Cocoa Hovers Near 12-Year High on West Africa Supply Concerns

This article from Dow Jones may be of interest. Here is a section:

Cocoa futures traded near a 12-year high on worries about West African output.

Prices are up more than 40% year-to-date and are expected to keep rising, supported by concerns that global supplies will remain strained amid adverse weather conditions. Heavy rain in West Africa already has knocked young pods from trees and facilitated the spread of black pod disease, which thrives in humid conditions.

Uncertainty also remains over the El Nino weather phenomenon, with analysts at StoneX anticipating that impacts will persist into early next year.

“The long-term uptrend in the cocoa market remains in place, as low production out of West Africa is expected to keep supplies tight,” ADM Investor Services wrote in a note on Monday.

Ivory Coast, the world’s top cocoa producer, is in the midst of negotiations over new environmental rules for European exports, and Ghana has hiked farm-gate prices in an effort to fend off smuggling. Still, there has been recent optimism that good weather could support a better harvest in Ivory Coast and some areas of Nigeria.

Veteran commodities traders may remember there was an effort by chocolate makers several years ago to boost cocoa supply by providing funding for farm modernization and several invested in additional processing facilities. That fed growing demand but appears to have done little to improve supply.

Cocoa only grows in a narrow band around the equator and requires hot and humid conditions. It is mostly cultivated in countries with few resources and no access to modern farming methods. The whole question of how to increase supply while complying with the EU’s directives on deforestation is a significant impediment to expansion.

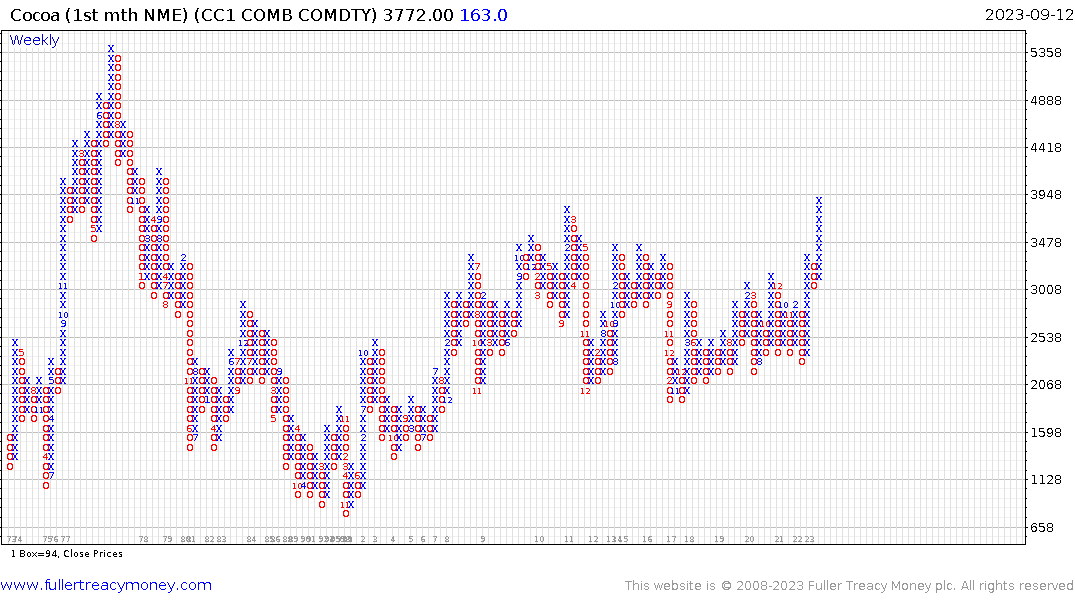

The price is now testing the spike peak from 2011. A clear downward dynamic will be required to check momentum. During the inflationary trend of 1975-77 the prices jumped from $1000 to $5000. At that time most soft commodities experienced similar epic runs.

The price is now testing the spike peak from 2011. A clear downward dynamic will be required to check momentum. During the inflationary trend of 1975-77 the prices jumped from $1000 to $5000. At that time most soft commodities experienced similar epic runs.

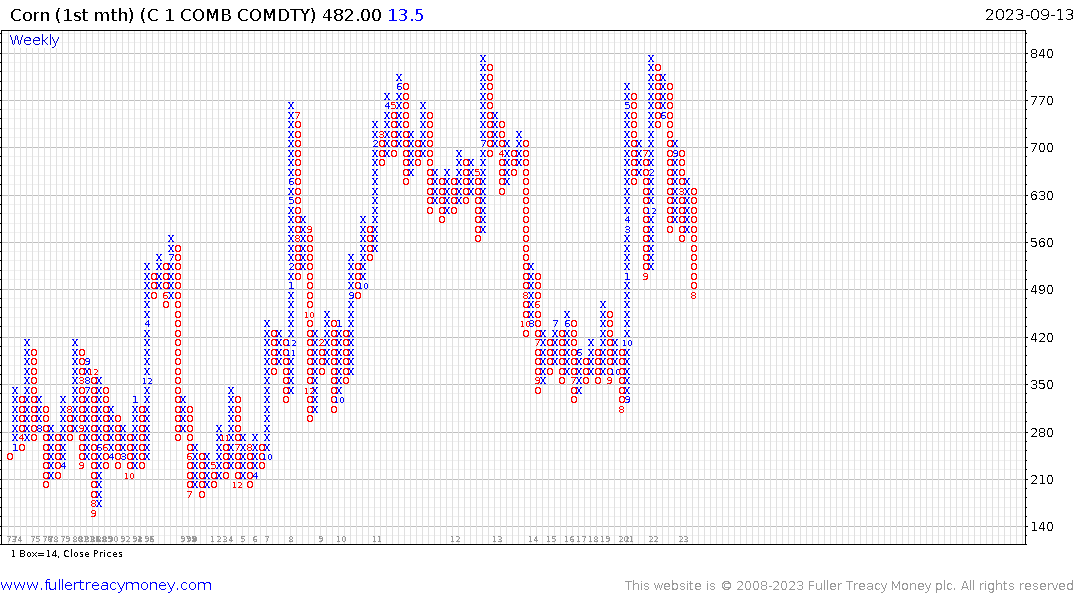

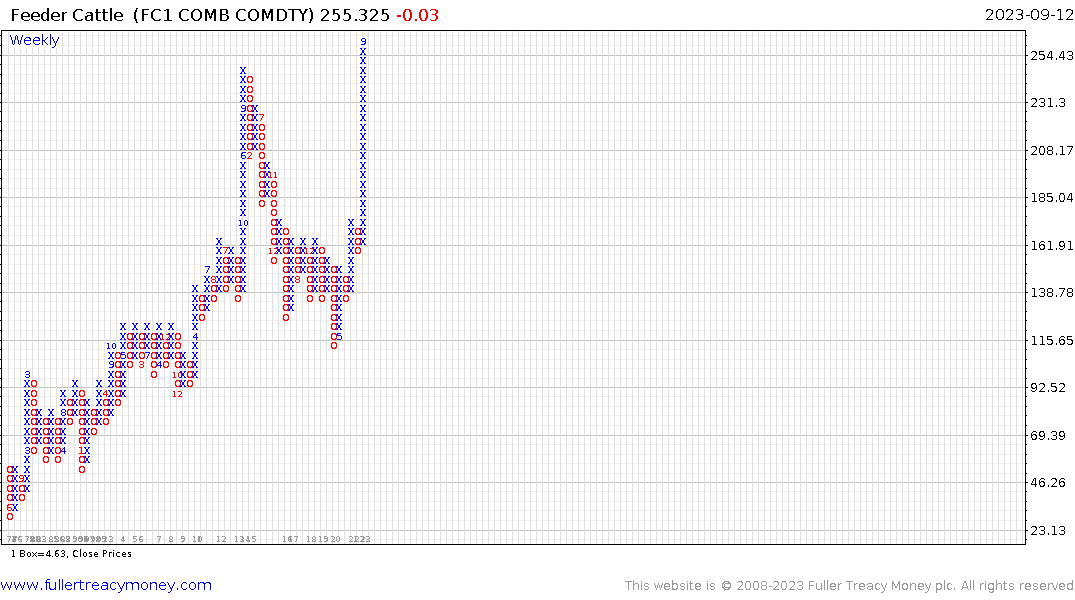

In the feeder cattle market demand is outstripping supply. That’s another symptom of the mismatch between consumers’ ability to pay and the tight finances of cattle operations. The strong price of cattle reflects a lag from the high prices for feed stock like corn last year. Farmers decided to feed up fewer calves in response to higher input costs. Now that the primary grains have retreated, next year’s supply of cattle should be better.

The price is very short-term overbought but a break in the succession of higher reaction lows will be required to signal a peak of more than short-term significance.

The price is very short-term overbought but a break in the succession of higher reaction lows will be required to signal a peak of more than short-term significance.

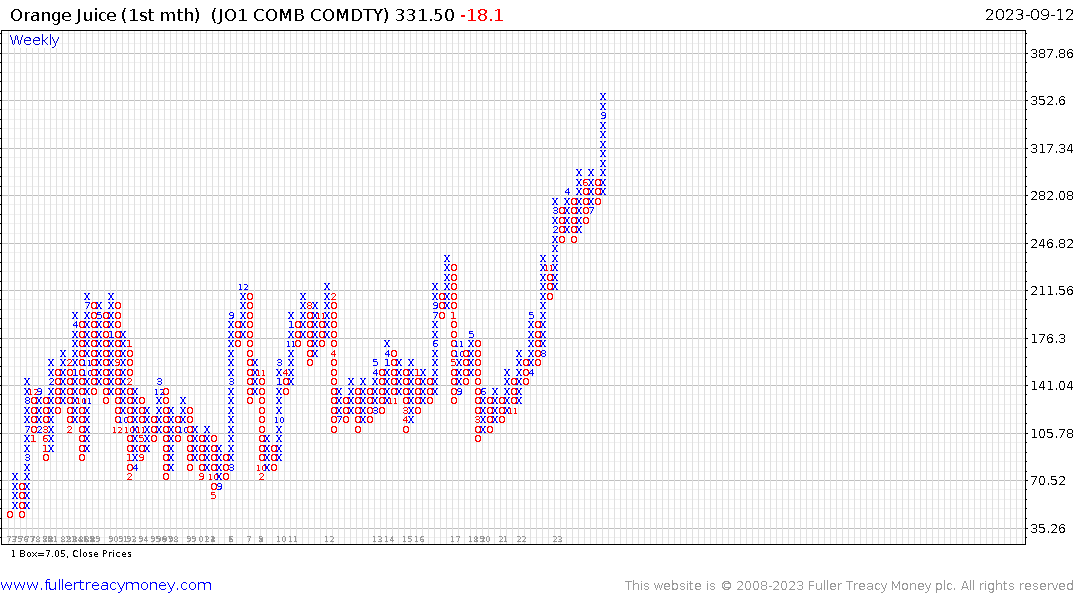

Orange Juice has surged to unprecedented levels following the hit to supply from hurricane Ian last year. The price is very overextended but a clear break of the succession of higher reaction lows will be required to signal a peak of more than short-term significance.