Drilling Three Miles Sideways Brings Risks for Shale Operators

This article from Bloomberg may be of interest. Here is a section:

Eoin Treacy's view -“It’s a risk-reward decision, because if something bad happens at 18,000 feet, that’s an expensive mistake,” Kaes Van’t Hof, president of Diamondback, said on a call with analysts. The company has even gone sideways deep under the home of company chief Travis Stice. So far, he said, the results of the longer laterals have been positive. “The drilling guys can do it, there’s no doubt about that.”

Pioneer, the largest independent producer in the Permian, has an inventory of more than 1,000 future wells that run at least 15,000 feet horizontally — or about 2.8 miles — and some even exceed 18,000 feet. That’s about 3.4 miles, or the length of 50 football fields. The longer horizontal wells generate more oil, cost less per lateral foot and require fewer vertical holes and fracking workers, Pioneer’s president and incoming chief executive officer, Rich Dealy, said on an August conference call.

Servicers, the hired hands of the oil patch, are for the most part eager to take on these kinds of risky, big-ticket jobs. An average 2-mile lateral well costs $6.5 million, all in, compared to around $9 million for a 3-mile lateral well, according to data from Bernstein. Pioneer and Diamondback didn’t say whether they’ve had any problems when they extend the laterals or how much they’ve spent, though Dealy said on the call that the roughly 3-mile laterals result in capital savings of about 15% per foot. Longer horizontals are particularly popular in the Marcellus Shale of the US Northeast as well as the Midland Basin of the Permian in Texas.

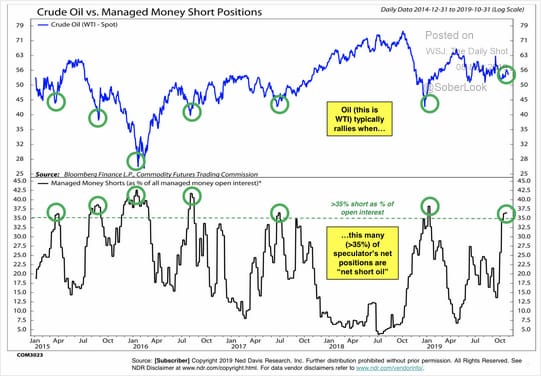

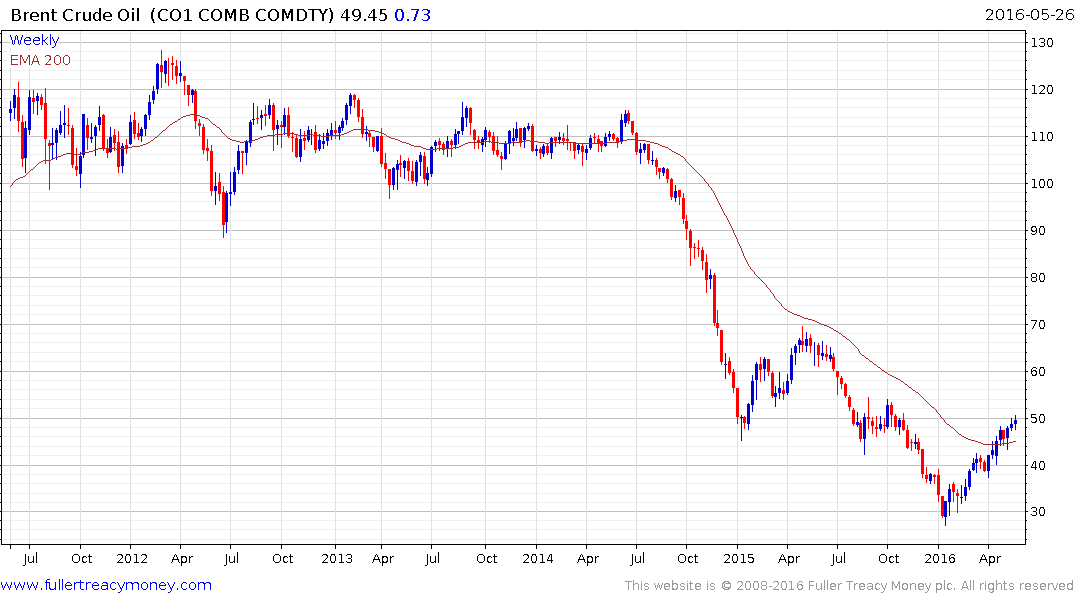

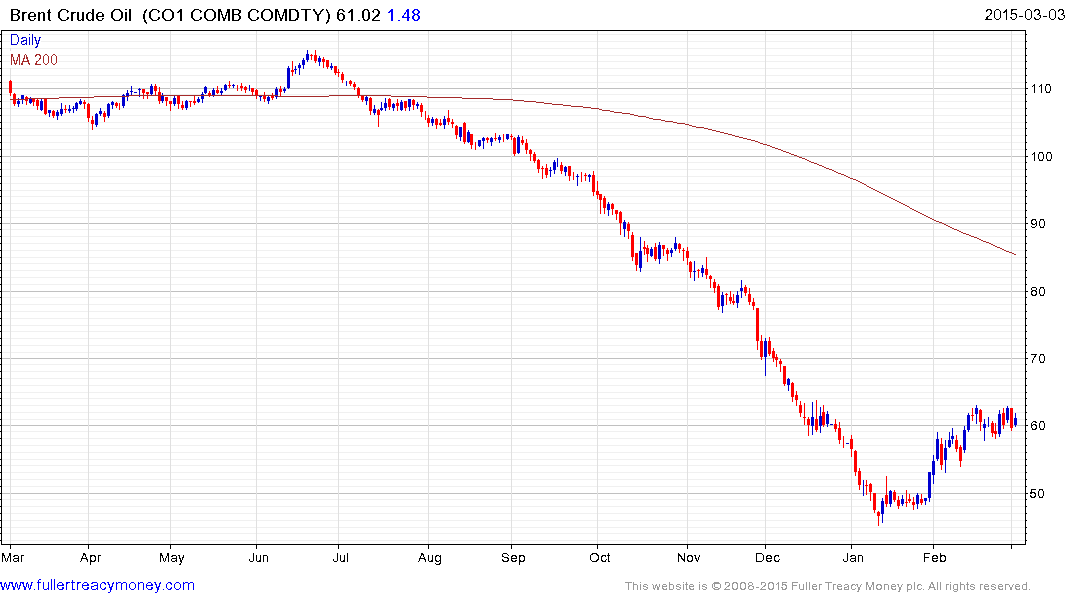

Unconventional wells are more capital intensive. The surge of capital chasing returns in a zero rate environment fuelled the initial surge in the early 2010s. Today capital decisions are more disciplined. They rely on higher expected prices and returns and less on acreage because access to capital has been constrained. The success of the anti-carbon movement and higher rates have led that transition.

This section continues in the Subscriber's Area. Back to top

_trend%2C_EU-28%2C_1990%E2%80%932012.png)

.png)

.png)