Global Ripple Effects Of American Energy Independence

Thanks to a subscriber for this highly informative report which ties a number of energy themes together. Here is a section:

It’s rare for more than one disruptive change to occur, but the unfolding of seven disruptive changes at once is unique to energy market today.

Much attention is rightfully being placed on the shale revolution in the US, which is impacting both sweet and sour crude flows starting in North America, but soon after that, the world.

Not far behind is the deep water revolution, also focused substantially on N. America, but also the Atlantic and Pacific Basins.

Refinery capacity build-out in the Middle East and East Asia are turning global flows on their head.

Russia’s move from a lumpy European supplier of oil and gas to a global supplier is having significant repercussions on the balance between pipeline and seaborne transportation.

China’s preference for pipeline sourcing, is impacting not just Central Asian supply lines, but is reinforcing Russia’s move toward tied pipeline transportation.

New sources of LNG in the US, Canada and Australia are about to have dramatic impacts on the pricing and flows of natural gas globally.

The dramatic drop in solar pricing, combined with ongoing drive to boost renewable generation, is already impacting coal and natural gas markets, but is posing questions of economic viability for various high-cost LNG projects.

Here is a link to the full report which you wish to print off for your archives.

We are living through an incredibly interesting period in the energy markets. The high price environment that has prevailed for much of the last decade has translated into a supply response where new supplies and adoption of alternatives will change the complexion of the market for years to come.

The predominately rangebound environment evident in crude oil markets since 2011 highlights the amplification of geopolitical risk this evolution has contributed to. If alternative supply avenues open up and demand growth for crude oil moderates, as consumers migrate to natural gas and solar, the revenues on which despotic regimes rely to placate their citizens come under threat.

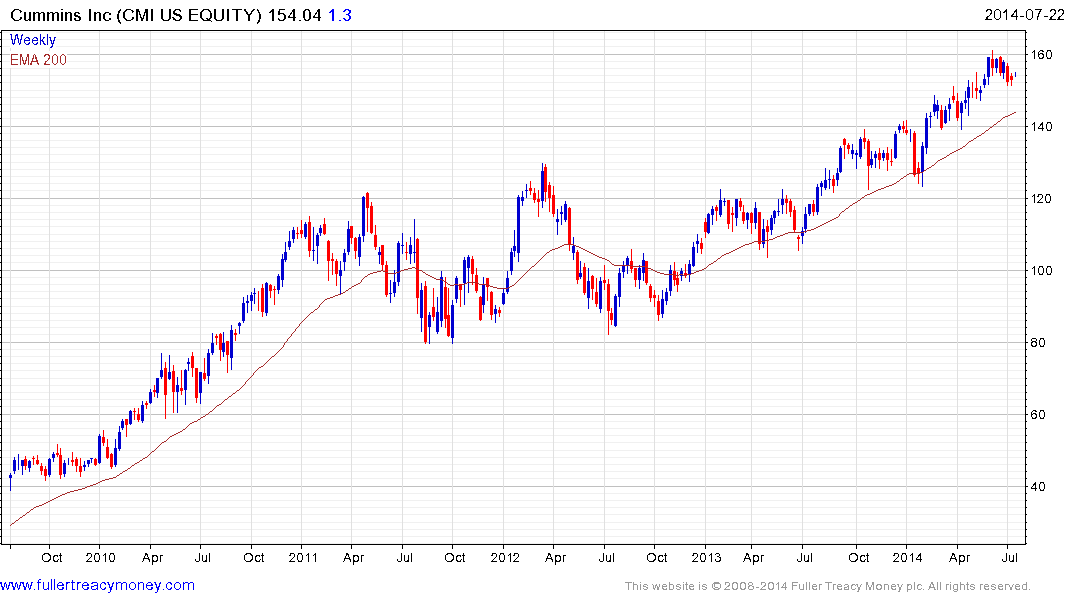

Natural gas is becoming an increasingly globally mobile energy resource which is boosting demand and its availability will slowly but surely compress global arbitrages. When the supply of any commodity increases and its cost relative to an alternative is more attractive demand increases. Natural gas as a transport fuel for trains, ships, haulage, excavation and cars remains on a growth trajectory. Cummins is among the companies most likely to benefit from this adoption due to its concentration on the diesel and natural gas power train sectors. The share continues to hold a progression of higher reaction lows.

The graphics of timelines, for the adoption of new solar relative to how long it will take to develop unconventional gas resources in a number geographies, contained in the above report are particularly interesting. This is the first time I have seen the claim made that the technology for large photovoltaic plants is improving so quickly that it will be competitive with unconventional gas before countries have had a chance to develop it.

The success of companies like SunEdison, SunPower and Solarcity in promoting solar installations across North America for daytime electricity generation represents some engineering challenges that have not yet been overcome. If you think about your car, it will burn more fuel in stop/start traffic than when you are driving at a consistent speed on the motorway. Part of the reason for this is because it has to overcome inertia. As solar utilisation increases it will take over supply of electricity for daytime peak demand. However at sunset, as conventional supply takes over, the temporary spike in demand from lights coming on, air conditioning and heating getting turned on when people get home from work, cookers getting turned on etc. will mean that there will be a demand spike in order to get machines up and running. Solar is wonderful while the sun is shining but it will foster demand for natural gas to pick up the slack when the sun sets.

Back to top