Laggards catching up

At FullerTreacyMoney, we have been highlighting the return to outperformance of cyclical sectors for much of the year. We have also pointed out that this type of action is often an indication that the cyclical bull market is entering a mature stage. A select group of miners, fertilisers and oil companies have been completing base formations and I thought it would be illustrative to highlight the recent performance of some of the laggards.

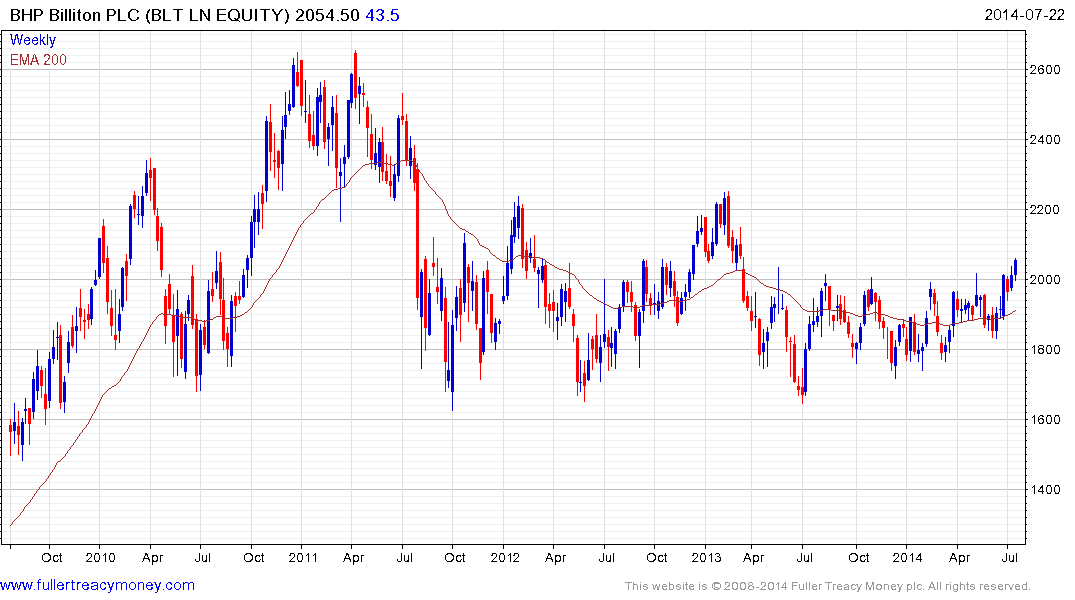

BHP Billiton is the world largest miner and also derives more than 30% of revenue from petroleum and coal. The share has held a mild upward bias for much of the last year and broke out to new 12-month highs last week. A sustained move below 1900p would be required to question medium-term potential for additional upside.

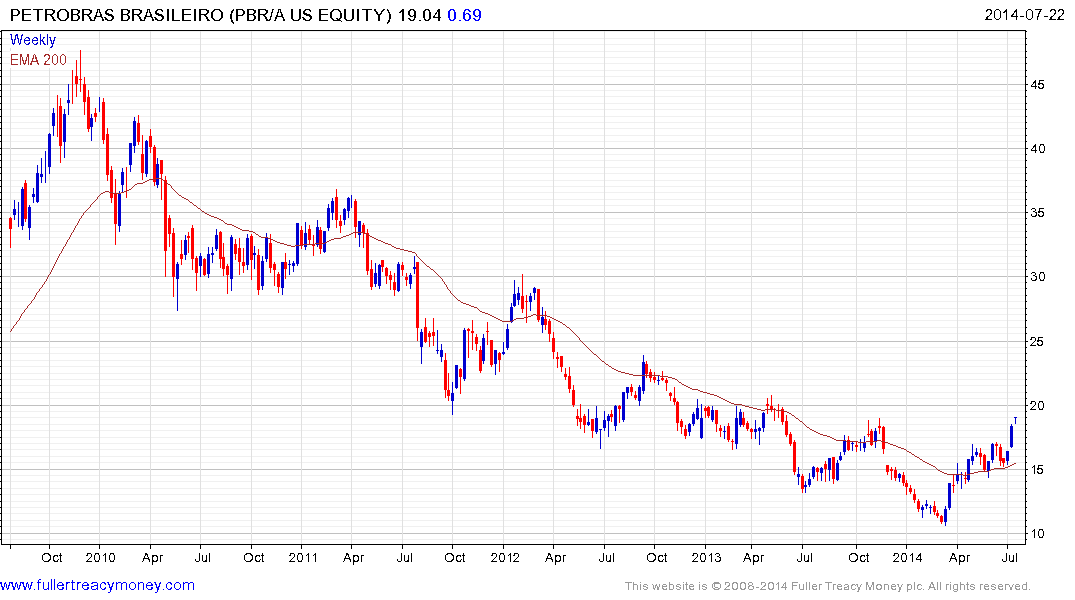

Petrobras has been trending lower for nearly five years following continued bouts of share dilution. However as its new deepwater fields reach production, the share has rallied to break its progression of lower rally highs. A sustained move below $15 would be required to question medium-term recovery potential.

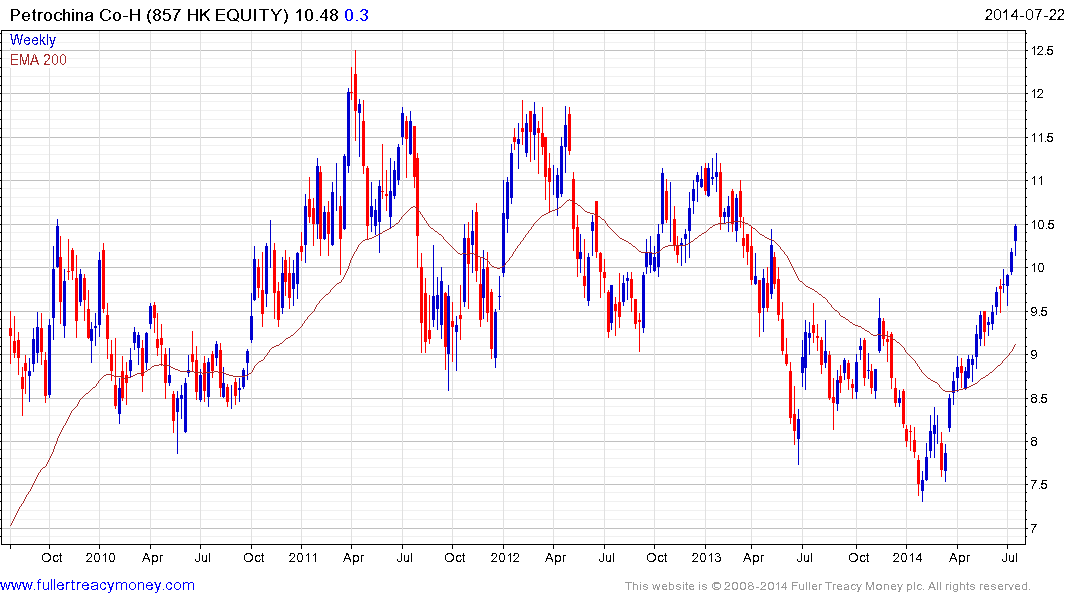

Petrochina rallied in May to break a three-year progression of lower rally highs and continues to extend the move. While somewhat overextended in the short term, a sustained move below the 200-day MA, currently near HK$9 would be required to question medium-term upside potential.

HK$2.50 has represented an area of resistance for Sinopec on a number of occasions since 2009. It is currently rallying towards that level and a sustained move above it would suggest a return to demand dominance beyond the short term.