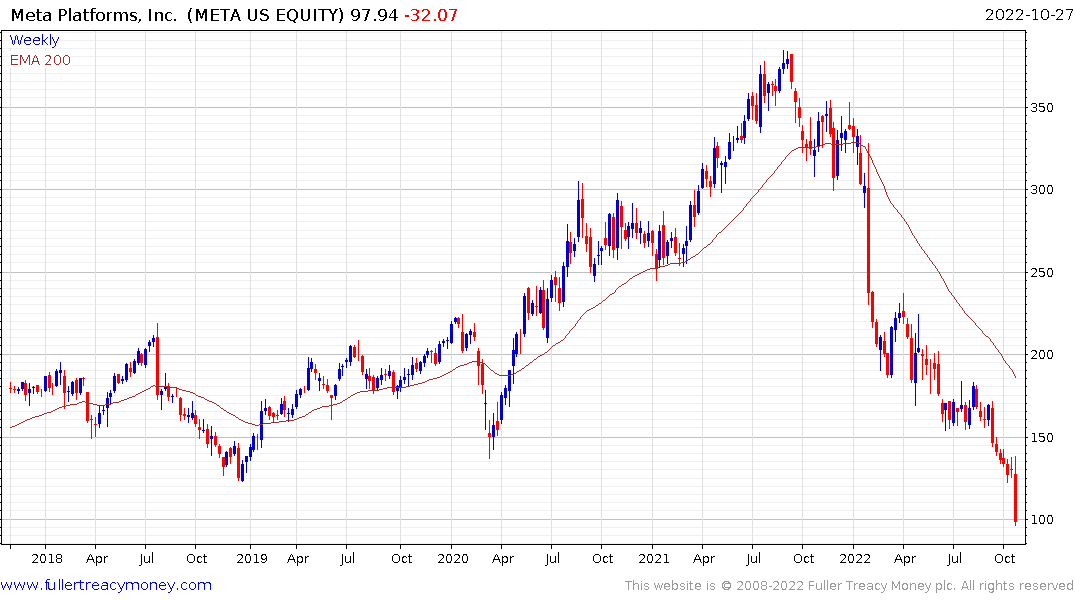

Meta Plummets as Capex Plans Spur Downgrades

This note may be of interest to subscribers. Here are some relevant quotes:

Jefferies (buy, PT $200)

There are “no signs of expense discipline,” and this is “going against what investors want”Vital Knowledge

The expense outlook is “the big negative” of the report; “investors were hoping for mgmt. to aggressively slash costs, but it doesn’t seem like that’s happening”The results and outlook “weren’t great, but neither was any worse than SNAP or GOOGL”

Truist Securities (buy, PT $240)

The revenue outlook is “still decent all things considered,” but the guidance for total expenses is “materially higher than our estimate”

There is only so much money available to be spent on advertising. Over the last decade, the number of companies seeking to suckle on the ad spend of the corporate sector has grown considerably. The net effect today is many new companies are basing their business models on offering advertising space.

In the online marketplace, the cost per acquisition for a new client can be exceptionally high. Therefore, the question that needs to asked is at what point does supply and demand return to equilibrium.

Google pioneered the online advertising marketplace. Social media offered a fresh innovation. Amazon got into advertising in 2019. Netflix is toying with an ad supported version of its service. Apple’s new walled garden rules mean it is hoarding user data for its own advertising efforts. Volta is trying to build an array of advertising venues built into its EV chargers. Fragmentation of the market means more competition between venues for data acquisition and spending.

I have no faith in Meta Platforms foray into virtual reality and the metaverse. The primary reason is I have tried VR headsets and the eye strain is not something I am prepared to deal with. It is not a technology you can spend your whole day immersed in. Until/unless that issue is solved there is no path to widespread adoption.

Nevertheless, the share has an 11% free cashflow yield and price/sales has fallen to 2 so the valuation is not demanding. The reality is Meta has room to increase capital expenditure even if that takes a toll on the stock. The most confidence inducing policy for investors would be to pay a dividend. However, that would puncture the idea that it is a high growth company.

Nevertheless, the share has an 11% free cashflow yield and price/sales has fallen to 2 so the valuation is not demanding. The reality is Meta has room to increase capital expenditure even if that takes a toll on the stock. The most confidence inducing policy for investors would be to pay a dividend. However, that would puncture the idea that it is a high growth company.

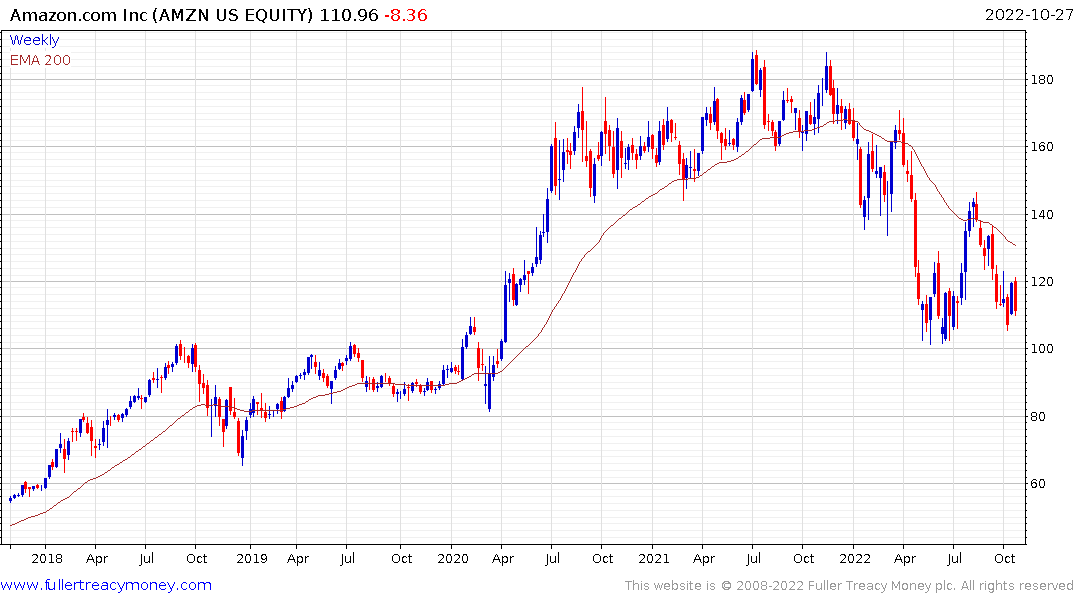

Amazon has grown its ad revenue considerably over the last three years. However, that is increasing costs on the retail side which is destroying the company's price advantage. Many goods are now cheaper from a supplier's own website and the 3-day shipping is good enough for most purchases. The share was down over 20% in the after hours market following negative guidance on the holiday period.

Apple’s services business is where steady growth is coming from while product portion jumped from $220 to almost $300 billion in 2021. The company’s challenge is product represent 80% of revenue and are highly cyclical. The company’s future either relies on a new wonder-product like a new kind of car, or advertising revenue from its installed base of phones through the Appstore.