Australia Firms Ramp Up Spending Plans Signaling Strong Recovery

This article from Bloomberg may be of interest to subscribers. Here is a section:

The result is likely to boost the Reserve Bank of Australia’s confidence in the economy’s prospects as the board prepares to review the A$4 billion weekly pace of its bond-buying program in February. Su-Lin Ong at Royal Bank of Canada put the odds of quantitative easing ending at that meeting at 30%.

The capex data is “likely to see markets continue to price in multiple hikes over the year ahead,” said Ong, head of Australian economic and fixed-income strategy at RBC. Money markets are wagering the RBA will start its policy tightening cycle with a 15 basis point hike to 0.25% by May 2022.Today’s report showed the Covid lockdowns weighed on outlays, with total capital expenditure slipping 2.2% in the three months through September from the prior quarter. Spending on equipment, plant and machinery fell 4.1%, suggesting it will detract from economic growth in the period.

Australian firms are looking around the world and see massive monetary and fiscal stimulus. Much of that spending will be focused on infrastructure and they are in line to benefit from outsized demand for resources. This is the time to invest in new supply before everyone else does.

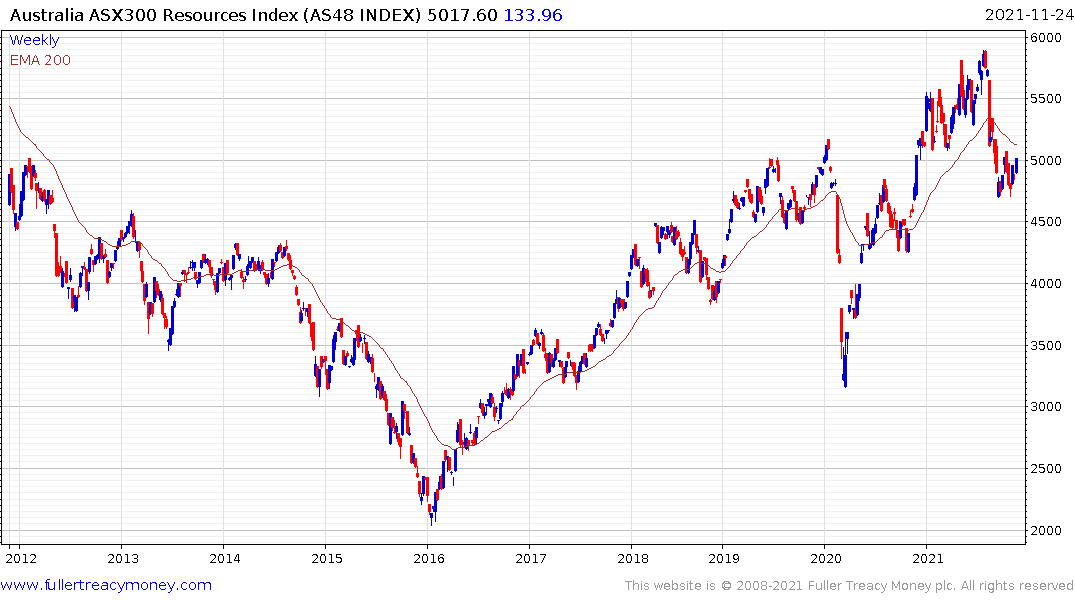

The S&P/ASX 300 Resources and the Energy sector are both rebounding following recent weakness.

The challenge for the RBA is this spending in the resources sector will boost inflationary pressures but the fractious debate about lockdowns in Australia is weighing on economic activity.

The Australian Dollar is back testing an area of potential support near the September and August lows but a clear upward dynamic will be required to check the slide.

The Australian Dollar is back testing an area of potential support near the September and August lows but a clear upward dynamic will be required to check the slide.

2-year yields continue to support the view that interest rate hikes are more likely than not over the next 12 months.

Generally speaking, banks tend to do well in a rising rate environment. The fact that the S&P/ASX 300 Banks Index is now breaking downwards suggests investors are more concerned with the impact rising rates would have property values. The prevalence of floating rate mortgages and banks servicing their own mortgages suggests high exposure to the property sector.

Generally speaking, banks tend to do well in a rising rate environment. The fact that the S&P/ASX 300 Banks Index is now breaking downwards suggests investors are more concerned with the impact rising rates would have property values. The prevalence of floating rate mortgages and banks servicing their own mortgages suggests high exposure to the property sector.

Australia, New Zealand and Canada are all in the same boat on this one. Their respective property markets avoided the crashes experienced in the USA and much of Europe following the credit crisis. Domestic debt ratios have exploded over the subsequent decade. That complicates the argument for raising rates. Their economies are much more interest rate sensitive now than they were in 2008.

Banks are liquidity providers and significant underperformance would be a clear warning sign of trouble ahead so these sectors are worth monitoring.

Back to top