Opening up the RMB bond market

Thanks to a subscriber for this report from Deutsche Bank which may be of interest to subscribers. Here is a section:

Key theme: 2016 is the first year for China to implement its 13th five year plan and we expect the Chinese authorities to continue to roll out financial liberalization reforms with manageable risks. We believe financial deepening in the RMB bond market will accelerate in 2016 and with China gradually liberalizing bond market access by foreign investors and borrowers, the RMB bond market is an emerging global asset class to facilitate investment diversification and financing demands on a global scale..

Economic outlook: China's economy had a tough year in 2015. 2016 will likely be even more challenging. The current round of policy easing may help to boost growth in Q4 2015 and Q1 2016, but it will exacerbate overcapacity and raise leverage, both are damaging in the long term. In mid- 2016 the government may face a policy dilemma again. Downside pressure on growth may resurface, and force the government into further policy easing.

Our baseline forecast for GDP growth in 2016 remains 6.7%. We see 10% probability that GDP growth may be above 7% in 2016, 50% probability that it falls between 7% and 6.5%, 30% probability that it drops to the range of 6.4% and 6%, and 10% probability it falls below 6%. We see 20% probability the GDP growth to fall below 6% for four consecutive quarters sometime between 2017 and 2019.

We revise our baseline forecast for USDCNY market close rate to 7.0 by the end of 2016, a depreciation of 7.9% from its market close of 6.49 on December 31 2015. We see 10% probability that CNY appreciates or stay flat against USD by the end of 2016, 15% probability that it depreciates by less than 5%, 55% probability it depreciates by more than 5% and less than 10%, 20% probability that it depreciates more than 10%.

Equity strategy: We see an N-shaped roadmap with front-loaded returns in 1H16. We recommend starting 2016 with OW financials, industrials and IT, and suggest building core holdings in new-economy stocks and do tactical trades in old-economy plays.

Here is a link to the full report.

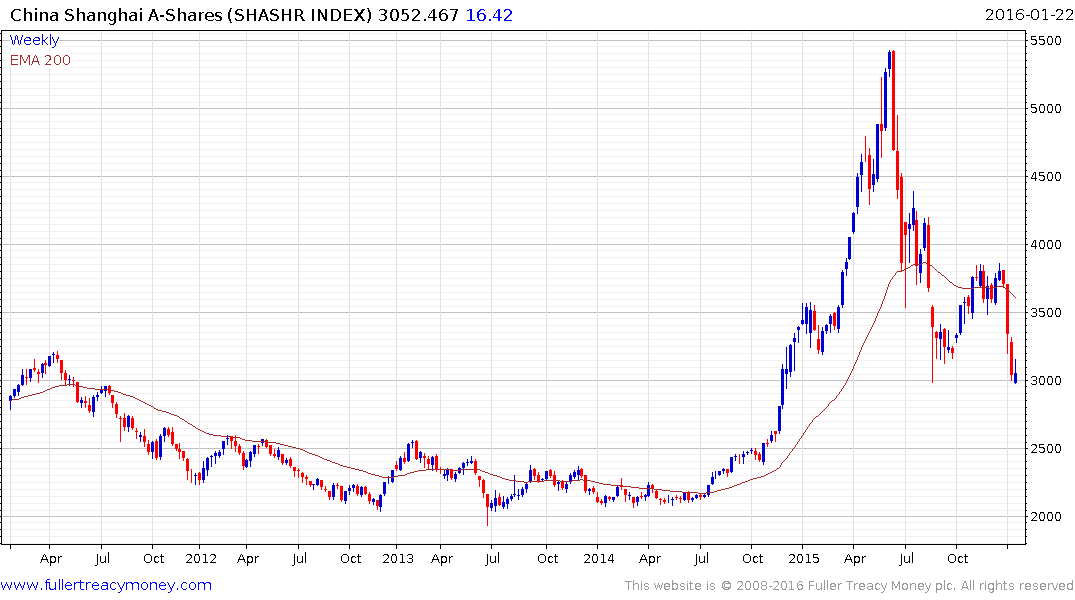

This looks like a sensible outlook considering how emotional the response to the Chinese market has been over the last couple of months. The prospect of additional easing is a salve for sentiment, and prices have already pulled back enough for short-term oversold conditions to be evident.

The fact the Chinese administration previously supported the market at the 3000 level on the Shanghai A-Shares Index is also a consideration that will not have escaped the attention of China watchers. Some steadying in this area is looking more likely than not but we can expect a rangy environment overall because it will take time for sentiment to improve following what has been one of the most volatile environments in history for Chinese shares.

The contraction in Chinese government bond yields is also something to keep an eye on because there are a number of potential reasons for the move. The first would be that demand has gone up in response to stress in the stock market and the wider economy. The second is that investors are buying in anticipation of greater international demand for Chinese bonds. The third is that Chinese corporates have been paying off US Dollar denominated debt and refinancing with Chinese denominated debt; removing currency risk in the process.

The first might result in a negative interpretation of market events while the second two suggest an altogether more benign environment and reality is likely to be somewhere in between.

Back to top