In the Struggle for Big Oil's Soul, the American Vision Wins Out

This article from Bloomberg may be of interest to subscribers. Here is a section:

Shell Plc, BP Plc and TotalEnergies SE have spent the last few years trying to convince investors about the merits of net-zero carbon and investment into renewables. But in 2022 they switched to showering them with tens of billions of dollars earned from pumping oil and gas, just like their US peers.

The change of course was triggered by Russia’s invasion of Ukraine, which shifted governments’ focus back to energy security and created a huge gap in Europe’s oil and gas supplies that the majors are well placed to fill.

“Oil production will be back above 2019 levels,” said BP Chief Executive Officer Bernard Looney, a change in tone from 2020 when he suggested that peak demand may already have been reached. “Demand for this product is strong.”

Shell has said it will pause the growth in spending at its renewables unit while expanding gas output. BP slowed the planned decline in its fossil fuel production and scaled back its target for emissions reductions. TotalEnergies is opening new liquefied natural gas import terminals in Europe so it can keep growing a business that expanded by 15% in 2022.

If the majors are slowing down investing in renewables, despite significant subsidies, that’s really not good news for the solar, wind and hydrogen sectors. Meanwhile, if the majors increase exploration and production budgets is should be very positive for drillers.

The Invesco Solar ETF remains in a triangular pattern and is currently pulling back from the upper boundary.

The Invesco Solar ETF remains in a triangular pattern and is currently pulling back from the upper boundary.

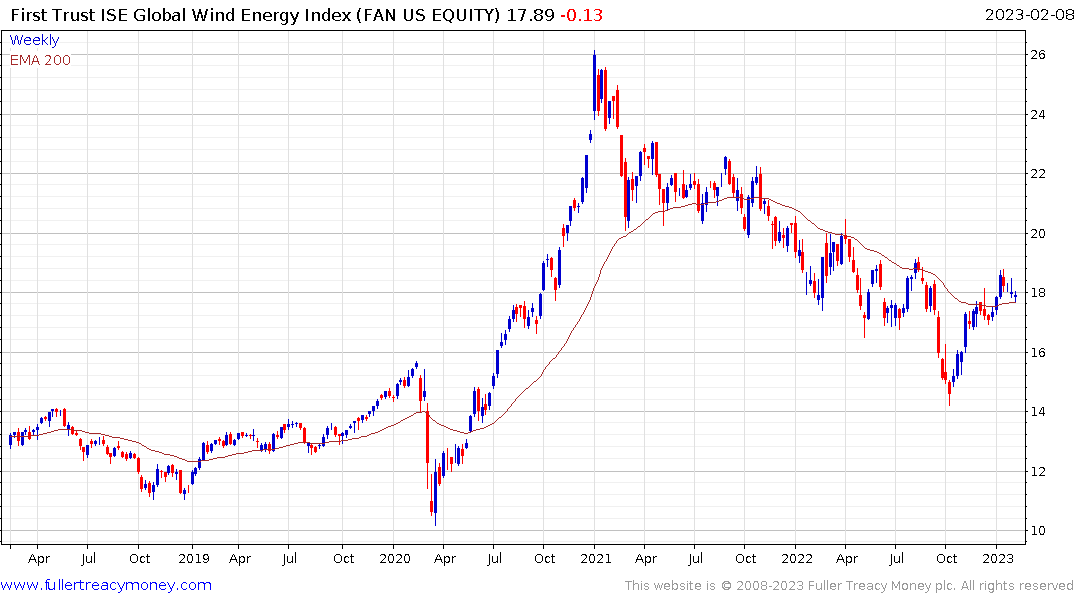

The First Trust Global Wind ETF is testing a two-year sequence of lower rally highs and needs to continue to hold the current level if potential for recovery is to be given the benefit of the doubt.

The First Trust Global Wind ETF is testing a two-year sequence of lower rally highs and needs to continue to hold the current level if potential for recovery is to be given the benefit of the doubt.

.png) The VanEck Oil Services ETF continues to hold the breakout from its three-year base formation.

The VanEck Oil Services ETF continues to hold the breakout from its three-year base formation.

The one thing all of the offshore drillers talk about in their earnings calls is how much more carbon friendly their businesses are than onshore projects. That argument is not going to fly with environmental advocates but it does tick boxes for oil companies.

Rates for ultra-deepwater rigs have jumped from around $100,000 to $400,000 a day over the last year. In 2014, before the oil crash, rates were in excess of $500,000. Most of the offshore companies went bust in 2020 and relisted in 2021 and 2022. With no investment in new rigs required they are leveraged to the possibility of oil prices staying higher for longer.

Rates for ultra-deepwater rigs have jumped from around $100,000 to $400,000 a day over the last year. In 2014, before the oil crash, rates were in excess of $500,000. Most of the offshore companies went bust in 2020 and relisted in 2021 and 2022. With no investment in new rigs required they are leveraged to the possibility of oil prices staying higher for longer.

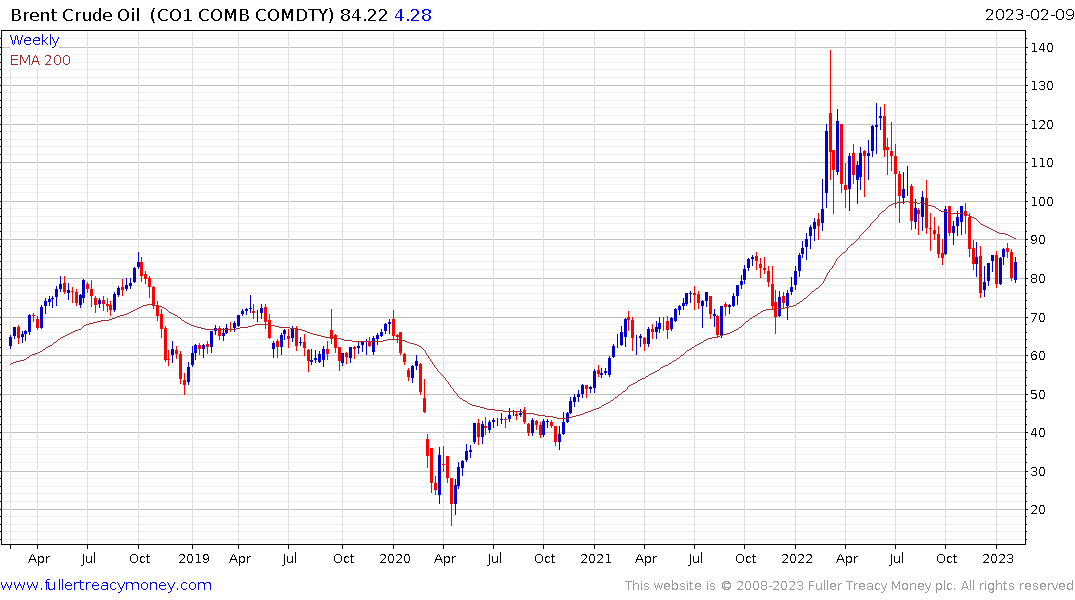

Brent Crude continues to hold the $80 level and will need to continue doing so if the upside is to be given the benefit of the doubt.

Brent Crude continues to hold the $80 level and will need to continue doing so if the upside is to be given the benefit of the doubt.