Secular Themes Review October 2021

On November 24th I began a series of reviews of longer-term themes which will be updated on the first Friday of every month going forward. The last was on May 7th. These reviews can be found via the search bar using the term “Secular Themes Review”

Supply Inelasticity Meets Rising Demand was the phrase David coined to explain the last commodity-led bull market. After decades of underinvestment in commodity supply infrastructure, the market was not prepared for the massive swell of new demand from China; as it leaped from economic obscurity into one of the largest economies in the world. A decade of investment in new production was needed to supply China and that crested ahead of the credit crisis in 2008.

Today, we also have extreme example of supply inelasticity, and demand is breaking records for all manner of goods and services. The factors contributing to these trends are quite different from a decade though. Some will be resolved relatively quickly. Others will take years.

On the demand side there has been a massive transfer of wealth during the pandemic to consumers. It is estimated that in the USA alone household balance sheets have swollen by $4 trillion over trend. That’s mirrored in other countries so there is a great deal of money sloshing around looking to buy goods and services.

Central bank balance sheets remain on an upward trajectory and government deficit spending remains a tailwind. The challenge is central banks are increasingly attempting to taper their assistance and raise rates.

They are worried about the signs of froth in the market I identified in last month’s review. At the same time, they are eager to reload their monetary weapons before the next crisis emerges. That’s particularly true because of fears this cycle will be shorter than the last one, because valuations are starting from a much higher base level.

That’s doubly true for governments where outstanding debt multiplied in 2020, but servicing costs fell. Governments like the USA, with short durations on debt, have significant exposure to rising interest rates which is why the 5-year yield’s breakout this week was greeted with such angst on Wall Street.

Nevertheless, that only ensures growth and recovery strategies will be further prioritised. With such high interest rate sensitivity, the only way to keep a lid on rising costs is to compensate with outsized growth. Without that, the risk of stagflation is nontrivial. As a result, I remain deeply sceptical about how successful efforts to raise rates will be.

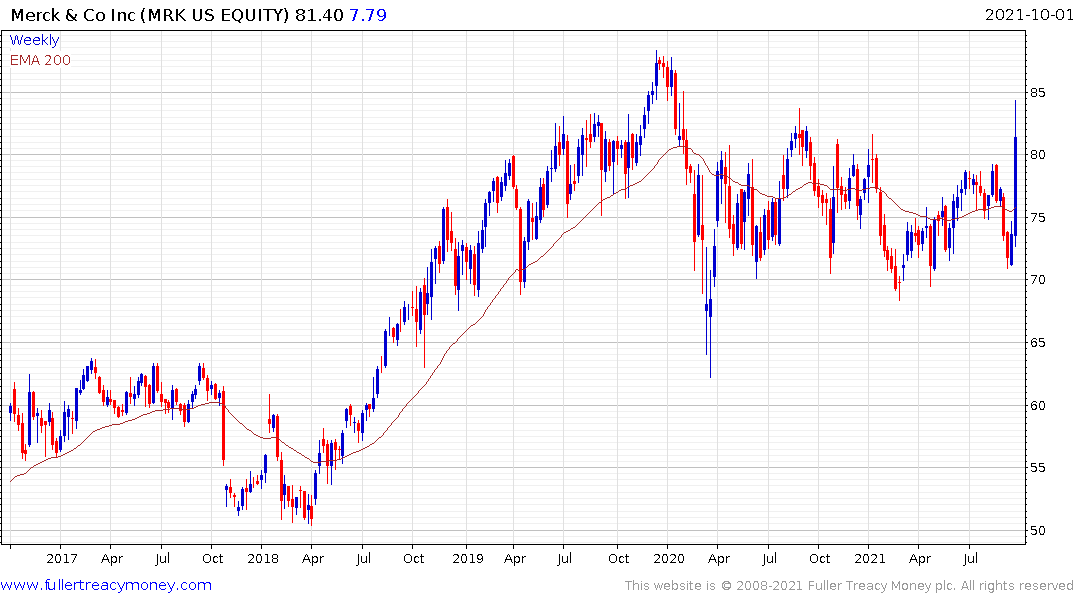

Merck’s news today that it’s COVID-19 pill is effective in cutting the risk of death by 50% is particularly welcome. It weighed on shares like Moderna but ultimately, the increasing availability of both treatments and vaccines is positive for re-opening and aggregate demand growth for just about everything. It also suggests there is potential for a fresh rotation back into the reopening portion of the market.

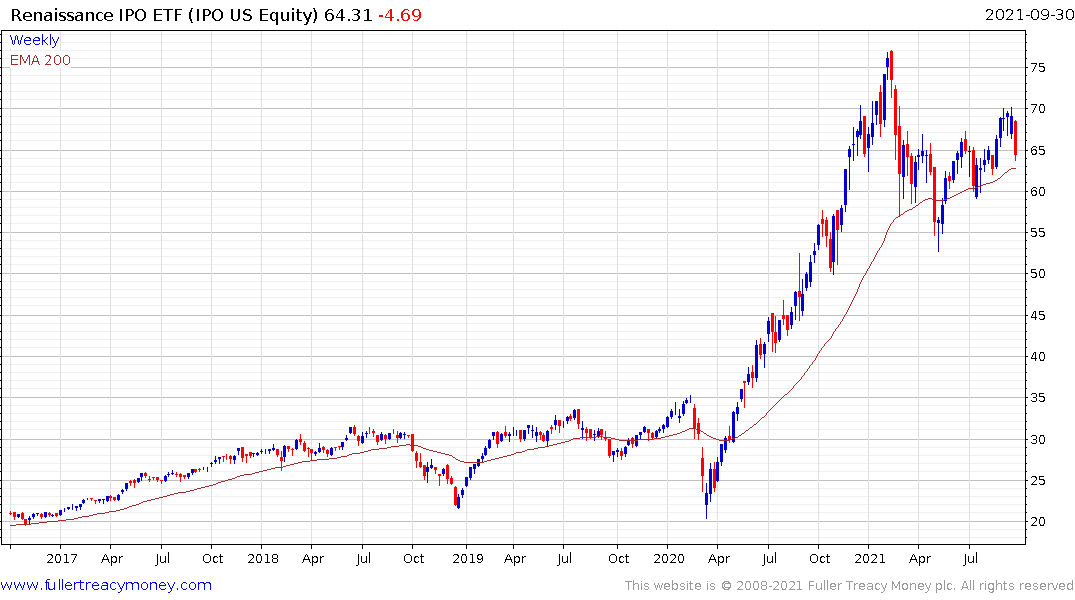

Since Moderna is the Renaissance IPO ETF’s largest holding at 9% the good news of the COVID treatment is weighing on the speculative fund’s performance.

That winner takes all attitude is also weighing on the biotechnology sector.

The challenge on the supply side is more urgent at present. Just-in-time-manufacturing was enabled by global supply chains, low shipping costs, low barriers to trade and clear visibility on what demand would be months in advance. Most importantly it relies heavily on China remaining on friendly terms with the rest of the world.

The pandemic punctured the business model. Despite initial claims businesses would be more resilient, there is little evidence substantial measures to reduce reliance on just-in-time manufacturing have been successful. Instead, companies have got right back to their pattern of buying back shares instead of prioritising investments in the future.

As supply inelasticity continues to plague supply chains, additional spending on alternative routes is inevitable. Company focus has been on protecting margins. That will be increasingly difficult to do and a number of globally significant suppliers of ingredients are complaining about margin compression as they struggle to deal with these pressures. Price rises are inevitable to deal with this issue.

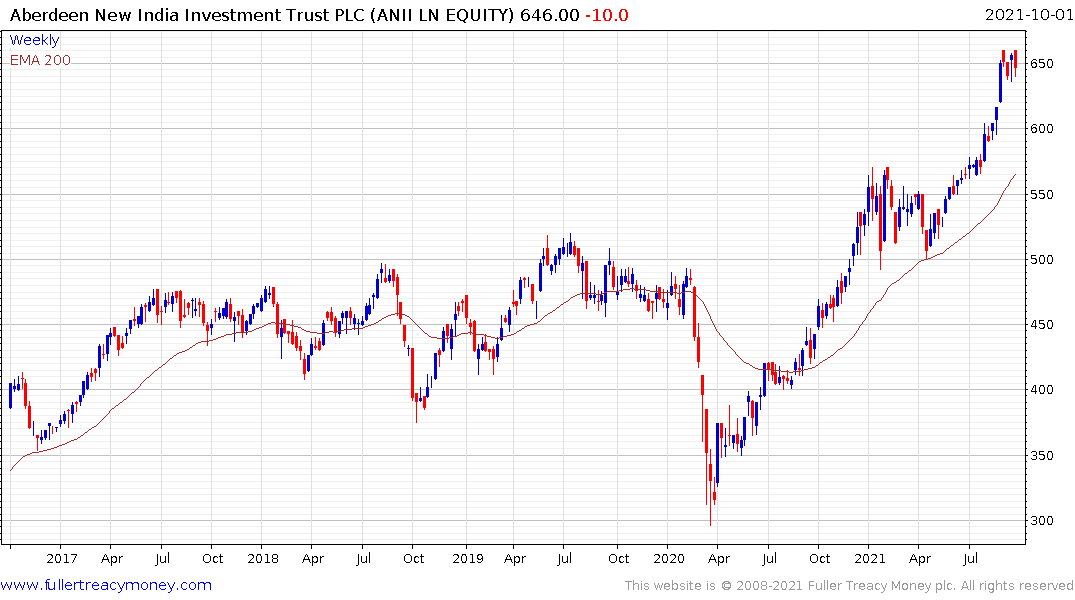

India is in a new credit cycle of its own and is one of the primary destinations for supply chain reorientation. The country is also being looked to as a country balance to China’s growing influence in Asia. With impressive demographics the stage is set for India to be a growth dynamo for the global economy.

India is in a new credit cycle of its own and is one of the primary destinations for supply chain reorientation. The country is also being looked to as a country balance to China’s growing influence in Asia. With impressive demographics the stage is set for India to be a growth dynamo for the global economy.

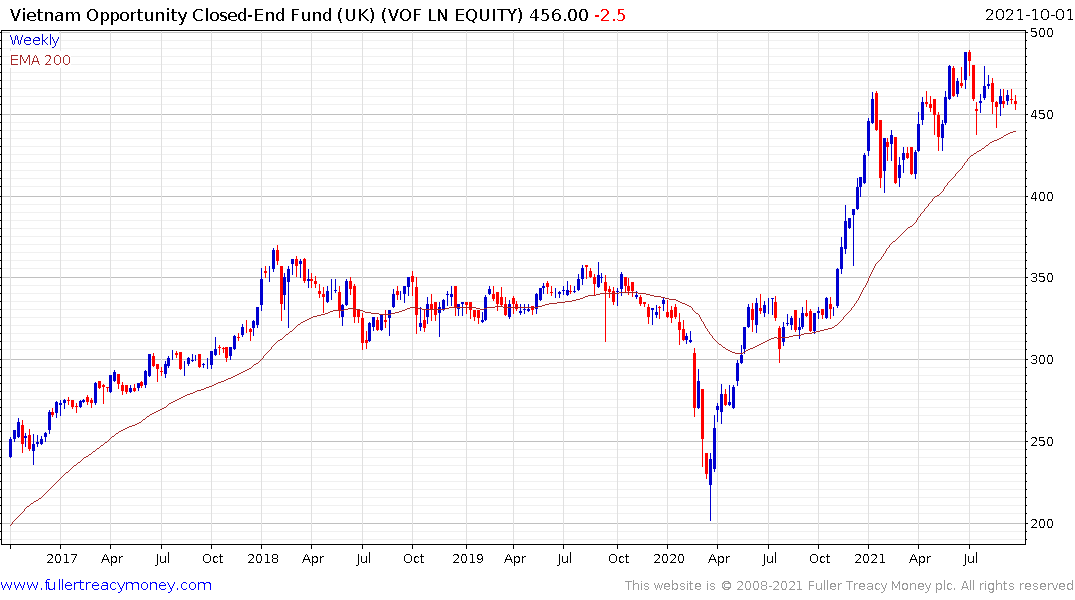

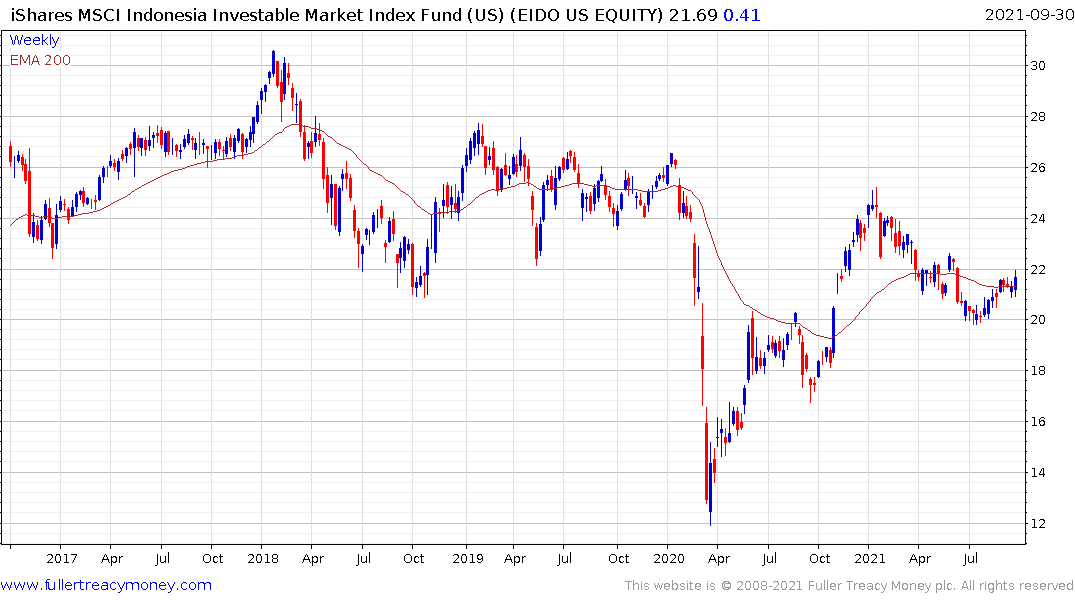

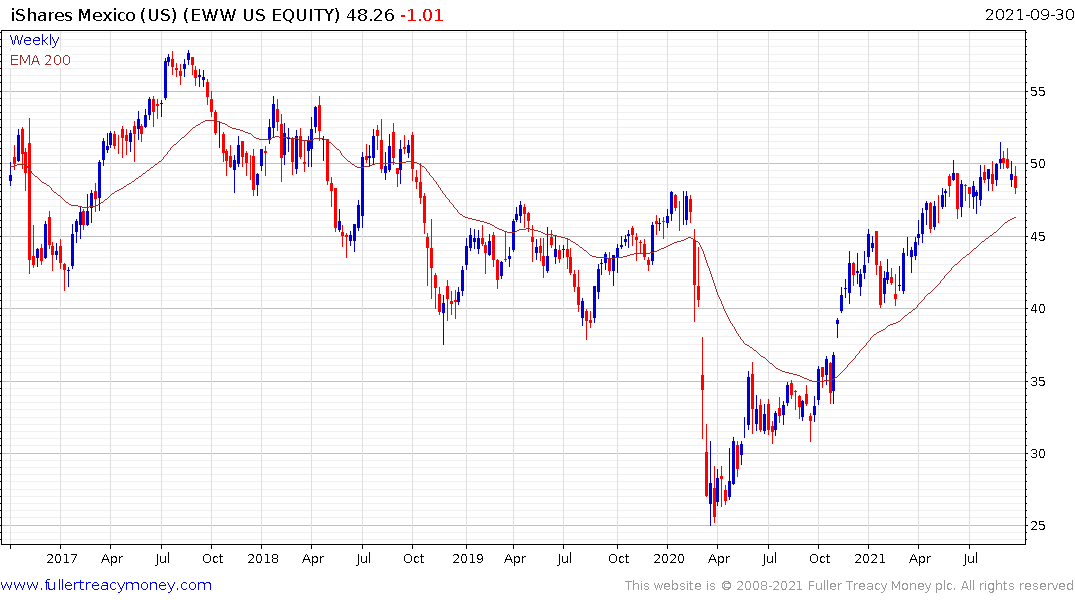

Vietnam, Indonesia and Mexico are the other primary venues for supply chain migration.

Concurrently, demand for new ships is back at the peak levels from 2007 as shipping rates trend higher.

The Breakwave Dry Bulk Shipping ETF remains in a consistent medium-term uptrend.

The outperformance of banking sectors, globally, is particularly noteworthy. As liquidity providers they prosper in bull markets where interest rates are rising because margins increase. Insurance companies are also benefitting because of the same reasons. That’s a very different

At the same time, a succession of crises have rocked China’s ability to act as the workshop of the world. The China Evergrande bankruptcy is exposing the soft underbelly of China’s local government funding mechanism.

With no property tax, land sales have been used to fund local government revenue short falls. Creating off balance sheet liabilities is against the official rules but since they have no other recourse, the practise has been ignored for years. Local government debt now approaches half of GDP and paying it back is a non-starter without a new revenue source. That ensures China credit impulse is troughing. They have no choice but to support the system and will eventually have to introduce property tax. Meanwhile efforts to reduce the scope for contagion further into the property market are also inevitable. That supports the view liquidity is about to recover which is positive for the outlook for a bounce.

The low efficacy rate of China’s domestic vaccines has been one of the primary reasons why they have continued to follow a zero-tolerance policy towards COVID infections. The occasional lockdowns are damaging the ability of the supply chain to function because it restricts worker movement from the hinterland to the coast.

China is also beginning to take its environmental commitments more seriously and not least because of the EU’s threat to impose carbon taxes on imports. The additional urgency of ensuring clear skies over Beijing for the Winter Olympics is also creating a demand surge for natural gas and other lower carbon solutions than coal.

The unbelievably aggressive surge in prices for UK natural gas highlight how fragile supply chains have become. The UK has replaced coal with wind power in the energy mix over the last decade. When times are good, that looks like a sound decision, but when the wind stops blowing it creates significant problems. Meanwhile, China’s power shortage has had a similar effect on Newcastle coal prices. As governments all over the world attempt to put their climate change mitigation strategies into place, the potential for continued volatility has to be the base case.

The path towards a zero-emission future is neither clear nor easy, to the extent it can be achieved at all. This report from Bridgewater may be of interest. Here is a section:

As a result, oil demand is more likely to fall through policy action (e.g., taxes, subsidies) or the development of cheaper alternatives than through supply pressures. Reduced supply makes oil expensive, with the revenue going to producers; carbon taxes make oil expensive for consumers but not producers, with the revenue going to governments, who can give the money back to consumers or invest in subsidizing alternatives. If oil is expensive through reduced supply, you keep incentivizing new suppliers to come in and take advantage of the windfall (potentially through private companies less susceptible to climate action pressure, as we have seen in the most recent oil recovery). If oil prices to suppliers fall because of taxation or cheaper alternatives, fewer suppliers will want to enter, making price increases to consumers more permanent.

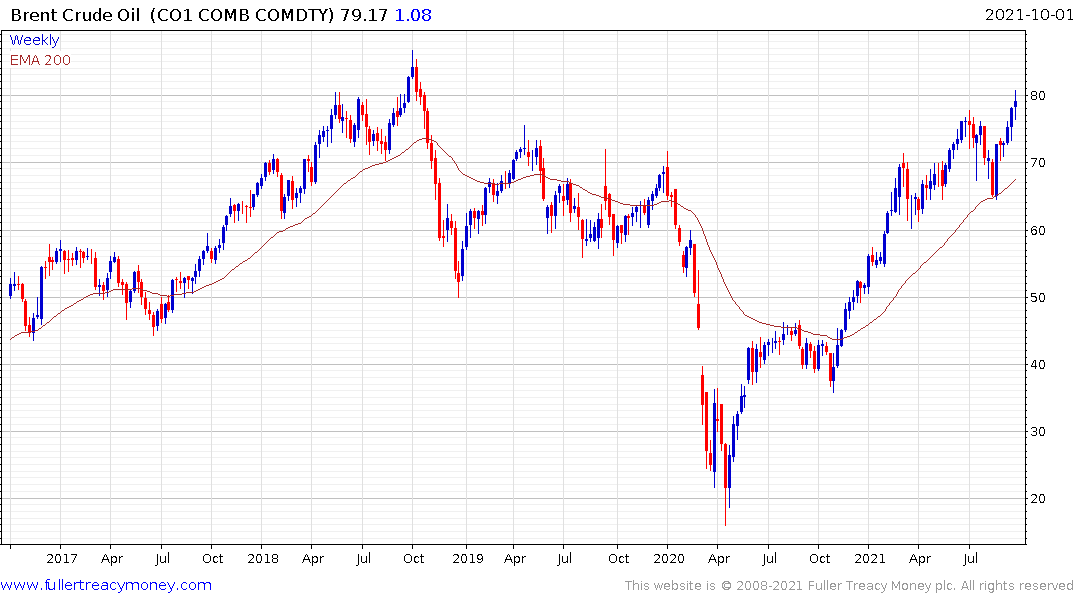

This set of potential market interactions suggests higher prices will encourage new supply eventually but sustained high prices will be required to ensure a long-term supply response such as additional offshore supply or tar sands.

Crude oil is at the point today where any additional price increase will begin to initiate a supply response. Employment in the Texas drilling regions is now increasing which suggests the transition is already underway. The big question for investors is whether demand will be reduced in a meaningful way any time soon.

The Energy SPDR jumped from the region of the trend mean this week to confirm near-term support.

Meanwhile Royal Dutch Shell completed a medium-term base formation.

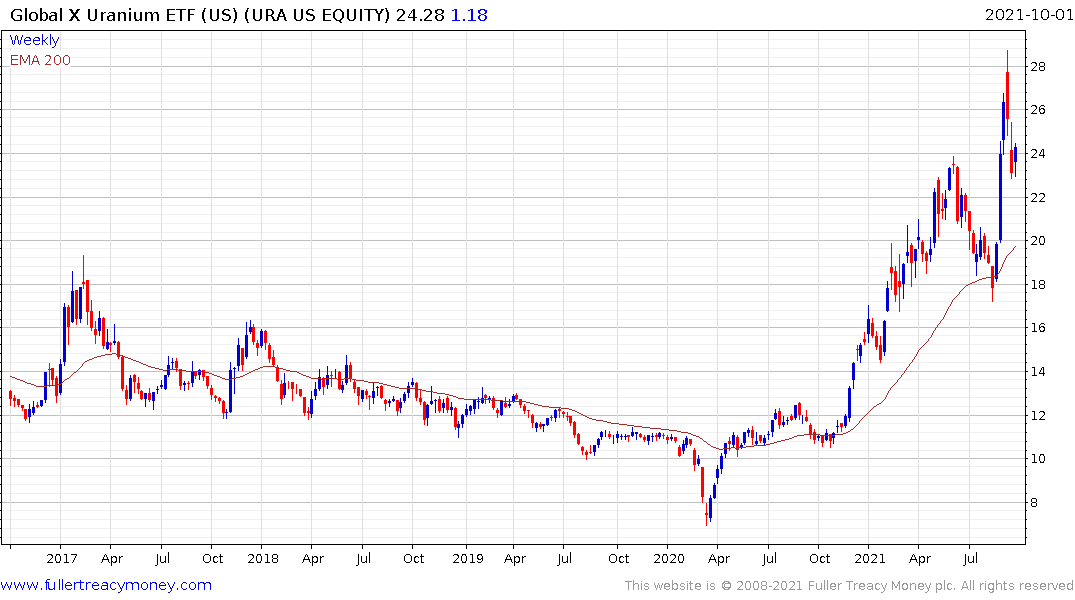

The big argument supporting electric vehicles is economies of scale will ensure they are much more cost competitive. The big challenge is the investments in additional electricity generating capacity, to offset oil demand, are incredibly profound. Considering the volatility that flows from relying on intermittent supply, everyone now understands base load alternatives have to be prioritised. That strongly supports the uranium sector despite still less than lukewarm public support.

The Global X Uranium ETF is currently unwinding a short-term overbought conditions but remains on a recovery trajectory.

The Global X Uranium ETF is currently unwinding a short-term overbought conditions but remains on a recovery trajectory.

Despite extraordinary volatility for other China-dependent commodities copper remains quite steady in the region of its all-time highs. While one has to squint to see how oil prices can sustain elevated levels, copper has the full backing of support from governments everywhere and their renewable energy aspirations. This is a commodity bull market which is being led by copper more than oil.

Despite extraordinary volatility for other China-dependent commodities copper remains quite steady in the region of its all-time highs. While one has to squint to see how oil prices can sustain elevated levels, copper has the full backing of support from governments everywhere and their renewable energy aspirations. This is a commodity bull market which is being led by copper more than oil.

The continued politically sponsored upward pressure on carbon prices remain a fundamental tailwind for rising inflationary pressures.

The one aspect that seems to attract little comment is how dependent ESG funds are on the performance tech companies and how the funding for the energy disruption is dependent on low interest rates.

The relative performance of the FANGMAN (Facebook, Apple, Netflix, Google/Alphabet, Microsoft, Amazon and Nvidia) shares has rolled over. Since they represent 19% of the market that represents a major rotation and suggests the largest companies in the world are struggling to sustain outperformance as they run up against the law of large numbers.

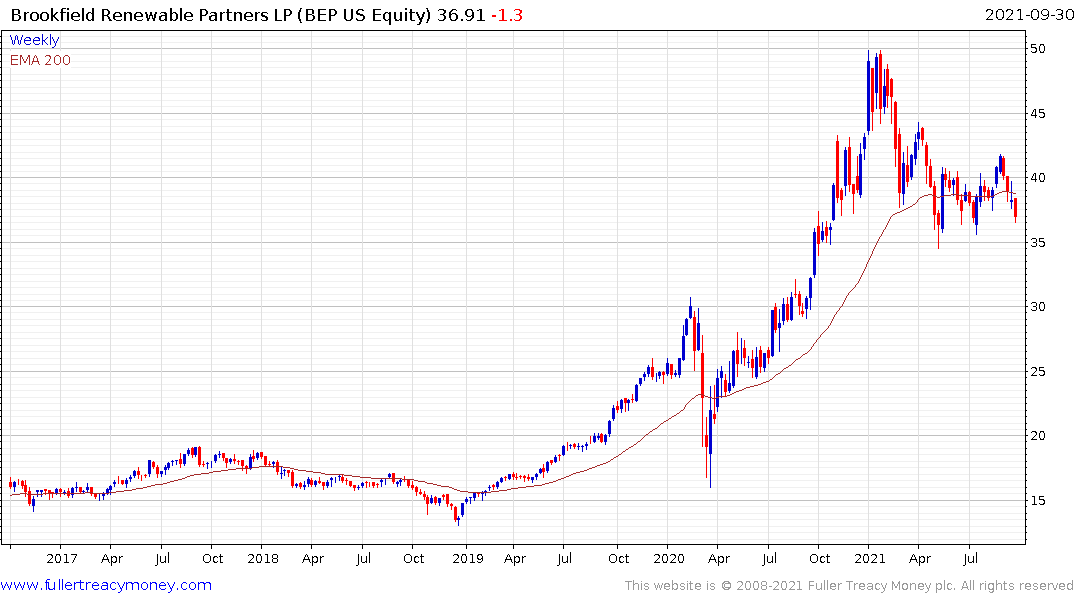

Whenever bond yields rise the solar sector in particular experiences selling pressure because so many business models in the service delivery portion of the sector are interest rates sensitive.

Brookfield Renewable Partners Fund is heavily reliant on solar utilities for its performance so that is also worth monitoring in the event yields continue to rise.

Brookfield Renewable Partners Fund is heavily reliant on solar utilities for its performance so that is also worth monitoring in the event yields continue to rise.

Meanwhile Bitcoin continues to attract interest and rebounded impressively today following a benign statement from Jay Powell to the effect he would not seek to ban cryptocurrencies. Nevertheless, it is increasingly likely the sector will become subject to regulation. Stablebcoins will eventually be regulated like money market funds while crypto tokens will be viewed as securities.

Meanwhile Bitcoin continues to attract interest and rebounded impressively today following a benign statement from Jay Powell to the effect he would not seek to ban cryptocurrencies. Nevertheless, it is increasingly likely the sector will become subject to regulation. Stablebcoins will eventually be regulated like money market funds while crypto tokens will be viewed as securities.

The price of bitcoin has at least held the region of the upper side of the underlying range and a sustained move below $40,000 would be required to question medium-term scope for additional upside.

Ethereum is also bouncing from the region of the 200-day MA.

Ethereum is also bouncing from the region of the 200-day MA.

There has been a trend over the last couple of years where bonds and equities fall together during times of stress. One of the most reliable strategies for investing conservatively over the decades has been to create a balanced portfolio in the hope that weakness in bonds would be compensated for by strength in equities and vice versa. The risk parity strategy developed by hedge funds takes that relationship and leverages it.

It seems reasonable to conclude that at some point these instances when bonds and equities fall together will increase because of the leverage in the system and the bubble in the bond markets. Therefore investors will need to made a decision about what assets to hold during times of stress. Some have obviously concluded cryptocurrencies are a viable option despite the fact they tend to behave like risk assets. Meanwhile others continue to favour gold as an uncorrelated asset. In the last week, the Dollar was the go-to asset to hold as investors simply went for cash.

Gold is increasingly showing sings of steadying as it turns the corner in what has been a yearlong consolidation in the region of the all-time peak.

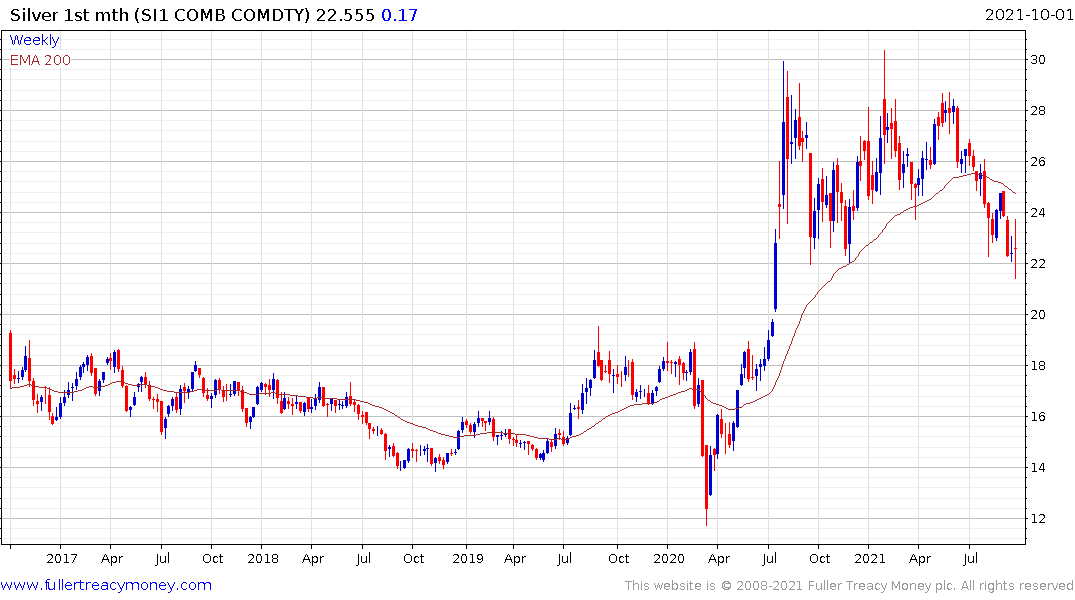

Silver took a hit this week from the China solar panel factor closures but continues to form a first step above the six-year base formation.

Silver took a hit this week from the China solar panel factor closures but continues to form a first step above the six-year base formation.

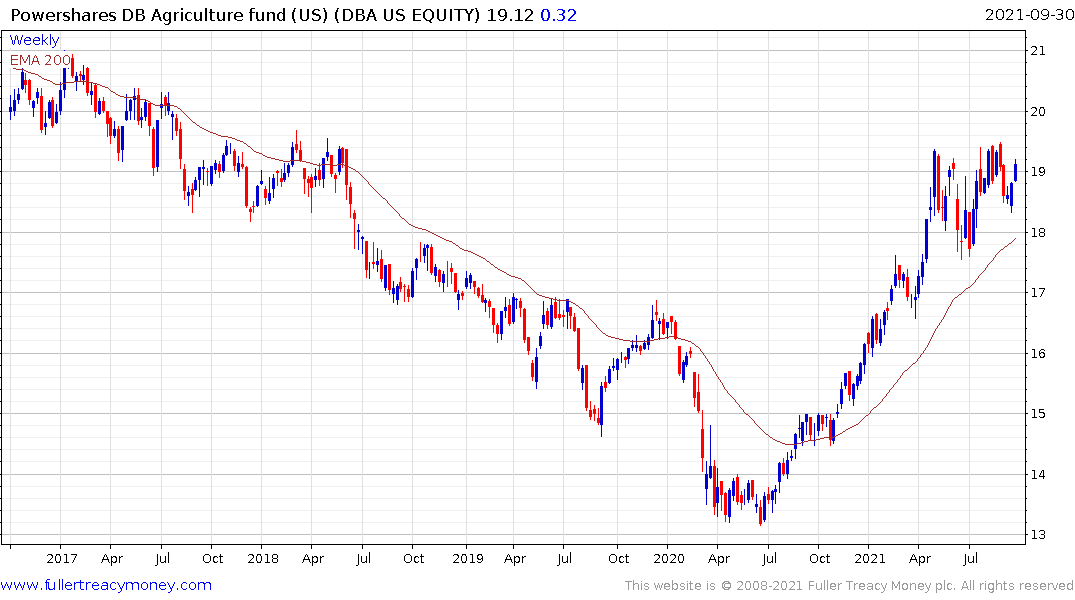

Agricultural commodity prices also continue to trend higher. The Invesco Agriculture futures fund remains in an uptrend and is supported by backwardations right across the sector.

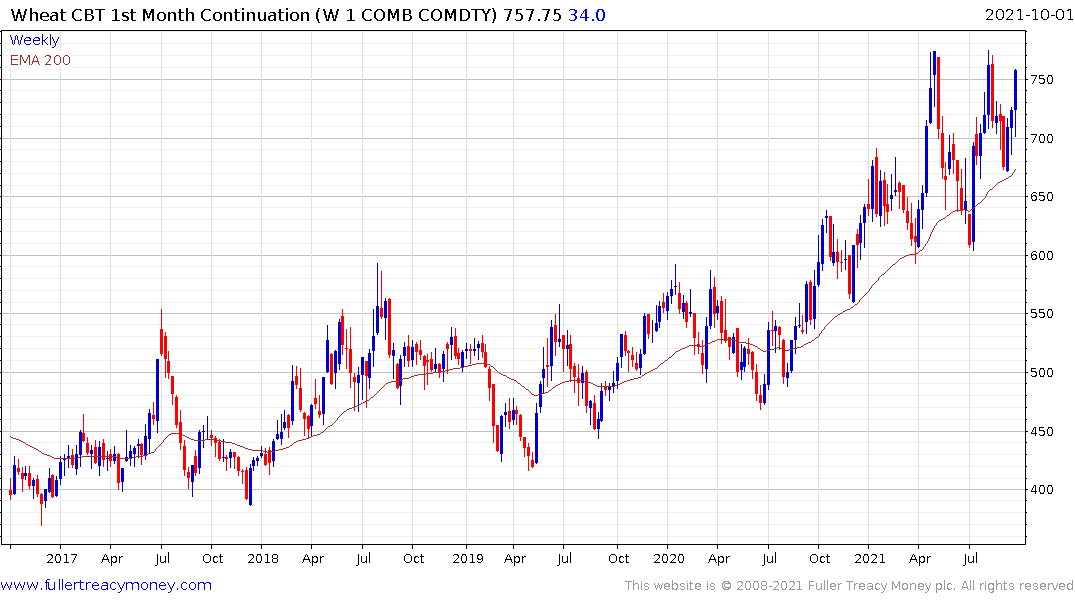

Wheat, Arabica coffee, palm oil, cotton and sugar are leading the way higher and all contribute to the impression inflation is out of control.

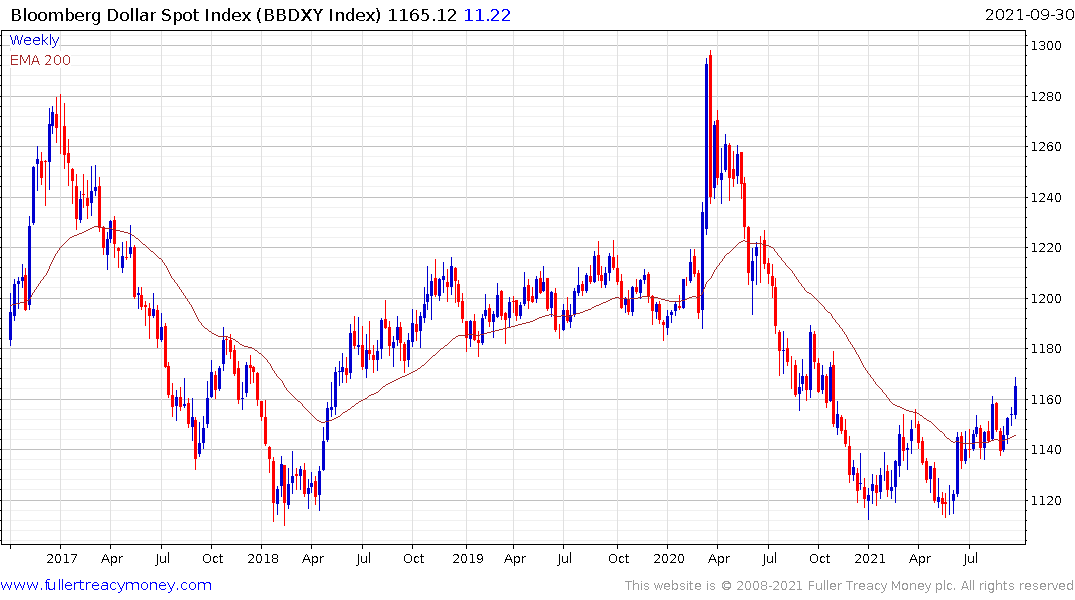

The Bloomberg Dollar Index popped on the upside during this week’s volatility spike but as pressure on prices abates, it is coming back down. The Dollar has been much steadier than I anticipated earlier this year but nonetheless continues to have a hard time rallying meaningfully.

If we try to draw these themes together. The biggest near-term risk is China. Emerging market US Dollar high yield bond prices continue to trend lower. China absolutely needs to step up monetary and fiscal assistance to avoid a deep contraction. That is likely to be stimulative for everywhere else too. However, the supply inelasticity portions of the market are likely to remain obstacles to growth and prosperity for at least another six months to a year. That could easily delay the pace of tapering in the West and support continued speculative activity in risk assets.

The S&P500 has experienced a 5% pullback for the first time in a year. That’s minute in the greater scheme of things but the angst the event elicited is further evidence of how leveraged the market is right now. Rotating towards more of a value/emerging markets/commodity weighting in one’s portfolio and eschewing the siren call of growth at all costs seems like a rationale decision at this point in the cycle.