The promising graphene oxide sieve could be highly efficient at filtering salts, and will now be tested against existing desalination membranes.

It has previously been difficult to manufacture graphene-based barriers on an industrial scale.

Reporting their results in the journal Nature Nanotechnology, scientists from the University of Manchester, led by Dr Rahul Nair, shows how they solved some of the challenges by using a chemical derivative called graphene oxide.

Isolated and characterised by a University of Manchester-led team in 2004, graphene comprises a single layer of carbon atoms arranged in a hexagonal lattice. Its unusual properties, such as extraordinary tensile strength and electrical conductivity, have earmarked it as one of the most promising materials for future applications.

But it has been difficult to produce large quantities of single-layer graphene using existing methods, such as chemical vapour deposition (CVD). Current production routes are also quite costly.

On the other hand, said Dr Nair, "graphene oxide can be produced by simple oxidation in the lab".

He told BBC News: "As an ink or solution, we can compose it on a substrate or porous material. Then we can use it as a membrane.

"In terms of scalability and the cost of the material, graphene oxide has a potential advantage over single-layered graphene."

Of the single-layer graphene he added: "To make it permeable, you need to drill small holes in the membrane. But if the hole size is larger than one nanometre, the salts go through that hole. You have to make a membrane with a very uniform less-than-one-nanometre hole size to make it useful for desalination. It is a really challenging job."

Graphene oxide membranes have already proven their worth in sieving out small nanoparticles, organic molecules and even large salts. But until now, they couldn't be used to filter out common salts, which require even smaller sieves.

Previous work had shown that graphene oxide membranes became slightly swollen when immersed in water, allowing smaller salts to flow through the pores along with water molecules.

Now, Dr Nair and colleagues demonstrated that placing walls made of epoxy resin (a substance used in coatings and glues) on either side of the graphene oxide membrane was sufficient to stop the expansion.

Restricting the swelling in this way also allowed the scientists to tune the properties of the membrane, letting through less or more common salt for example.

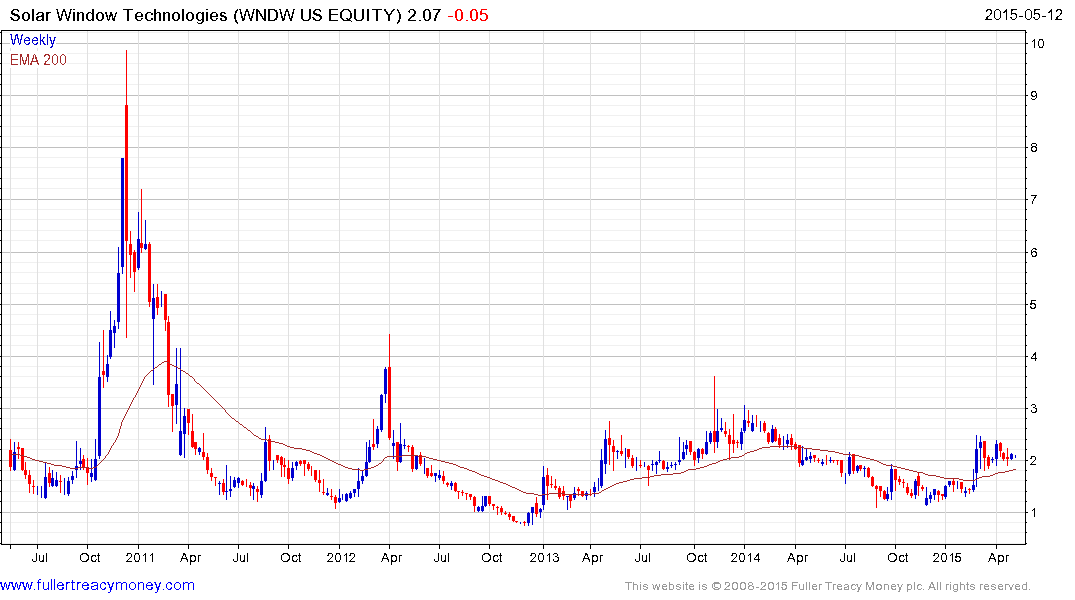

Graphene is one of the most useful products ever invented but apparently difficult to use on a commercial scale, at least so far. Mrs Fuller drew my attention to graphene years ago and wanted to know how to invest in it? I remain convinced that it will eventually have many applications which remain almost unimaginable today.

This item continues in the Subscriber’s Area.