Shale Giant Says U.S. Output Will Fall This Year on Big Cuts

This article by Bradley Olson for Bloomberg may be of interest to subscribers. Here is a section:

U.S. oil production is set to fall this year as drastic drilling cutbacks take hold faster than world governments expected, according to the biggest, fastest-growing shale company.

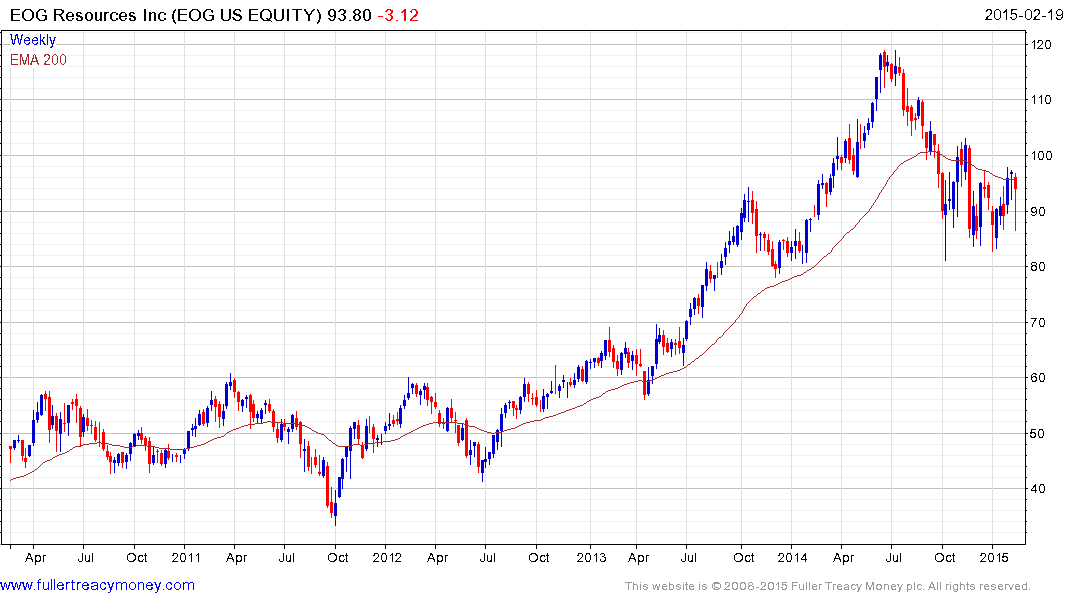

EOG Resources Inc.’s forecast contradicts most estimates that see U.S. production rising, including those by the U.S. Energy Information Administration and the International Energy Agency. The company said the crude market would rebound quickly and labeled the current downturn a “short cycle.”

The Texas producer said its own production would bottom in the second and third quarter, resulting in output remaining unchanged for the year compared to last year’s breakneck pace of growth. The deciding factor in what has been viewed as a price war with Saudi Arabia and its OPEC allies is how many of the thousands of U.S. producers will follow suit.

“EOG is viewed as the premier company in shale development, and if they’re not going to grow, it is a very important signal to the market,” said Michael Scialla, a Denver-based analyst at Stifel Nicolaus & Co. “The argument that this slowdown is going to take a while to have an impact on supply is completely wrong.”And

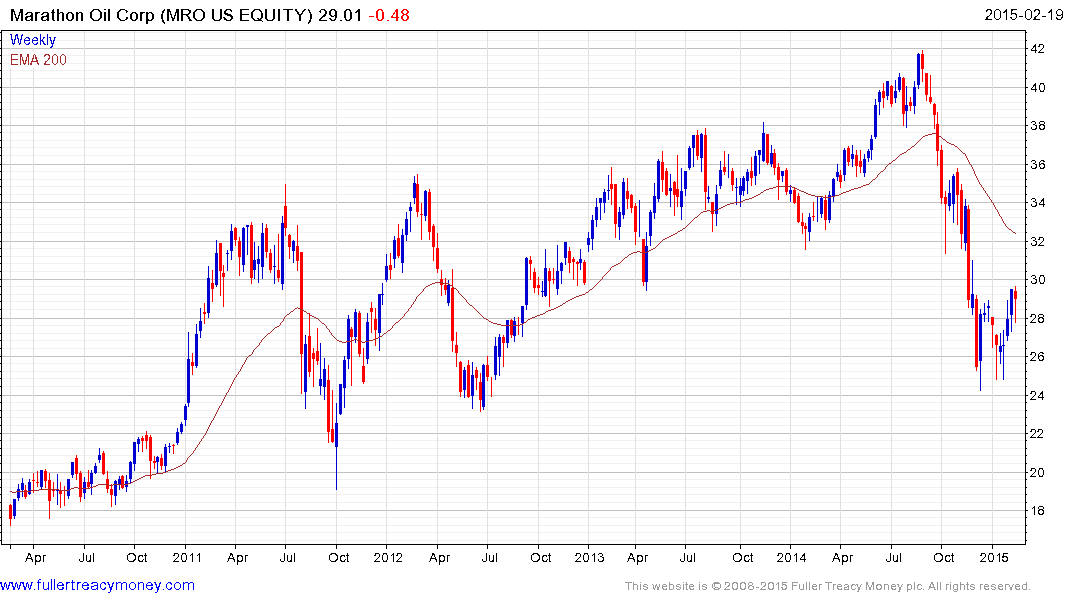

Noble Energy Inc., Devon Energy Corp. and Marathon Oil Corp., three other companies with significant shale operations, said they will boost output this year. More than half of Devon’s 2015 oil production is hedged at a price of $90.75 a barrel. Apache Corp. plans to pump about the same volume of oil as last year.

The mechanics of unconventional oil and gas wells means that supply growth is not possible without constant drilling of new wells to make up for the early peak in production from older ones. It is for this reason that the Baker Hughes Rig Count has become such a focus of attention as prices fell. In a low oil price environment, at least relative to that seen early last year, unhedged producers have little choice but to cut back on expansion plans. Those that have hedged have secure cash flow, provided their counterparties are solvent, so they will be under less pressure to cut.

In such a charged environment the crowd had little time for a nuanced view of the market. The majority of shale oil producers pulled back sharply. As oil prices rebound, they are being addressed on their individual merits. Some of the better performers include:

EOG Resources recoupled its entire early decline today and has had one of the sector’s shallower reactions.

Denbury Resources posted an upside weekly key reversal in December and continues to

unwind its oversold condition relative to the 200-day MA.

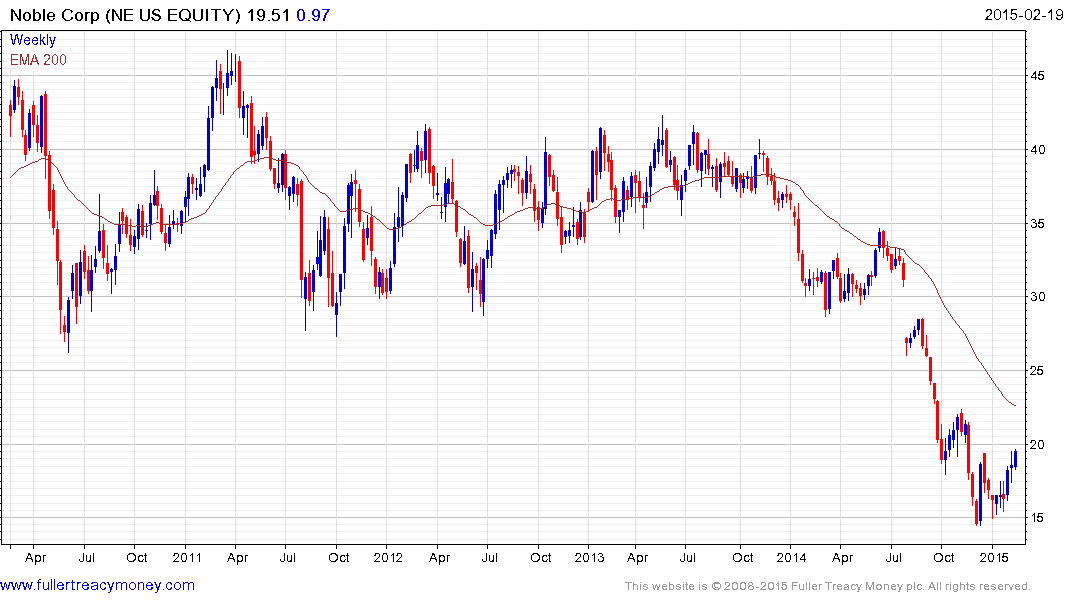

Noble Energy shares a similar characteristic.

So does Marathon Oil Corp.

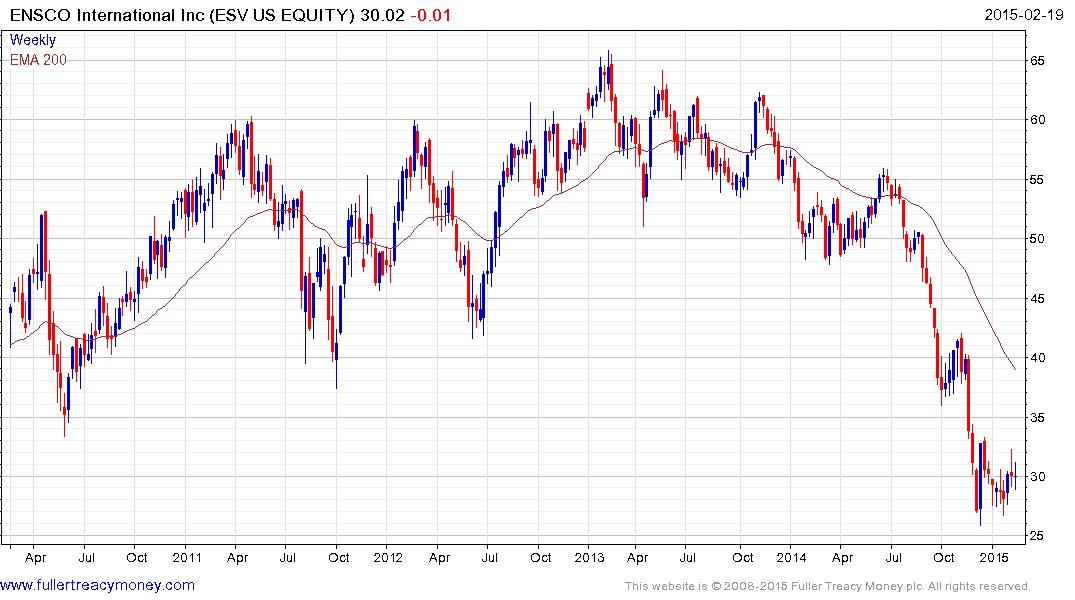

Ensco continues to stabilise in the region of tis December low.

Solar cell manufacturers are a tangential play on oil prices. First Solar dropped below the 200-day MA in October to break a two-year uptrend. It has stabilised in the region of $39 over the last month and a break in the short-term progression of higher reaction lows would be required to question medium-term scope for additional higher to lateral ranging.