Bridging Hong Kong, Shanghai for the future

This article by Zhu Ning for ChinaDaily Asia, dated May 19th may be of interest to subscribers. Here is a section:

To be fair, allowing Chinese domestic investors to access the Hong Kong stock market may prove to be even more valuable. Given the controls on capital accounts and cross-country listings, Chinese domestic investors are severely underdiversified in their portfolios.

Such underdiversification costs Chinese investors dearly, especially given the exorbitantly high volatility and recent disappointing performance in the Chinese A-share market.

By investing in the Hong Kong market, Chinese investors can not only buy cheaper stocks offered by the same company (for most companies cross-listed between Shanghai and Hong Kong, the H-shares trade at a discount), but also invest in overseas companies that cater to Asian investors and are listed in Hong Kong.

?With the direct investment channel between Hong Kong and Shanghai, Chinese investors can use their existing accounts to invest in overseas companies. Such convenience and familiarity will no doubt boost Chinese investors' confidence in investing overseas, which not only helps their portfolio performance but also propels more Chinese capital into the international financial arena.

Speculation that the A-H Share spread would disappear due to changes in Chinese regulations sent the Hang Seng to an accelerated peak of 32,000 in 2007. When this speculation came to naught, the Index pulled back sharply before collapsing during the credit crisis. By contrast news that the Chinese are prepared to allow domestic investors relatively unfettered access to the Hong Kong market within the next six months has on this occasion been met with little fanfare.

Of course the stock market situation is totally different today. In 2007, the A-Share market was surging ahead and investors were speculating that the Hang Seng would participate in a major catch-up move. Today investors need a lot of convincing to consider China particularly when other markets are doing a lot better. The A-H Share premium has fallen to its lowest level since 2006 and may have disappeared altogether by the time the regulatory change comes into being. Whereas in 2007 the Chinese were worried about an overheating stock market, today they are eager to continue to attract investment. Therefore the potential of them following through to allow greater access to their domestic market is probably greater today than it was in 2007.

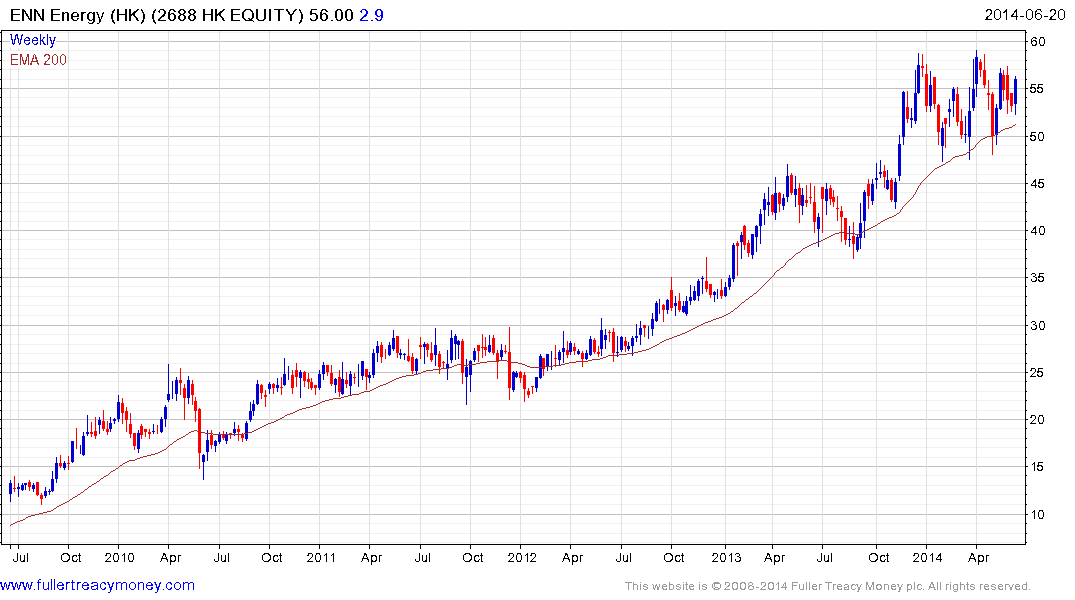

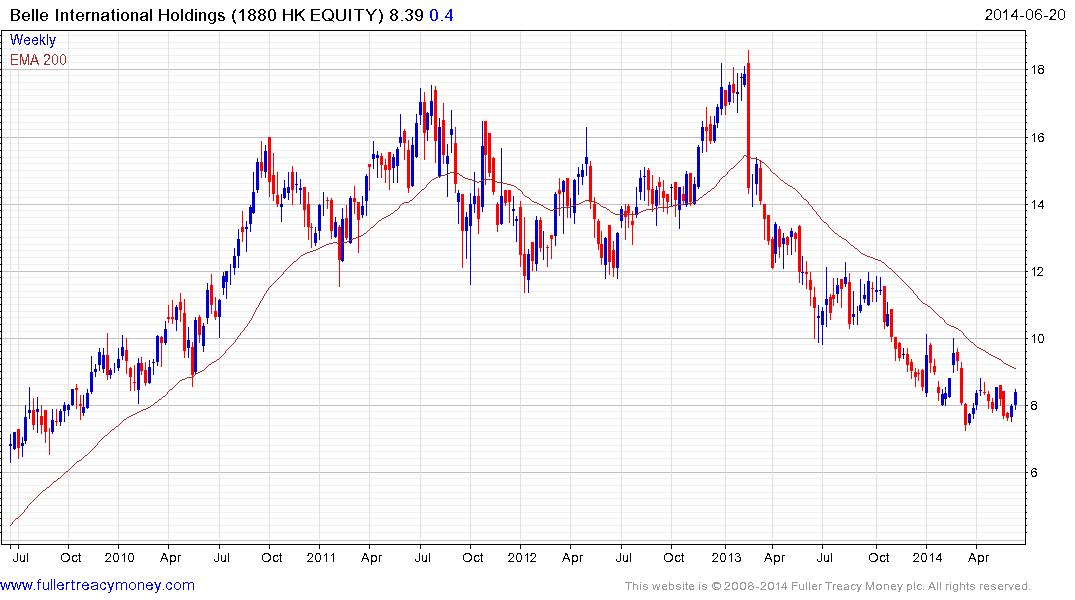

A number of major Chinese companies hold dual Hong Kong and mainland China listings. However there are also a relatively small number that are only listed in Hong Kong. Mainland investors will be able to buy them once this regulatory change takes place. Tencent Holdings, China Mobile, CNOOC, China Overseas Land & Investment, ENN Energy, Kunlun Energy, Want Want, Hengan International, Belle International are all mainland focused companies that are listed in Hong Kong but not the mainland.

Of these:

ENN Energy, which is a natural gas pipeline company, remains in a reasonably consistent uptrend.

Belle International, which is a shoe retailer and manufacturer, has lost downward momentum following a more than 50% decline. A sustained move above the 200-day MA would break the progression of lower rally highs and suggest a return to demand dominance beyond the short term.

AIA Group was spun-off from AIG Group during its post-credit crisis restructuring and has businesses in number of Asian countries. The share continues to hold a progression of higher reaction lows, a sustained move below HK$37 would be required to question current scope for additional upside.

Back to top