Nuclear power could see its biggest expansion in decades, leading to increased demand for uranium

This article from MarketWatch may be of interest. Here is a section:

"Growing interest in nuclear energy is being seen around the world," said Freebairn, noting this his company has been highlighting events in Eastern Europe and North America.

For now, nuclear power provides around 10% of the world's electricity, according to the International Energy Agency.

It comes from roughly 440 reactors in 31 countries with about 390 gigawatt electrical (GWe) capacity, according to UxC's Hinze. If total power demand grows by 2% to 3% as agencies like the IEA predicts over the next 10 to 20 years, and nuclear power keeps it share of the total in the 8% to 10% range, then Hinze expects nuclear power should reach at least 500 GWe by 2040 and as high as 550 GWe.

That would represent a roughly 40% growth over the current market size, he said.

There are potential downside risks to nuclear power growth, including competition from fossil fuels and renewables, but since nuclear power is "already not a huge share of the market, it would make sense that its growth can continue regardless of how the other energy fuels fare," Hinze said.

The uranium price war is over. Kazakhstan flooded the market with supply between 2011 and 2016. That forced several smaller miners out of business. Even Cameco closed mines and supplied long-term contracts by buying spot on the open market. The introduction of the Sprott Uranium ETF helped to soak up available supply and was instrumental in setting up the conditions for the current recovery.

The big long-term story for the nuclear sector is generation IV and modular designs. They hold the promise of both reliable carbon free energy, lower construction costs and mobility. The challenge in the short term is the global supply chain is totally dependent on Russia for processed fuel. Building an independent supply chain is going to take both time and a long-term commitment to demand.

Cameco remains the primary vehicle investors are using to play the sector. The share is accelerating to test the 2007 peak.

Cameco remains the primary vehicle investors are using to play the sector. The share is accelerating to test the 2007 peak.

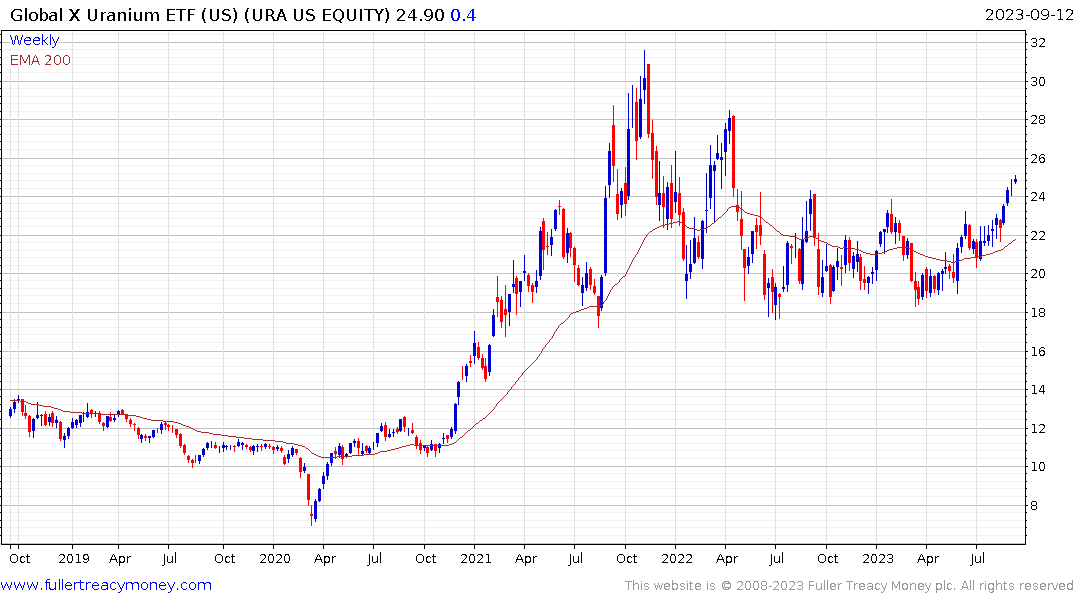

The Global X Uranium Miners ETF continues to extend its breakout and has broken a medium-term sequence of lower rally highs.

The Global X Uranium Miners ETF continues to extend its breakout and has broken a medium-term sequence of lower rally highs.

Centrus Energy (old USEC) is developing production capacity for the HALEU fuel for small modular reactors. The share now testing the upper side of its yearlong range.

Centrus Energy (old USEC) is developing production capacity for the HALEU fuel for small modular reactors. The share now testing the upper side of its yearlong range.