EU Squeezes Hard on Russia, Sweeping In Oil, Bank, Business

This article from Bloomberg may be of interest to subscribers. Here is a section:

The European Union plans to ban Russian crude oil over the next six months and refined fuels by the end

of the year as part of a sixth round of sanctions to increase pressure on Vladimir Putin over his invasion of Ukraine.

“This will be a complete import ban on all Russian oil, seaborne and pipeline, crude and refined,” European Commission President Ursula von der Leyen said in remarks to the European Parliament. “We will make sure that we phase out Russian oil in an orderly fashion, in a way that allows us and our partners to secure alternative supply routes and minimizes the impact on global markets.”

Hungary and Slovakia, which are heavily reliant on Russian energy and had opposed a sudden cut-off of oil, will be granted a longer timeframe -- until the end of 2023 -- to enforce the sanctions, according to people familiar with the matter.

A rumbling argument in the oil market is contributing to the evolving wedging characteristic in prices. For the bulls, the dislocation caused by Western Europe’s efforts to stop buying Russian oil, as well as leaning on other countries to do the same, is a clean support for prices. The bears believe the impending global slowdown will kill off demand, and the market will turn to surplus faster than many people expect.

There is clear potential that we get the bullish outcome first and the bearish one after. Europe cutting off Russian imports is a near-term issue. The slowdown in global growth is a medium-term issue. By some estimates avoiding Russian exports Europe would take a 5% hit to GDP. The price is testing the sequence of lower rally highs at present and a sustained move above $115 would confirm a return to demand dominance.

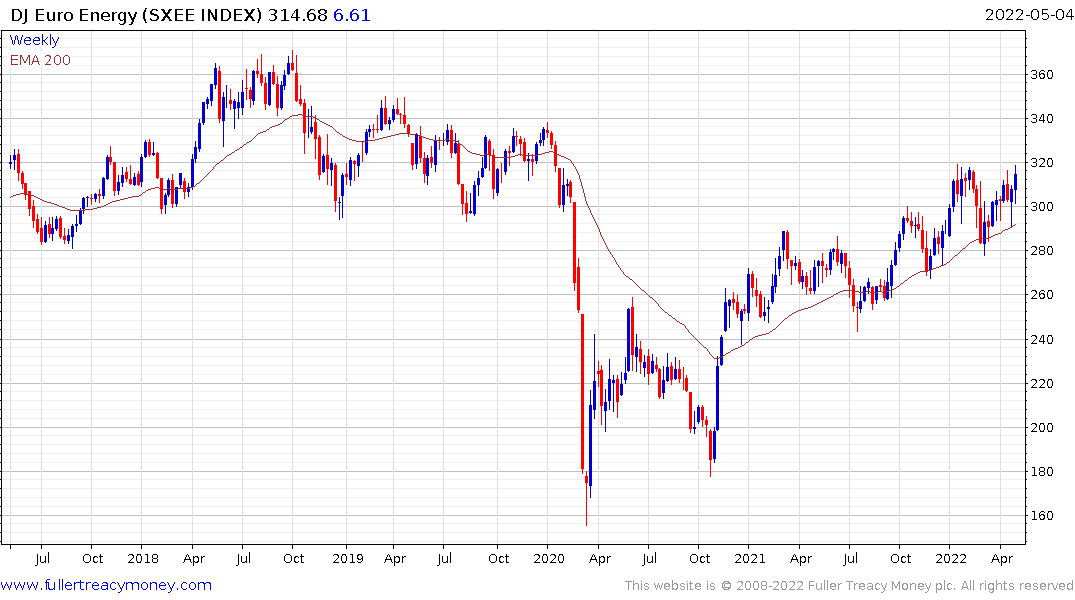

The Euro STOXX Oil & Gas Index continues to trend higher in a reasonably consistent manner.

The Euro STOXX Oil & Gas Index continues to trend higher in a reasonably consistent manner.

The FTSE-350 Energy Index is trending higher in a more aggressive manner; led by Shell which occupies 66% of the Index.

The FTSE-350 Energy Index is trending higher in a more aggressive manner; led by Shell which occupies 66% of the Index.