Point & Figure

2016 will be 47th year of The Chart Seminar and it is still the longest running course on a behavioural approach to interpreting the market in the world. We will soon be announcing dates for when you can expect to attend both at a physical location and via webinar this year.

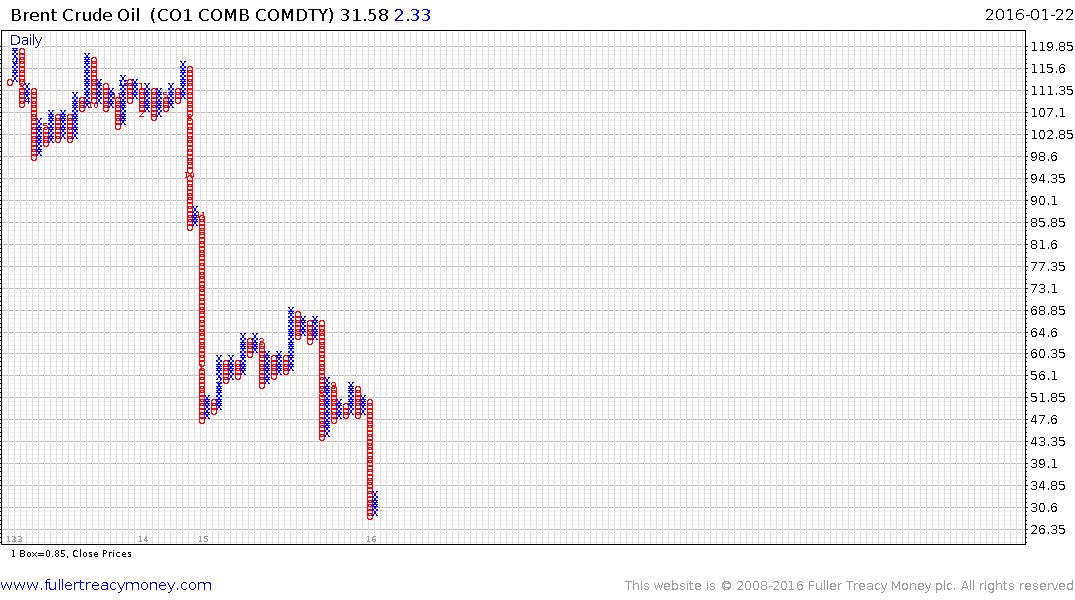

I was thinking about this earlier in the week and was ruminating on how we focused on p&f charts when we relied on chartbooks but on candlestick charts now that we have the online Chart Library. Both have their merits and candlesticks are certainly more expedient because you do not have to customise box sizes. However there is nothing quite like monitoring a persistent decline, or rally, on a p&f chart because the reversal when it comes is very clear.

Here is the Brent Crude Oil p&f chart I posted on Wednesday with an 85¢ box size. It had steadied between $40 and $60 but was unable to push back up into the overhead trading range and instead broke lower and experienced a persistent decline from $52.85 to a closing low this week near $27. It has now formed a p&f reversal. It this rally is anything like what we saw following that last decline we can expect a potentially powerful short covering move.

With oil prices finding a short-term low, the pressure that has come to bear on related stock market sectors such as the major oil producers, service companies, pipelines and renewable energy should ease.

.png)

Exxon Mobil has found at least near-term support above its August low.

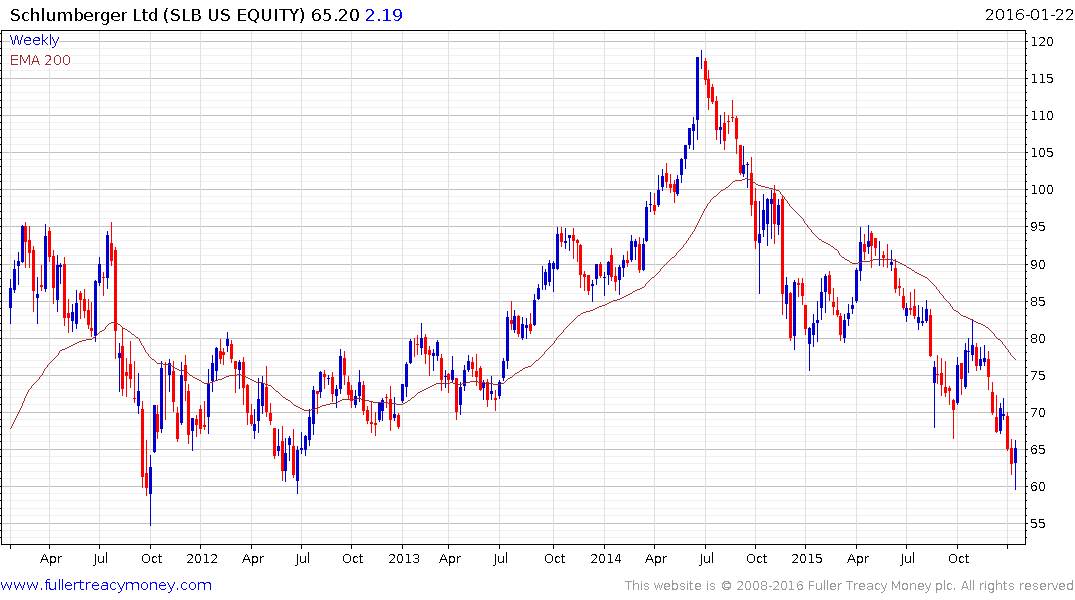

Schlumberger has halved since 2014 and bounced this week from the region of the 2012 and 2011 lows near $60.

KinderMorgan collapsed when it cuts its dividend by 75% so the indicated yield is now around 3.25%. With a lot of the bad news out of the way, the share posted an upside weekly key reversal this week following a 75% decline from its April peak near $45.

First Solar continues to exhibit base formation characteristics and a sustained move below the $55 area would be required to question medium-term potential for additional upside. .