Chesapeake's Covenants Could Pinch in 2020

This article by Allison McNeely may be of interest to subscribers. Here is a section:

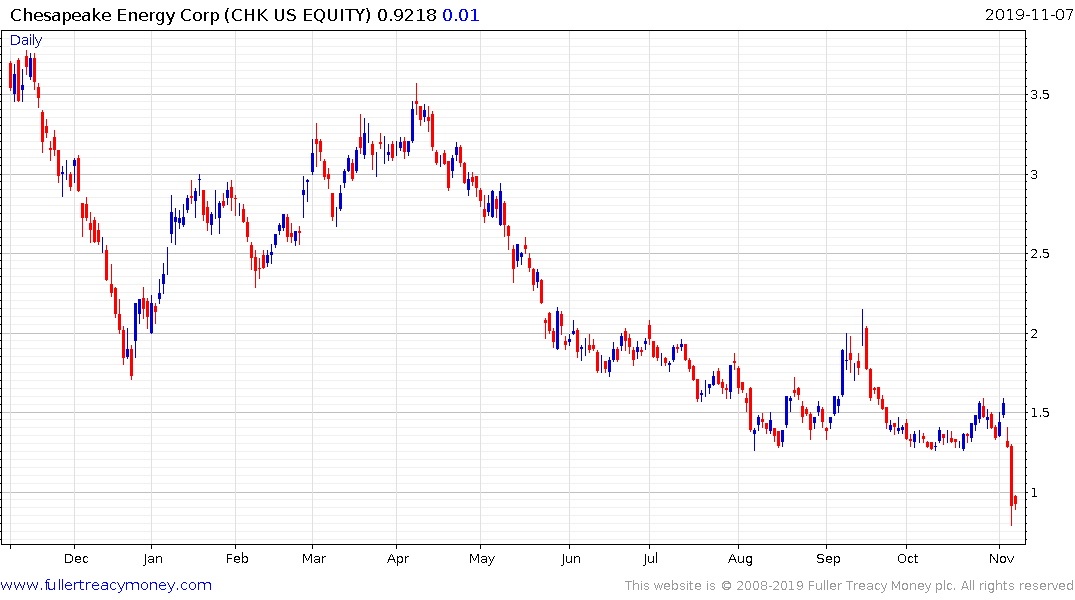

The company warned there is doubt about its ability to continue operating. Its shares and bonds have plunged since reporting earnings Nov. 5.

*Based on price assumptions of $55 per barrel for oil and $2.50 per million British thermal units for natural gas as well as no debt reduction, Chesapeake is likely to trip its leverage covenant by the third quarter of next year, if not sooner, CreditSights analysts Jake Leiby and Michael Mistras wrote in

the report.

**They predict Chesapeake will have a free cash flow shortfall of about $50 million in 2020 and finish the year with gross leverage of 4.6 times debt to a measure of earnings, above the 4.25 ratio in its covenant.

Chesapeake dropped significantly over the last couple of days and is now dependent on the kindness of strangers to ease debt covenants if it is to survive. The problem for the company is it is not viable at a shale industry average of $55. Its breakeven might be closer to $70. Meanwhile natural gas prices remain volatile, even after the rebound over the last week which took the price back above $2.50.

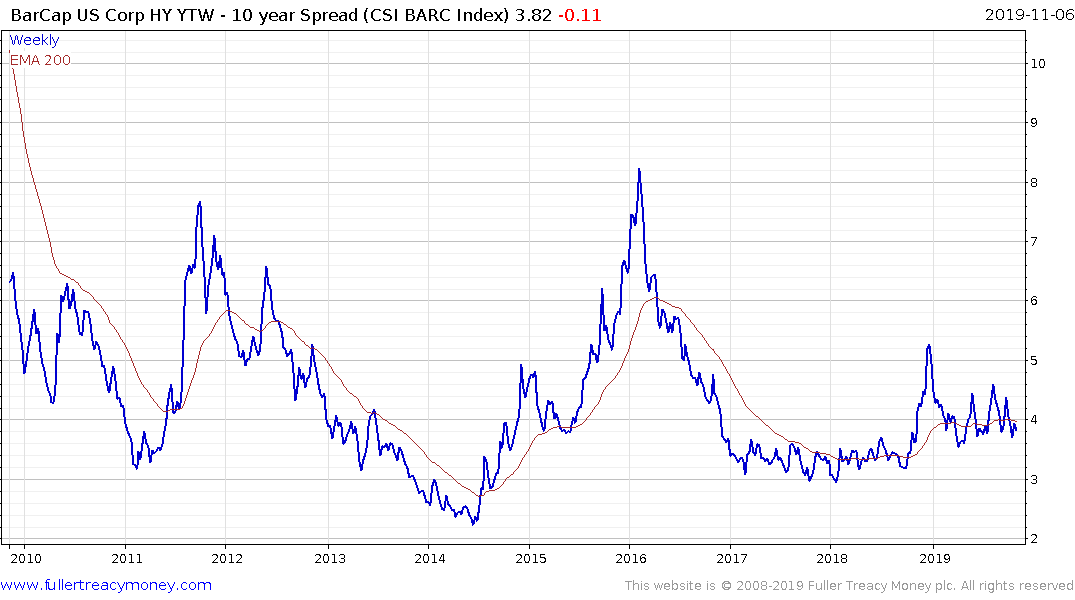

About 15% of all high yield debt originates from the energy sector. There have been a number of concerns raised over the last year about the number of BBB bonds outstanding and the potential for downgrades to high yield representing an existential threat to both the bond market and the ability of the companies concerned to source liquidity.

The BarCap US Corporate high yield spread remains relatively well contained but does have first step above the base characteristics. A sustained move above 500 basis points would likely be a catalyst for liquidity concerns in the wider stock market.

Meanwhile, energy high yield spreads are trending higher and represents where the clearest risk to the high yield bond market resides.

The immediate conclusion is yields above 10% have historically been attractive buying opportunities. The next is that the relatively low oil price is winnowing the energy market of the most highly leverage companies with the greatest dependence on high prices for survival.

Back to top