Thank you for mentioning MMT in the service

The most of us agree that applied MMT not necessarily leads to more growth (especially because in the reality part of the government spending is wasted in less than transparent submission processes, bureaucracy and corruption, hence it does not flow 100% into the economy process) but to more debt for future generations

However, it gives a useful framework for investors to better understand our modern world of FIAT currencies. A world in which classic economical doctrine and orthodoxy as I (we) learnt at university (pure monetarism, Fisher Theory and Schumpeterist “creative destruction”) fails to explain the modern world and the political influence

As you point out populism gels perfectly with MMT. And as long as populism is on the rise, we should maybe devote more time to understand MMT and try to profit as investors.

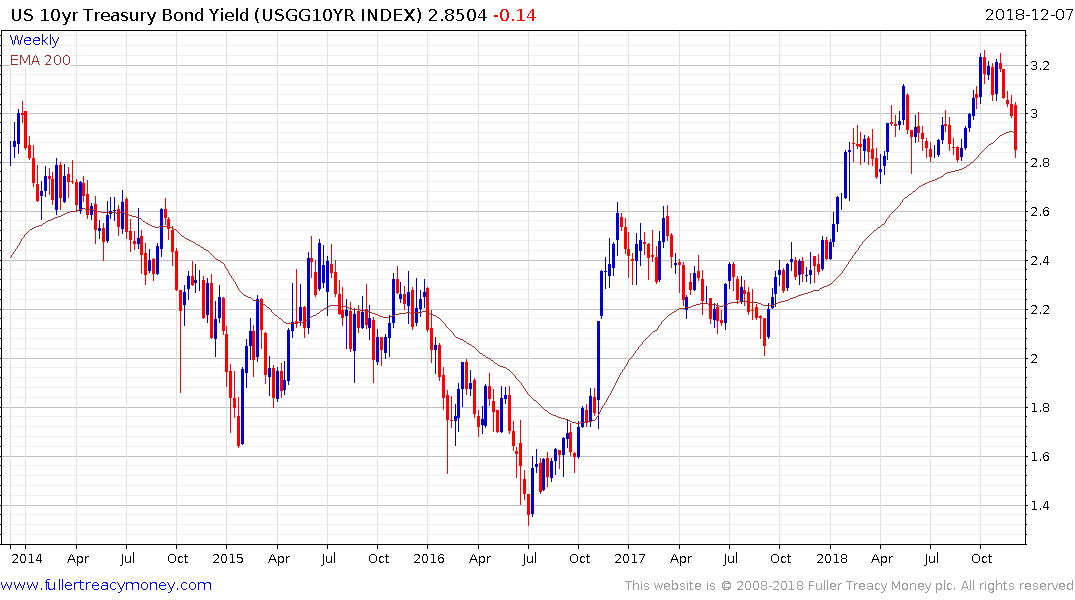

Interesting are the aspects related to the effect of interest rate hikes by the FED which MMT claims are inflationary and not disinflationary because hikes add income to the private sector that holds the government securities. In the same way they claim QT add interest bearing securities to the economy (via the banking system) and are also not disinflationary.

Also interesting is the stress on government spending as a source of Aggregate Demand and not just on the Debt with which this demand is financed. So national debt is the “private sector” asset.

I don’t know if I am a correct but from the perspective of an investor MMT is insofar useful as it opens a new perspective and try to explain markets behavior by looking at what is happening.

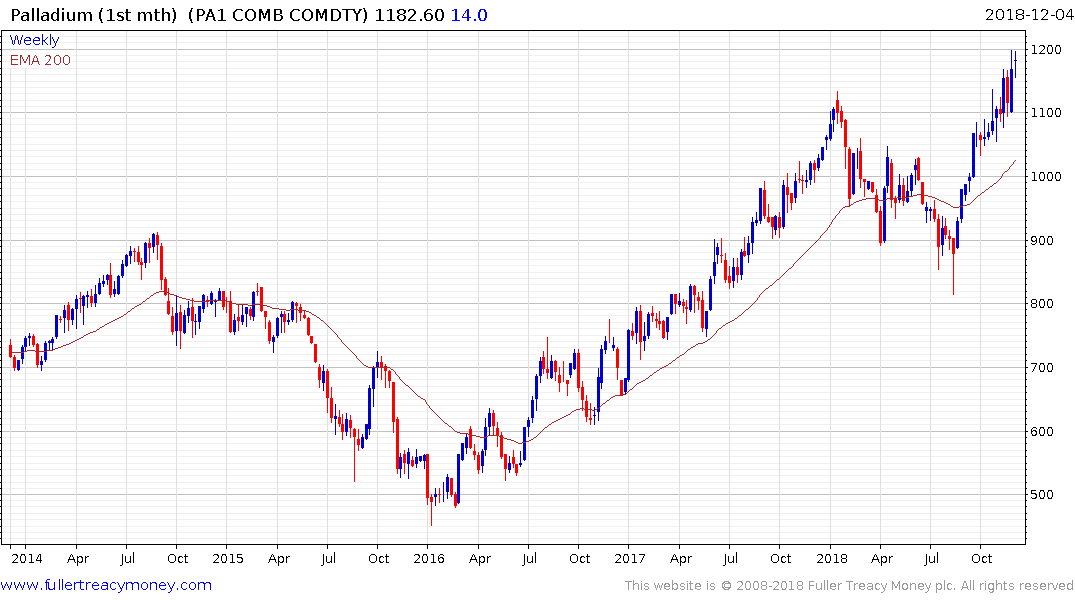

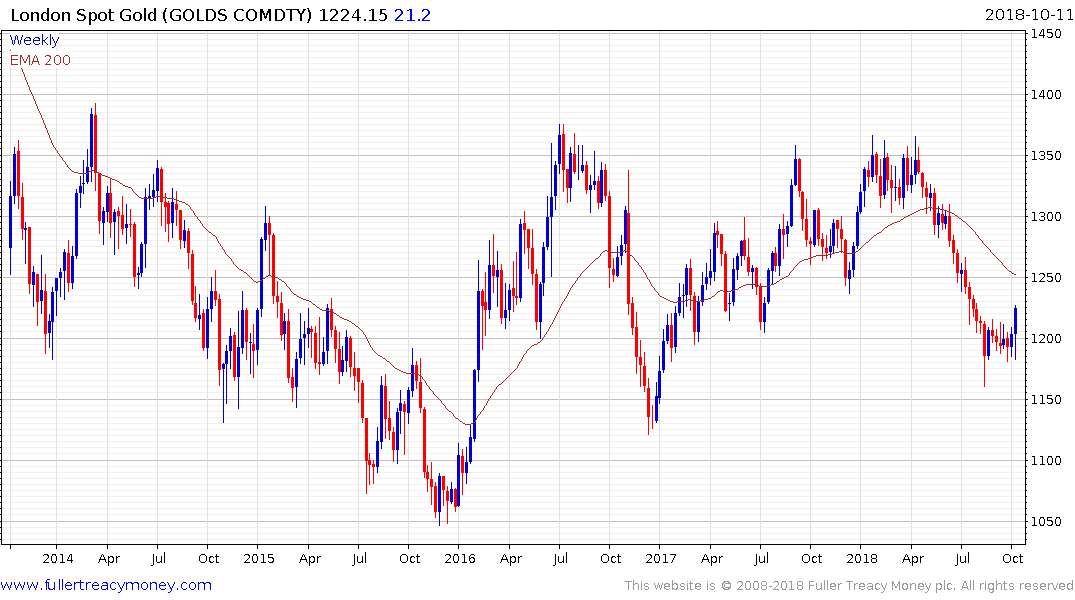

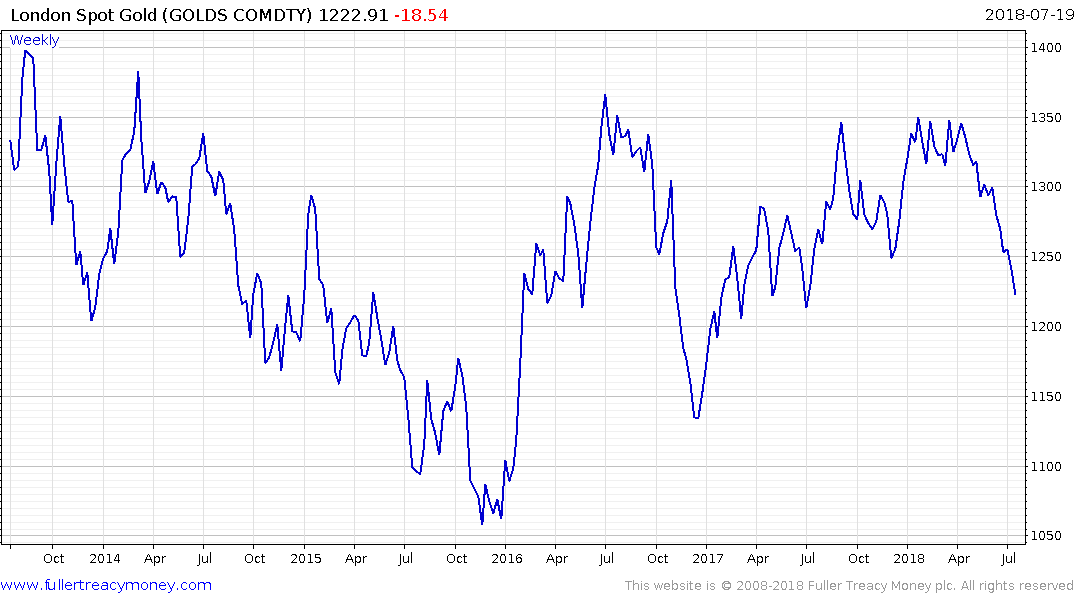

For example, from an MMT perspective we should continue have a strong economy as long as government spending is on the rise (i.e. the corporate sector profits and equities are a buy), the USD should weaken the more debt is added and the more the FED tries to stem inflation by hiking rates and engaging in QT (latter is counterintuitive) because it adds income to the system. Likewise, Bonds are a sell because of rising inflation while gold and hard assets are a buy.

Actually, if we look at reality and at countries that control their own currency that involve in profligate fiscal policies, they all tend to have depreciating currencies, high interest rates and a rising national debt. To me Turkey, Argentina, Venezuela come to mind first. However even the US under Trump is moving in this direction. Hence the USD bearishness (the US have still a big advantage though i.e. that they are reserve currency)

On the other end countries with a tight fiscal discipline, that apply QE and ZIRP or NIRP tend to have deflationary economies, zero or negative yields and strong currencies. Examples are Switzerland and the EU (where the leading countries impose deflationary austerity and real deflation on the weakest Union members). Indeed, notwithstanding all the problems in some members of the EU, the EUR has been extremely resilient over the years.

What do you think?

Eoin Treacy's view - Thank you for this wide ranging and thought-provoking email. I agree with most of the points you make although I believe the reason for the Euro’s stability has to do with a lack of supply rather than inherent strength in the domestic Eurozone economy. The biggest issue right now is there is a clear trend towards profligate spending, fiscal stimulus, deficit spending or however you might wish to describe it. Modern Monetary Theory is the academic rationale for this spending which is being latched onto by politicians. In ages past this was referred to as devaluing the currency to point where it causes a rebellion from the bond market.

This section continues in the Subscriber's Area.

Back to top