Powering Up

Thanks to a subscriber for this report from Aviva which may be of interest. Here is a section:

For the grid to work, supply must match demand – all the time. “There are already times when we produce so much green electricity, we don’t know what to do with it,” says Hartman. “That can be in the middle of the day when the sun is shining, or in the middle of the night when we are not using so much electricity, but we are producing a lot from wind turbines.” At certain times, energy goes to waste; producers are paid to take capacity offline.

On the other hand, the vagaries of the weather mean generation can fall short of expectations as well. For instance, on rare occasions both Germany and the UK have experienced ‘not much sun’ and ‘not much wind’, so respective energy outputs slumped at the same time. Hence the hive of research activity around energy storage. Behind it is a key idea: if storage can be made cheap enough, dense enough and extensive enough, it becomes viable to operate an energy mix with a much higher percentage of renewables.

This is driving deployment of grid-scale storage; something companies like Tesla, LG Chem and Samsung are anticipating as they construct battery megafactories around the world15 (see Figure 4). Combining renewables with large, preassembled battery units to store excess power, with energy fed back into the grid when demand requires it, has taken off.

The relative attractiveness of this has shifted “seismically” recently, according to energy consultancy Wood MacKenzie.17 Producing energy using solar and wind power already undercuts natural gas on a levelised cost basis (see Figure 5) and recent discoveries suggest further efficiency gains are possible.

Henry Snaith, professor of physics at the University of Oxford, describes solar “being in 1965 in silicon technology terms,” for example, with “lots of room to improve”. (In Search of Wild Solutions has more details.) Now battery costs have fallen rapidly as well, so ‘solar PV + large-scale battery storage’ are cheaper than ‘solar PV + natural gas’ as back-up to meet peak demand.

Large numbers of battery factories are under construction. When they come on line, it will represent a voracious appetite for everything from copper, nickel, manganese and lithium to steel and aluminium. Between now and then there is still time to argue about the extent of the bull market.

In 2018, sufficient lithium supply came online to smother demand and prices gave up all their gains. Today, as demand increases, supply is having difficulty keeping pace, and prices have leapt to previously unimaginable levels. That mismatch between the timing of demand shifting and the ability of suppliers to adapt has contributed to a great deal of price volatility.

This is quite unlike the bull market in commodities arising from the industrialization of China twenty years ago. Back then economic growth of 10% per annum was relatively predictable, the source of demand was a well-defined geographic area and it was all state sponsored.

Today, big promises have been made but the technology is still catching up with aspirations. Battery storage is brand new technology. Fantastically large wind turbines are too. The quantity of money required to put a dent in fossil fuels’ dominance of the energy sector runs to trillions and no one seems to have a good explanation of where the money is going to come from. It is certainly going to be more difficult to fund aspirational development with higher interest rates. That suggests clear visibility of both the cost and resilience of solutions is going to be essential if the optimism about carbon neutrality is to be realised.

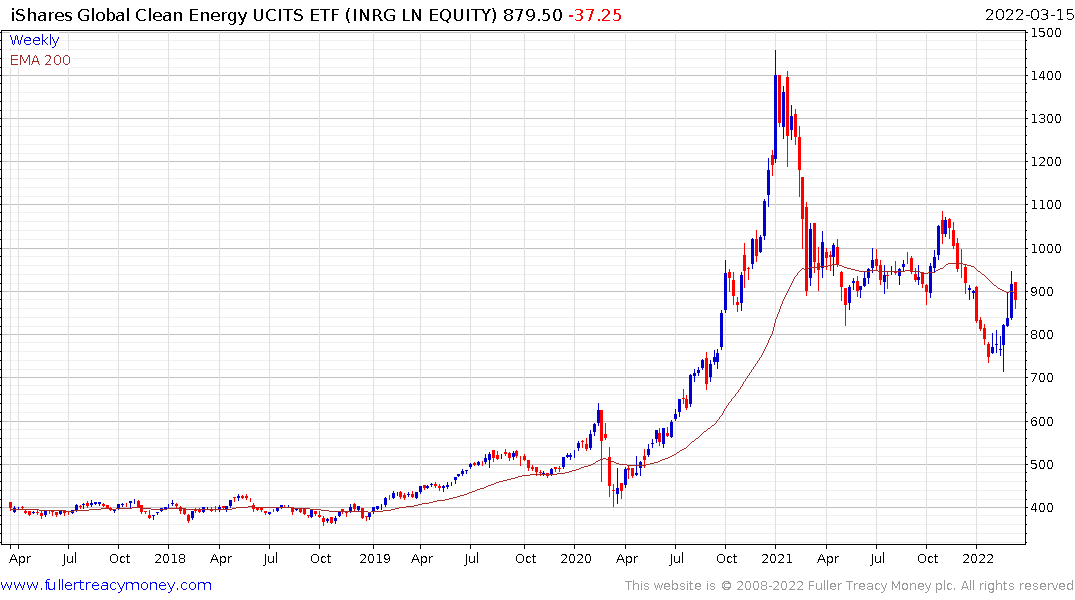

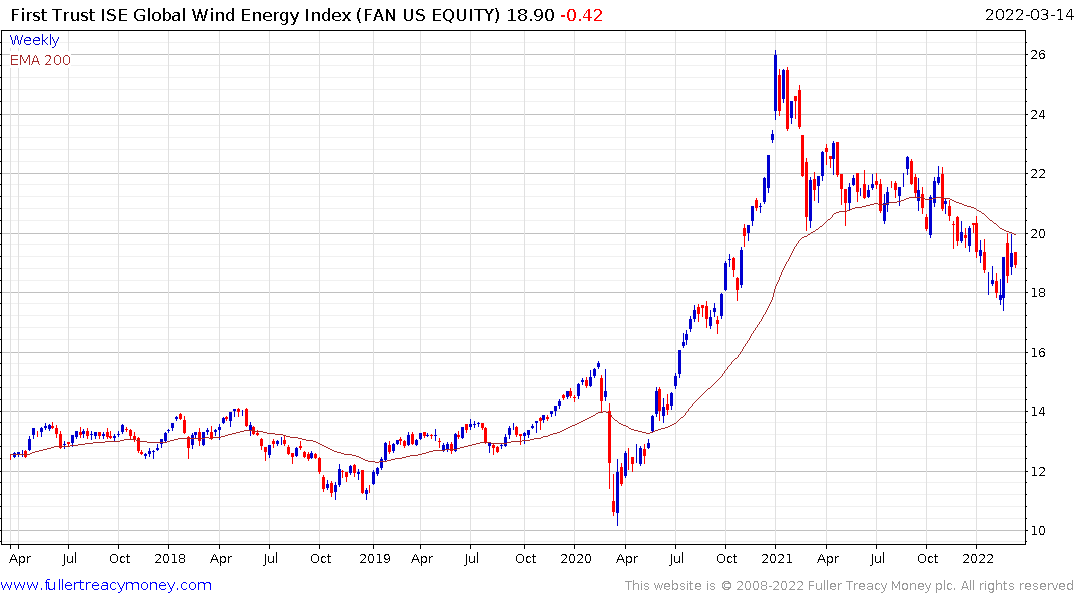

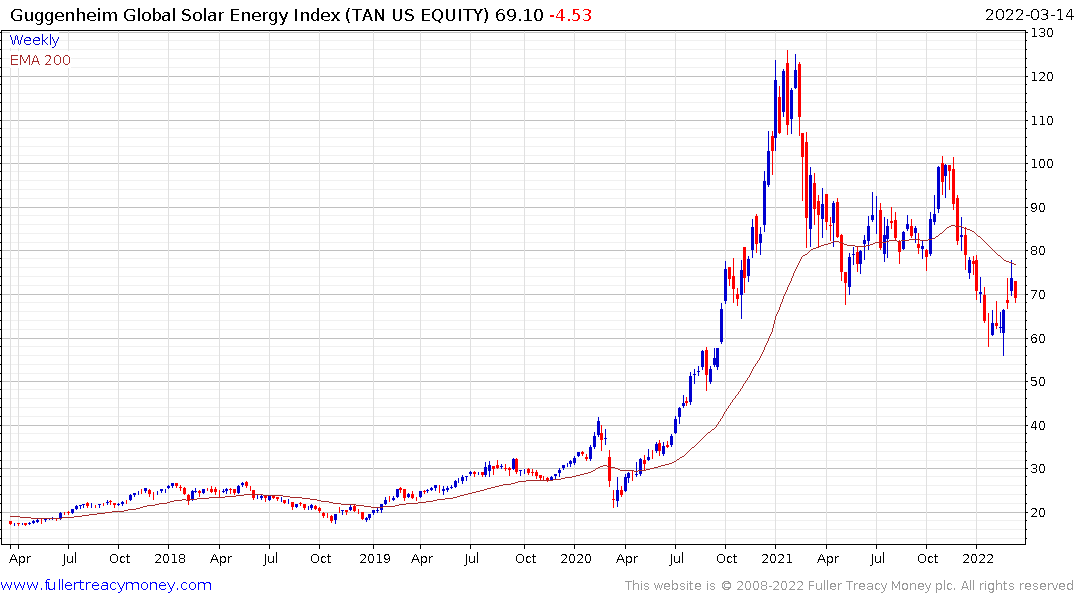

The high price of oil and geopolitical uncertainty have moved the needle in favour of renewables to such an extent that these concerns are being ignored. Both the wind and solar ETFs are putting in higher reaction lows.