Secular Themes Review March 4th 2022

In 2020 I began a series of reviews of longer-term themes which will be updated going forward on the first Friday of every month. These reviews can be found via the search bar using the term “Secular Themes Review”.

When Wall Street indices were breaking out to new highs in 2012/13 the world looked to be on the cusp of a golden era of globalisation, co-operation, and the inevitable rise of the middle class. Higher living standards would breed a more tolerant society with greater respect for the environment and for our fellow global citizens.

In predicting a secular bull market, we were correct about the market call. Wall Street and the FANGMANT stocks have outperformed global indices by a wide margin over the last decade. It was also correct to expect oil to underperform because of the bounty arising from shale oil and gas. Predicting a decade ago that the USA would become energy independent was seen as maverick. Today it’s a fact.

The social upheaval that began with the monetary and regulatory response to the credit crisis represents a significant threat to the utopian ideal of the everyman. Exporting job security in return for cheap products has hollowed out the middle class in most developed countries. The evolution of the subscription business model has also reduced individuals to cash flows; where ownership of hard assets is marketed as an outdated concept. This has contributed to significant social upheaval and the response to the coronavirus pandemic amplified it.

At the same time, the trend of geopolitical tension continues to rise. The concentration of wealth in the hands of a small number of people, companies and countries is creating greater competition. China is much more active in staking its claim to global trade than in the past and Russia’s current invasion of Ukraine is reflective of a desperate need for both security and relevance in a world that is actively working to use less of its primary export; oil.

The Dow/Gold ratio peaked in 2018 and posted a lower high in February before breaking lower.

The MSCI World Ex-US/Gold ratio never managed to complete its base formation and is now breaking lower as well.

The Nasdaq Composite/Gold ratio is rapidly unwinding its overextension relative to the 1000-day MA. That level represents a major potential area of support. If it breaks for any sustained period, it would be reasonable to conclude technology shares will on aggregate underperform commodity shares over the lengthy medium term.

The Nasdaq Composite/Gold ratio is rapidly unwinding its overextension relative to the 1000-day MA. That level represents a major potential area of support. If it breaks for any sustained period, it would be reasonable to conclude technology shares will on aggregate underperform commodity shares over the lengthy medium term.

.png) Meanwhile the Copper/Gold ratio is firming in the region of the upper side of its 13-year base formation. A sustained move above 0.30 would confirm the new commodity-led inflationary trend.

Meanwhile the Copper/Gold ratio is firming in the region of the upper side of its 13-year base formation. A sustained move above 0.30 would confirm the new commodity-led inflationary trend.

Gold continues to extend the breakout from a yearlong base formation and is climbing back to test the all-time high. 18-month volatile consolidations are not at all unusual in long-term trends for gold. They are usually followed by explosive breakouts that last longer and go farther than the crowd have been conditioned to expect by the lengthy range.

Gold shares generally do best in the early and middle stages of a gold bull market. They are still licking their wounds from the bear market. Financial discipline and shareholder returns are front of mind. As the price appreciates and investors become more willing to fund speculative projects, cashflow deteriorates and the sector underperforms. That’s still a long way off and the gold miners ETF is only just beginning to rally from the lower side of its first step above its base.

Gold shares generally do best in the early and middle stages of a gold bull market. They are still licking their wounds from the bear market. Financial discipline and shareholder returns are front of mind. As the price appreciates and investors become more willing to fund speculative projects, cashflow deteriorates and the sector underperforms. That’s still a long way off and the gold miners ETF is only just beginning to rally from the lower side of its first step above its base.

Copper broke out to new all-time highs today which completes the yearlong consolidation in the region of the 2011 peak. The entire renewable energy revolution can be synthesised in the argument for replacing reliance on coal with copper. The benefit is that once the copper is in place it can be used for long periods and then recycled whereas the oil is burnt. The downside is that oil is both reliable, concentrated and energy intense, Renewables need help to be all three of those factors.

Help is on the way. Russia’s invasion of Ukraine sends two very clear messages to the global community. The first is relying on a despotic partner to supply you with vital commodities is not a sustainable policy, regardless of how cheap or convenient it is. Europe now has no choice than to pursue energy independence.

That represents a clear tailwind for wind, solar and geothermal. It will be buying all manner of energy storage solutions. The clear conclusion is the promises made at COP26 now have a much greater chance of being acted upon. Not in service to climate change but because of the existential risk of relying on nuclear armed neighbour with extraterritorial ambitions.

The second lesson is nuclear weapons are the only viable deterrent to invasion. Ukraine gave up its nuclear weapons in good faith in 1994. Twenty years later Russia had annexed Crimea. China vowed to sustain the one country two states solution to Hong Kong. That commitment didn’t last half its expected term.

Russia’s targeting of Ukrainian nuclear facilities also makes the none too subtle point that creating domestic targets with potential for wide dispersion of radiation is not strategically optimal when geopolitical tensions are high.

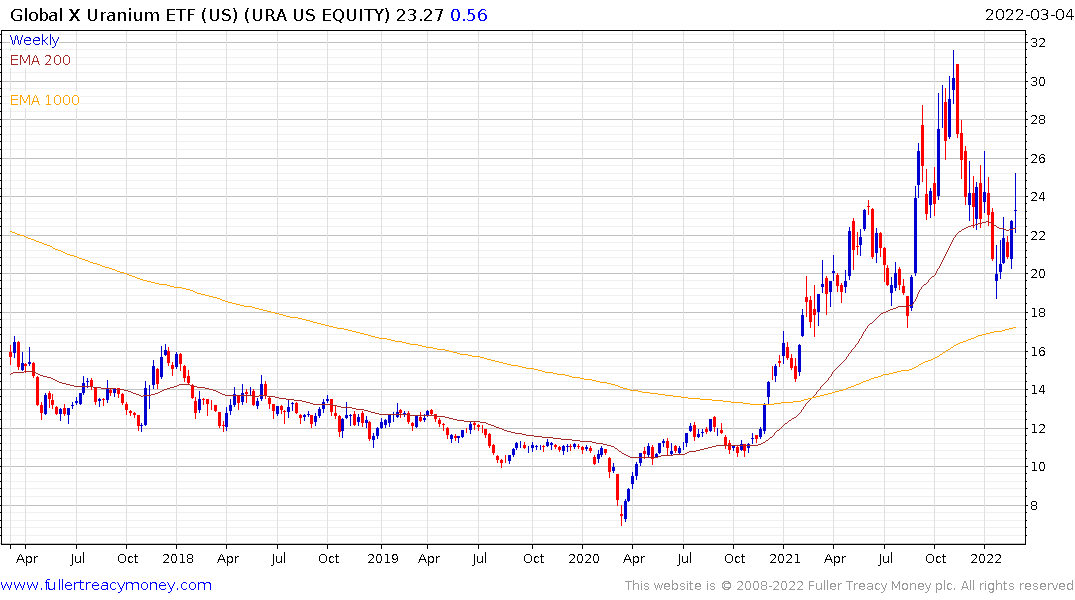

The Global X Uranium ETF took a leg lower today and will have a hard time recovering from this development.

Coal is the big near-term beneficiary even because the infrastructure already exists and can easily be ramped up.

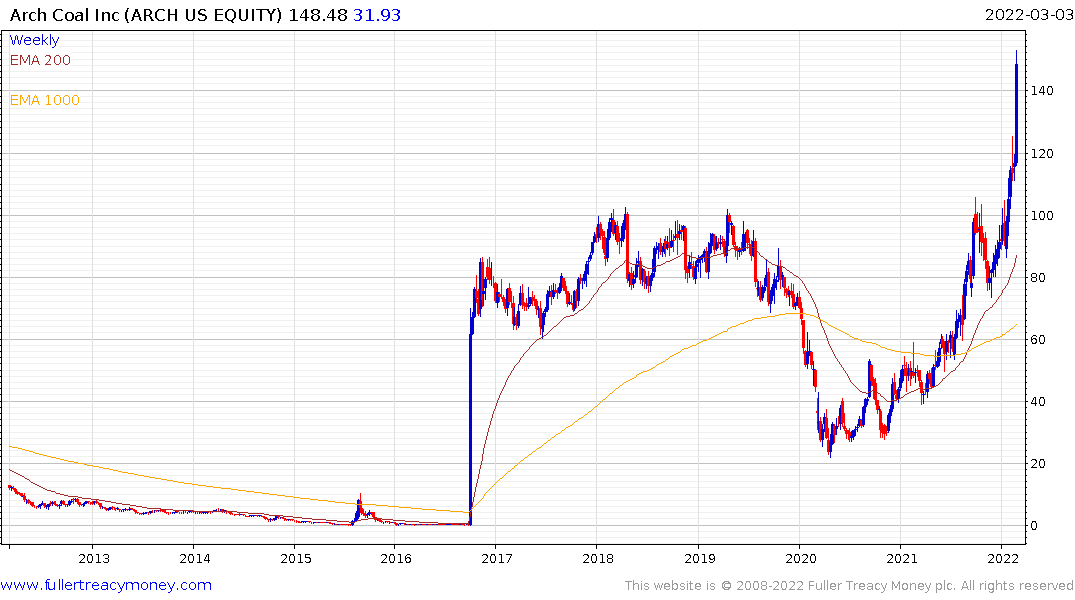

Arch Coal, Peabody Energy and others are breaking out.

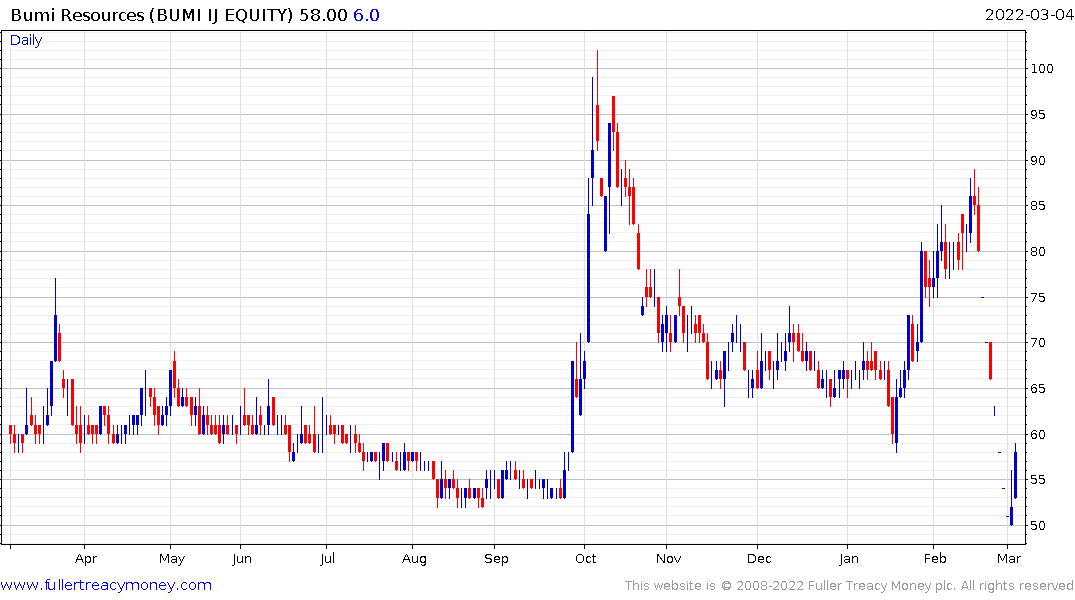

Bumi Resources went through a debt for equity swap in February. The share is now rebounding.

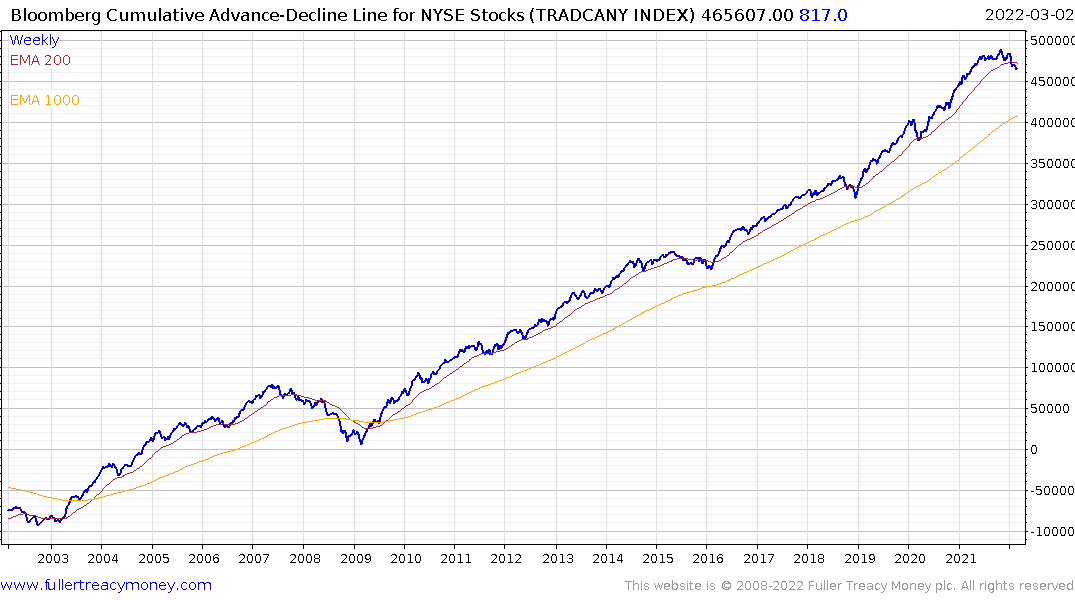

The Advance Decline Line for the NYSE has broken below its 200-day MA for the first time since early 2019. This measure simply takes the number of falling stocks from the number of rising stocks on a cumulative basis every day.

When it is trending lower, most shares are posting negative returns on successive days. Its strength is often viewed as the backbone of a bull market. When it trends lower, it is warning that medium-term corrections can turn into meaningful peaks.

The FANGMANT (Facebook (Meta Platforms), Apple, Netflix, Google (Alphabet) Microsoft, Amazon, NVidia, and Tesla are trending lower on both a nominal and relative basis. Since these are the largest stocks in the market, they represent a significant headwind for indices and ETFs.

The Federal Reserve has talked itself into raising rates so it is very likely that we will see a 25-basis point hike this month. It may be a while before we see the next one. Japan went through an epic bull market and has been unable to get off the zero bound for decades. Europe did not write off the debts from the sovereign wealth crisis and has been unable to raise rates since. The USA is now running the risk of Japanisation too.

Phenomenally large debts were run up during the pandemic. They need inflation to help erode the total and that implies lower standards of living. Government handouts, writing off student debt and forbearance on mortgage and rent is not free despite what Modern Monetary promises.

Only this week Jay Powell stuck to the narrative that the demand jump from the pandemic and the supply inelasticity from the pandemic were to blame for the rise in inflation. The Fed still sees no role for money printing in inflating assets. If history is any guide, the withdrawal of money printing certainly has a role in asset price contraction.

The problem with zero bound rates is the duration on investments goes to infinity because there is no discount rate. That allowed the value of companies with no observable route to profits to achieve valuations in the tens and hundreds of billions. Even a modest rise in the nominal bond yield blows a hole in the investment case for these kinds of companies.

The ARK Innovation ETF has fully unwound its bull market surge but is still trending lower in a consistent manner.

Bitcoin was the primary beneficiary of the zero-interest rate environment. The price has posted one 18-month range and two three-year ranges since 2010. The peak in April 2021 probably signalled the beginning of the next lengthy consolidation. If the bull market is to remain intact, the $20,000 level will need to continue to hold.

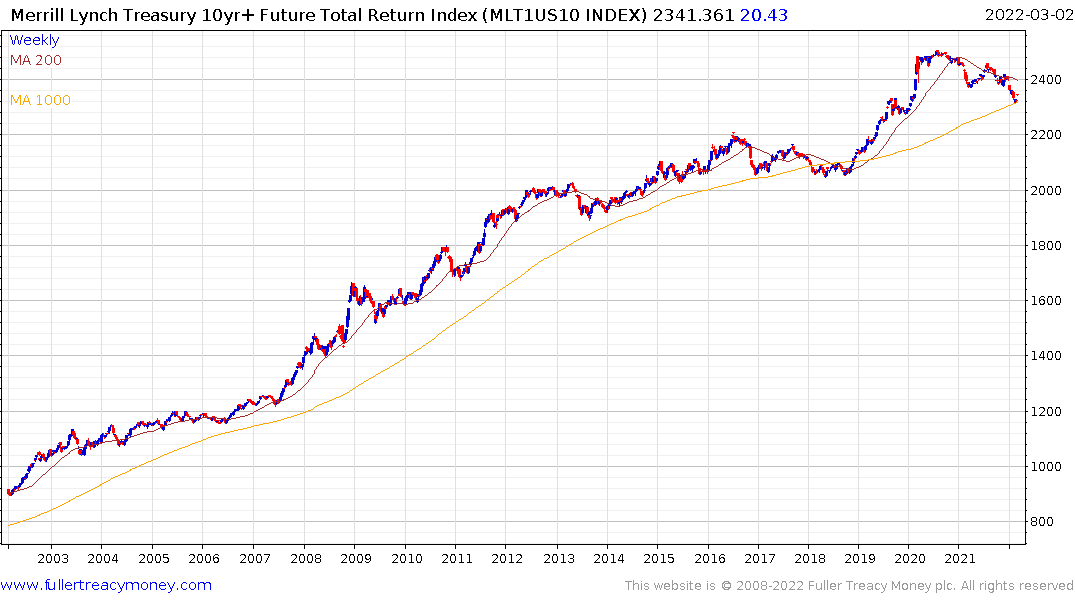

The Total return on 10-year Treasury Futures is back testing the region of the 1000-day MA. This has been the most rewarding trend in the world for forty years. If it is to continue, it will need to hold the low at 2300.

The Copper/Gold ratio breaking higher is generally thought of as a lead indicator for government bond yields so this represents a significant quandary for investors.

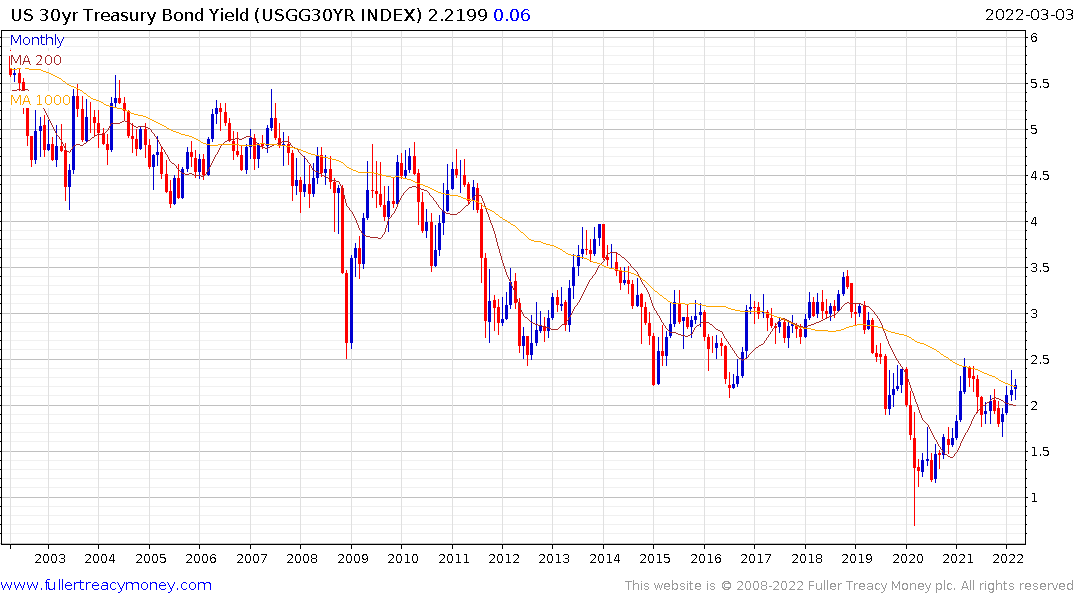

30-year yields bounced from the region of the 200-day MA this week and continues to fail at the 1000-day MA.

Politicians are desperate to get inflationary pressures down. That suggests a deal to enable Iran to sell its oil on the international market will be signed at terms favourable to Iran. That could bring prices down for the short term but the bigger risk is Iran becomes a nuclear power. That will set off an arms race in the region.

In the last twenty-four hours I have had two people ask me about protecting profits on coal and iron-ore companies respectively. It’s not every day I get asked about where the best place to put a stop is. It’s a sign that investors are nervous. It’s been a very difficult market environment recently so when people have profits, they want to make sure they protect them. That’s a recipe for choppy action.

It looks like we are at a major tipping point in the relationship between asset classes. The failure of the Dow/Gold ratio to continue to trend higher into the mid 2030s is a wakeup call that events and trends unfold faster now than in decades past. This a function of the trend of technological innovation; where information and capital travel instantaneously. It has also been supported by the long term of yields contracting on the back of disinflationary forces like globalisation and technological innovation.

If globalisation is over, or at least on hiatus, that suggests inflation is the new trend. That also means commodities and real assets outperform.

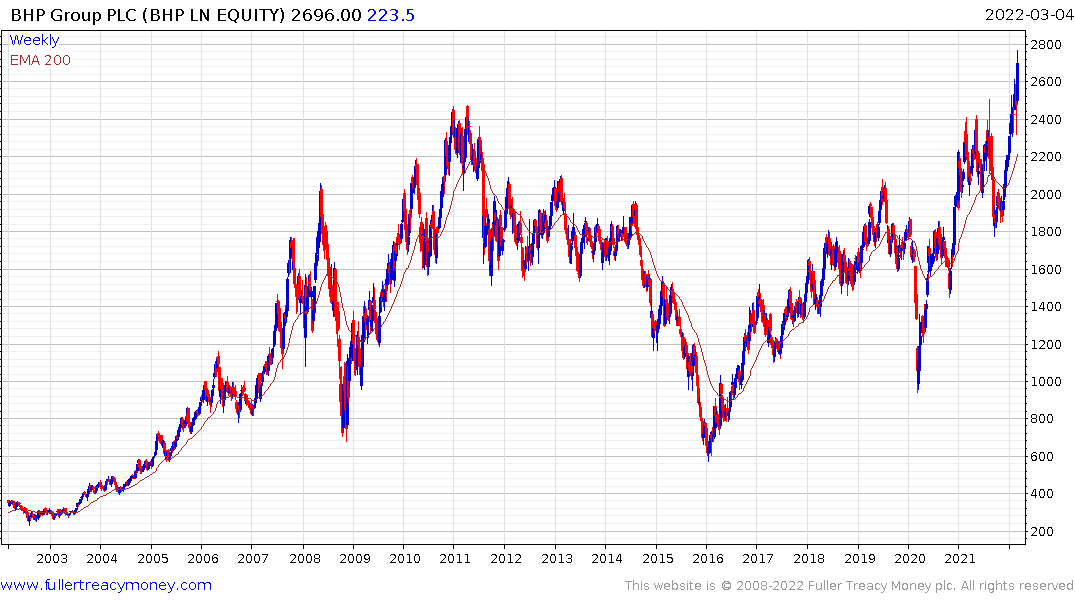

BHP Billiton broke out to new all-time highs this week. The end of the Winter Olympics in Beijing a few weeks ago means China’s metal bashing industries are open again and will need ores to produce steel, copper, and aluminium. Building out global renewable energy infrastructure represents a commodity demand growth driver larger than China’s original urbanisation/industrialisation.

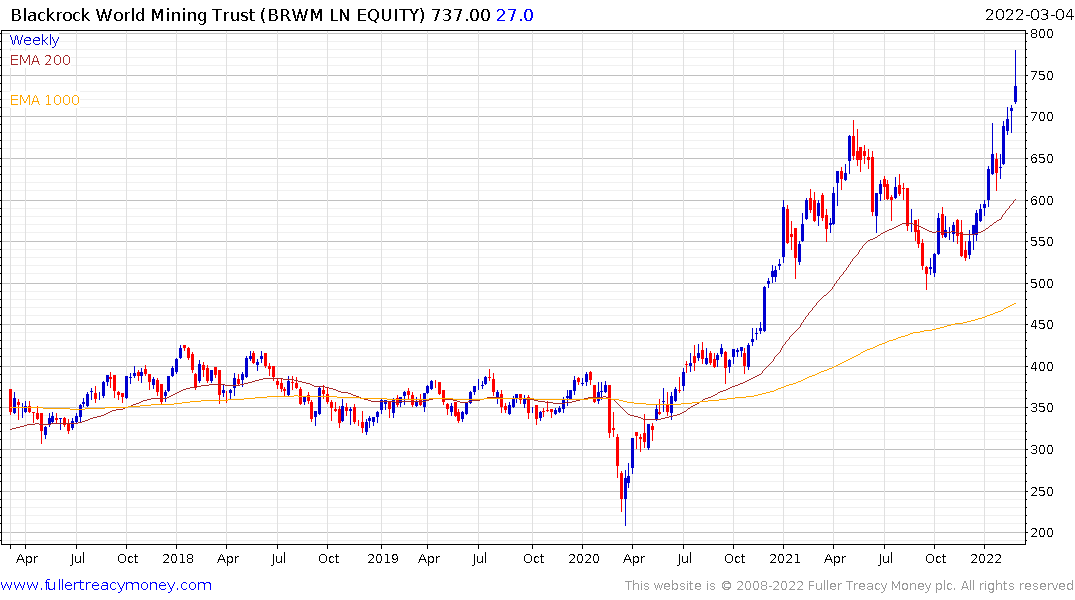

The Blackrock World Mining Trust is back testing its highs from back in 2008 and 2011. Some consolidation appears to be underway amid a short-term overbought condition.

The Blackrock World Mining Trust is back testing its highs from back in 2008 and 2011. Some consolidation appears to be underway amid a short-term overbought condition.

Resources in friendly countries will be more attractive because of security of supply. Brazil has been aggressively raising rates and is a major exporter of everything the world needs. The Real is testing the upper side of a two-year base formation and a sustained breakout would signal a return to medium-term demand dominance.

Brazil enjoyed a decade of global acclaim and influence during the last commodity bull market. It’s quite likely to be a leader in the next one too.

Russia is currently attempting to ban exporting fertilisers. That’s supporting the price of fertiliser shares from politically stable countries like the USA, Canada, and Australia. Mosaic continues to extend its breakout and that is representative of strength across the sector.

Inflation is often measured on a year over year basis. The peak in inflation that was expected to come in later this year is going to be challenged by the distortion arising from the invasion of Ukraine. That suggests inflation is likely to be stickier than initially expected. That’s especially true of countries that depend on Russia and Ukraine for food. Egypt is already experiencing stress and that will spread to other countries before long.

Central banks everywhere are going to have a difficult time raising rates both because of the massive public and private debts that have built up over the last forty years and because of the hit to growth containing inflation would entail.

That suggests we are going to have a general trend of financial repression for a lengthy period. Measures to control supply and deployment of credit will ebb and flow and governments will come up with more ways to tax production. Carbon credits fell aggressively this week in response to slower European growth but are unlikely to stay down for long. They are unlikely to be the last new tax devised by governments.

Meanwhile gold’s long-term store of value and unique characteristic of immutability supports its bull market.

Back to top