Inflation at 3% Flags End of Emergency, Turning Point for Fed

This article from Bloomberg may be of interest to subscribers. Here is a section:

None of this means it’s game over in the fight against price pressures — especially for the Fed, which is widely reckoned to be locked-in to another interest-rate increase later this month. Still, there’s now a better-than-even chance that a July 26 hike, which would take the benchmark US rate to 5.5%, could be the last in quite a while.

That’s the way markets were betting after Wednesday’s data. Yields on short-term Treasury yields plunged, stocks rose, and the dollar was headed to the lowest in more than a year by one measure – all in anticipation that the Fed might ease up.

‘Coming to End’

“The new data could give the Fed reason to debate whether any further rate hikes after this month are needed,” wrote Ryan Sweet, chief US economist at Oxford Economics. “This tightening cycle by the Fed is likely coming to an end.”

CPI is back inside the pre-pandemic range but the core figure is still at elevated levels. That represents a partial win for the Federal Reserve. The challenge is regular CPI is supposed to be more prone to volatility than the core figure.

Jerome Powell has stated he is focusing on the core services less housing figure. That has been steady around 4.5% since August 2022 and is the primary data point suggesting inflation is sticky. Nevertheless, traders are betting the July hike will be the last in this cycle.

The 2-year yield has failed to sustain a move above 5% on two occasions this year. That suggests clear support in this area and the surprises are likely to be on the upside for prices.

Crude oil prices rallied on the initial enthusiasm surrounding lower inflation.

Crude oil prices rallied on the initial enthusiasm surrounding lower inflation.

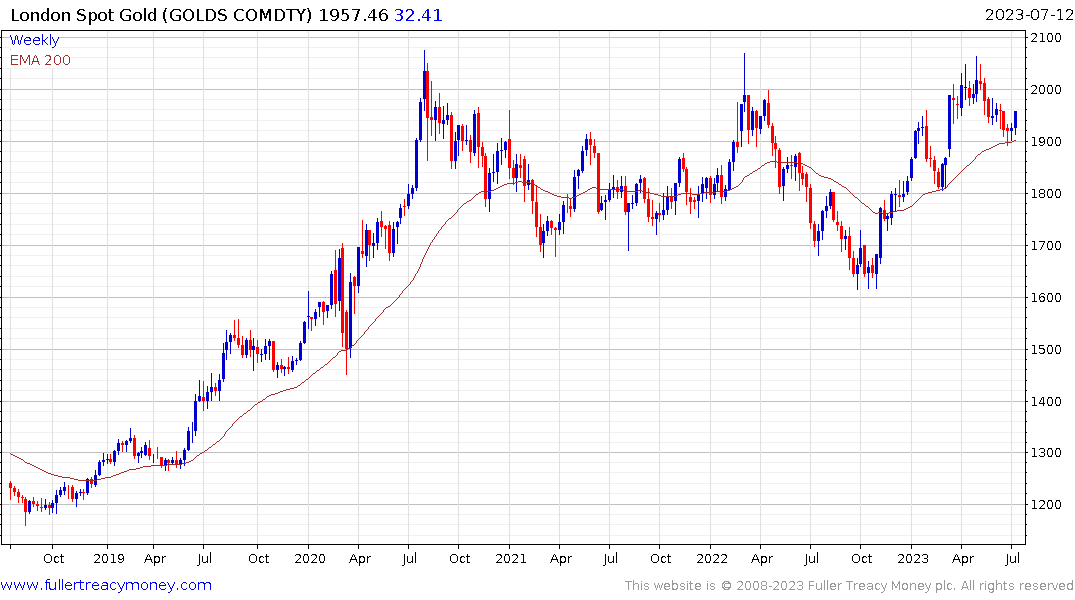

Gold extended its rebound from the region of the 200-day MA. The prospect of the trend of real rates turning lower from its currently strongly positive condition and the related topic of the Dollar losing its interest rate advantage are important bullish catalysts.

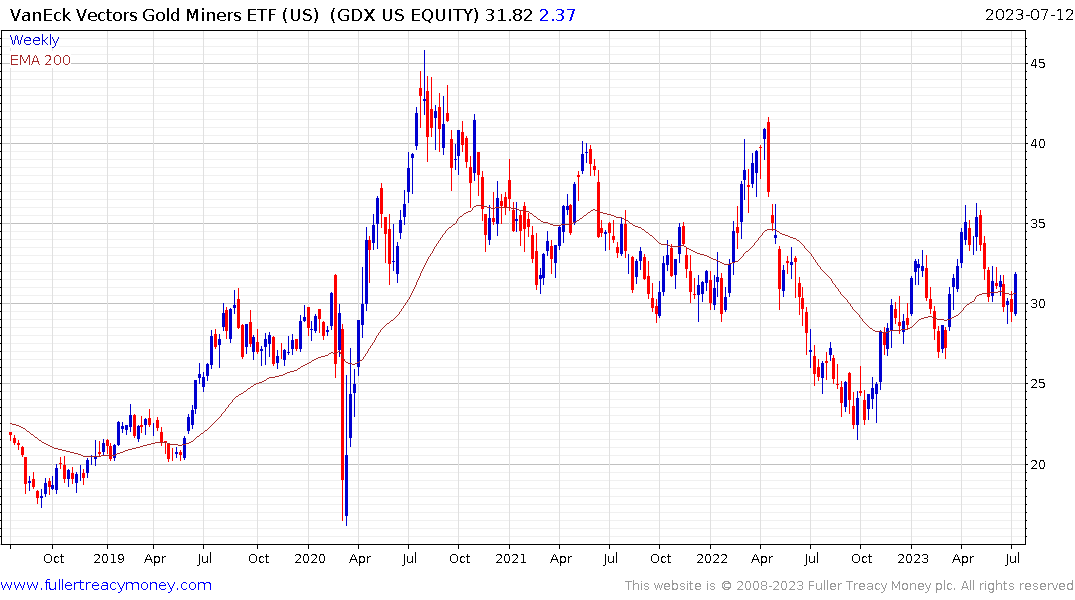

The VanEck vectors Gold Miners ETF rebounded to break the two-month downtrend, to confirm support in the region of the 200-day MA and the psychological $30 area.

The VanEck vectors Gold Miners ETF rebounded to break the two-month downtrend, to confirm support in the region of the 200-day MA and the psychological $30 area.

Silver jumped by over $1 to also confirm near-term support in the region of the trend mean. The entire volatile range since 2020 looks like a first step above the base formation which is a precursor to a longer-term uptrend.

Silver jumped by over $1 to also confirm near-term support in the region of the trend mean. The entire volatile range since 2020 looks like a first step above the base formation which is a precursor to a longer-term uptrend.