Array Climbs as Bookings, Profit Focus Encourage: Street Wrap

This article from Bloomberg may be of interest. Here is a section:

Array Technologies jumps as much as 26%, the most intraday in a year, after boosting its annual adjusted EPS and Ebitda projections, though the maker of renewable energy equipment also lowered its revenue expectations for the year. Analysts are encouraged by Array’s focus on profitability and rebound in bookings.

In June, a hailstorm in Scottsbluff Nebraska resulted in the single biggest insurance claim in the solar sector to date. Premiums doubled for the entire sector as a result. Array Technology installs mechanisms on solar panels so they are always pointing directly at the sun. That enhances energy output so they pay for themselves over time. They are also supposed to flip the panels away from oncoming weather when needed. The facility was fitted with Array’s optimization technology but there is some doubt as to whether it was operational at the time of the storm. Today’s announcement suggests the episode has no effect on sales.

The lesson over the last several years is investing in solar panel makers is a losing game. The sector is too competitive so margins are very thin. The shares which continue to do best are those that benefit from the volume of solar panels being installed rather than the brand of the panel.

The lesson over the last several years is investing in solar panel makers is a losing game. The sector is too competitive so margins are very thin. The shares which continue to do best are those that benefit from the volume of solar panels being installed rather than the brand of the panel.

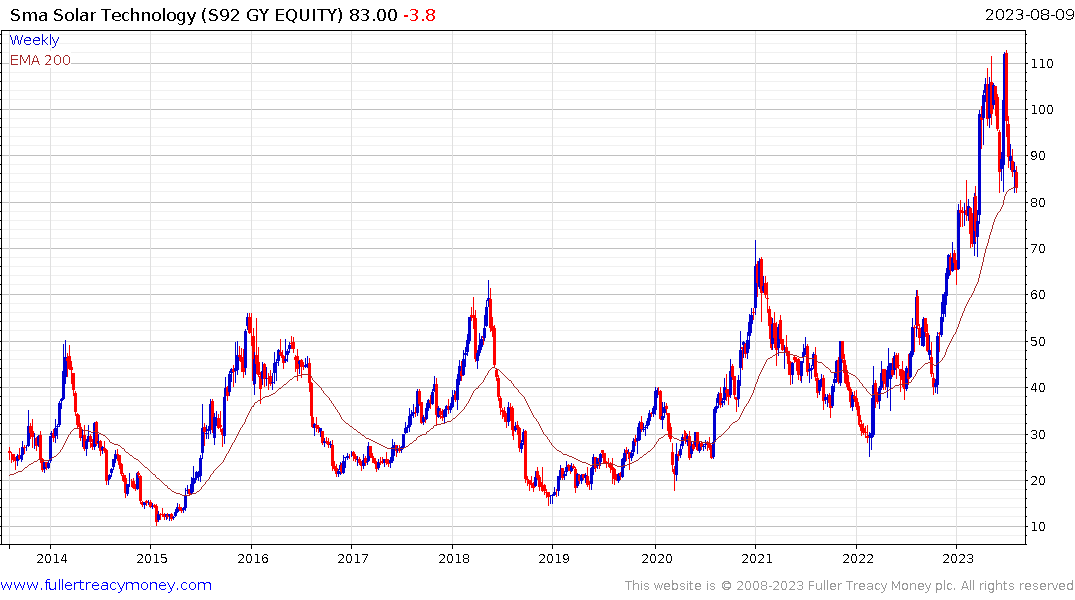

Array has potential to retrofit existing panels but solar inverter manufacturers like SolarEdge and SMA Solar Technology need new installs to fuel growth.

SMA Technology has tended to be very cyclical and is now pulling back sharply. Solaredge has type-3 top formaiton characteristics. That suggests new installs are under pressure.