Credit Availability Is Still High

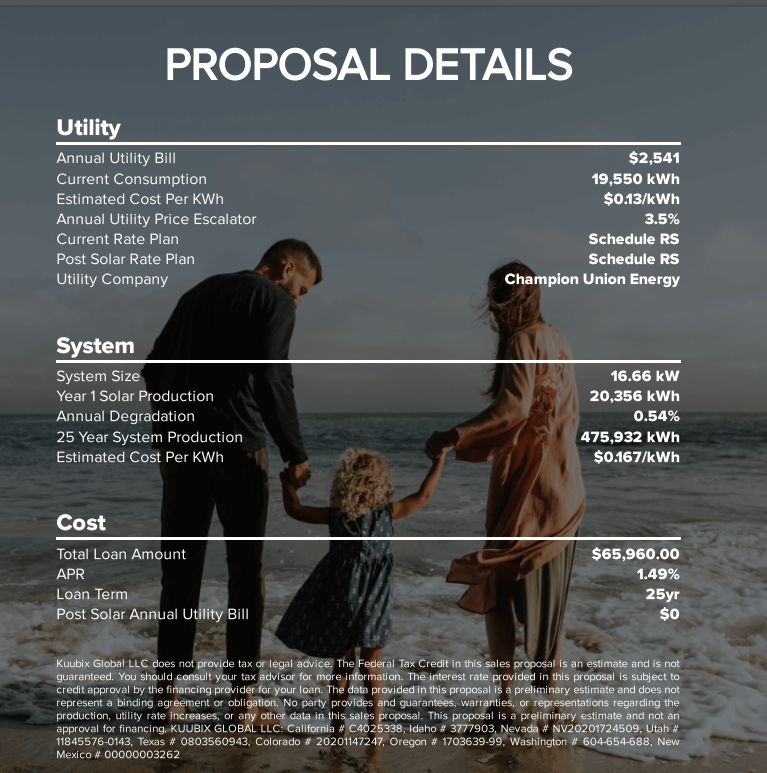

Over the weekend I participated in a sales presentation for solar panel installation. The cost to the consumer has not come down all that much over the last few years, which suggests manufacturing efficiencies are not being passed on to consumers. However, financing for the panels is unusually attractive.

I was offered a 25-year fixed rate loan for $65980 at 1.49%. 20-year yields are at 3.17% and 30-year yields are at 2.99% so it begs the question where are they getting the cash to lend at 1.49%?

I was offered a 25-year fixed rate loan for $65980 at 1.49%. 20-year yields are at 3.17% and 30-year yields are at 2.99% so it begs the question where are they getting the cash to lend at 1.49%?

Fast growing companies do not have the margins to carry the interest over such a long period, so the only answer is they are borrowing short-term and lending long-term. That leaves solar installers very exposed to both rising rates and any dip in demand for their products.

This kind of contradiction was exactly how leveraged loans got into trouble ahead of the credit crisis. Overreliance on repo financing of long-term commitments left lenders exposed to tighter conditions and they crashed when the subprime boom turned to bust.

As I mentioned in the Friday audio/video we have been doing a lot of home renovations recently. I have been amazed at the prevalence of buy now pay later options. Every home improvement store offers zero down and interest free options out to 12 months with some even offering 24 months. In the consumer sector, almost every website has a split payments options available now.

The availability of non-bank credit is very difficult to monitor because it is unregulated. However, we can clearly see that total consumer debt demand was at an all-time high in February. Much of that debt is tied to these kinds of interest free options so it helps to boost sales now but robs demand from the future.

There is a wall of consumer debt coming due later this year and into 2023 and 2024. All those interest free periods are going to roll off and people will need to start paying for their spending today. Companies expect margins to continue to grow over the coming year. That could be realizable given credit demand from interest free loans.

This helps to illustrate just how interest rate sensitive the US economy is. The bond market has been pricing in over 200 basis points of hikes. The flat yield curve suggests they are not going to get anywhere near that target before ill-effects are experienced. That is sufficient basis for a short-term rally in a Chuck Prince manner. The band is still playing.

This helps to illustrate just how interest rate sensitive the US economy is. The bond market has been pricing in over 200 basis points of hikes. The flat yield curve suggests they are not going to get anywhere near that target before ill-effects are experienced. That is sufficient basis for a short-term rally in a Chuck Prince manner. The band is still playing.

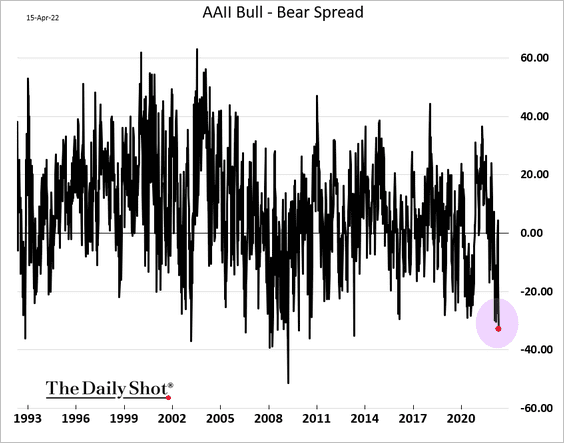

Bearish sentiment is close to a record and the Nasdaq-100 is firming from the 14,000 level. It has short-term inverted head and shoulders bottoming characteristics so there is scope for a rebound.

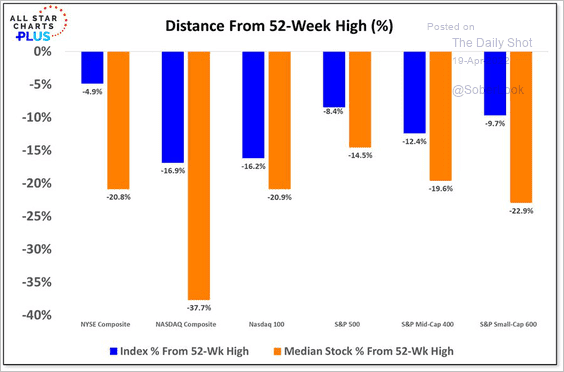

The median Nasdaq Composite stock is down 37.7% from its peak while the index is only down 17%. That highlights the weight and resilience of the mega-cap sector. The missing ingredient for a sustained rebound is lower Treasury yields.

The Russell 2000 is firming from the 2000 level but will need to sustain a move above the trend mean to question the medium-term downward bias.

The Russell 2000 is firming from the 2000 level but will need to sustain a move above the trend mean to question the medium-term downward bias.

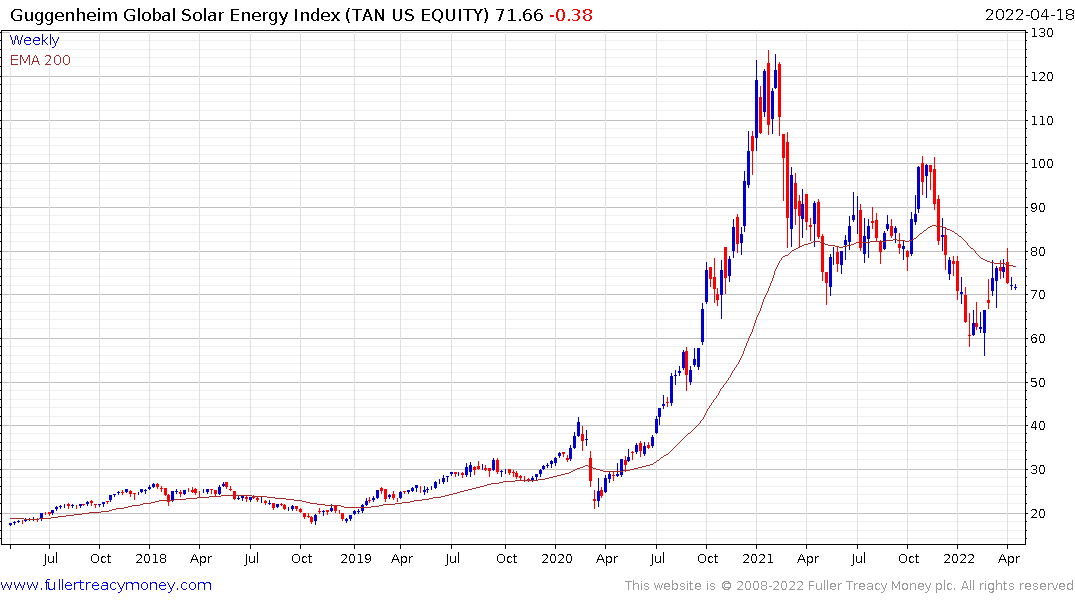

The Solar ETF found at least short-term support today as risk appetites recover.

The Solar ETF found at least short-term support today as risk appetites recover.