Hubert's Peak Is Here

Thanks to a subscriber for this report from Goehring & Rozencwajg. Here is a section on shale oil production growth:

Conventional wisdom believed the industry had improved its drilling and completion of shale wells. The ability to stay in the zone, the choice, and the volume of proppant and fluid were all said to have resulted in sharply higher drilling productivity. Wall Street and the energy industry both promoted a consistent narrative. We felt there were several unanswered questions and undertook a study to consider what was driving surging well productivity. If the industry had radically improved drilling techniques, it would ultimately be bearish for the sector. A previous low-quality Tier 2 location could now be transformed, through enhanced drilling and completion techniques, into a top-quality Tier 1 well. As a result, the inventory of best wells would explode, and the shale basins would continue to thrive for years to come. Modeling well performance is hugely complex. Shale basins are highly nonlinear with high degrees of variable inter-dependence. As a result, traditional statistical techniques, such as the linear regressions used by most analysts, fall short. We turned to advanced methods, including machine learning and neural networks, and achieved surprising results. Instead of improved drilling techniques, we concluded that two-thirds of the improved productivity between 2013-2018 came from favoring the best drilling locations. In 2013, 22% of Midland wells were Tier 1. By 2018, Tier 1 represented 50% of all wells. Since a Tier 1 well is nearly twice as productive as a Tier 2 well, the migration from lower to higher quality areas drove a massive amount of the improved well productivity.

Here is a link to the full report.

There is significant difficulty in assessing the production profile of shale fields because constant drilling is required to both grow and sustain production. If the shale drillers have been following the energy sector’s equivalent of “rich veining”, then it would be reasonable to expect they will be reluctant to invest in additional new supply until prices are higher enough to secure their margins.

It’s a fact that oil fields peak and once they have produced half the recoverable resources the cost of production trends higher. Let us assume that the Permian will in fact peak in 2024/25. That’s only around 18 months from now.

The first thing would be avoiding big investments in the fields that are about to peak. That is well publicised by the major oil companies refusing to boost supply despite record profits.

The second would be to expect M&A activity where the majors acquire longer-life assets. Exxon looking to acquire Pioneer is an example of that.

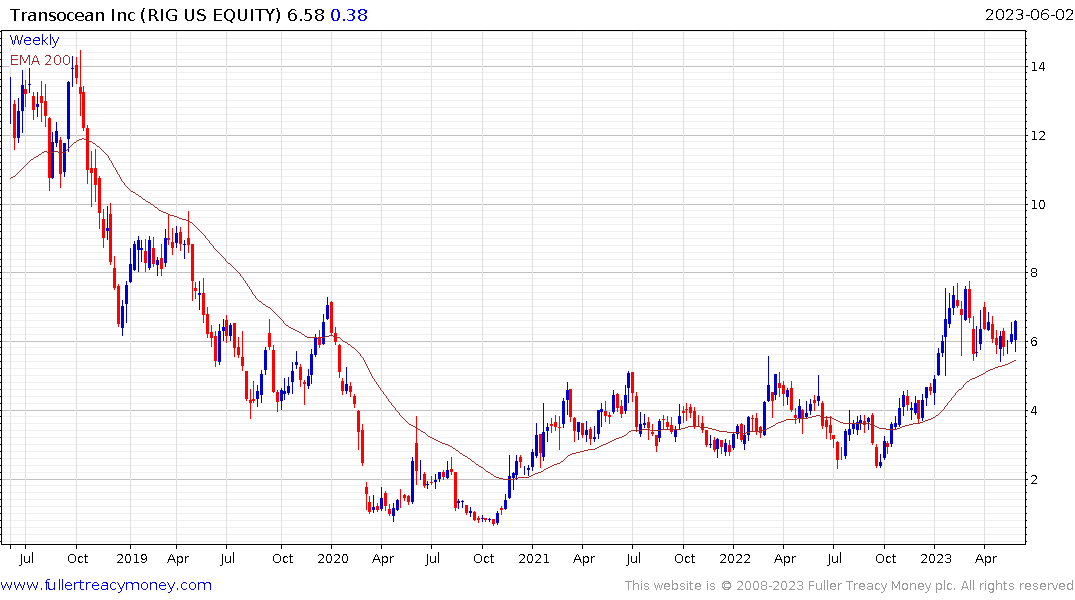

The third would be to favour reliable but more expensive supply. That suggests more investment in offshore is likely. I find it interesting that offshore is being rehabilitated as a greener form of production compared to onshore.

The third would be to favour reliable but more expensive supply. That suggests more investment in offshore is likely. I find it interesting that offshore is being rehabilitated as a greener form of production compared to onshore.

If a country were aware the bounty of oil supply growth was about to end, they would logically invest in alternative demand solutions. Upgrading utilities, easing restrictions for nuclear and incentivising the renewable energy sector all fit that bill.

With those themes, I still do not know if the Permian is about to imminently peak but if the companies and the country were to put preparations in place to cater to that event, I’m not sure they would be doing anything differently.

Brent crude continues to firm from the $70 area. A break in the medium-term sequence of lower rally highs would signal a return to demand dominance beyond short-term steadying.