These ten mines will make money even if gold price falls to $550

This article by Vladimir Basov may be of interest to subscribers. Here is a section:

These Top 10 lowest cost gold mines are all below all-in-sustaining costs (AISC) $550/oz level and will prove profitable – even if the price falls 50%.

Mining Intelligence looked at costs at primary gold mines and found 10 operations that would still make money, even if gold halves in value from today's levels. AISC metrics has been taken as a basis of comparison and ranking.

Since the World Gold Council (WGC) published a Guidance on AISC in June 2013, which introduced a transparent standardised production cost estimation metrics intended to be used commonly by the global gold industry, a majority – yet not all – of the leading publicly-trading gold producing companies successfully adopted WGC’s recommendations and implemented AISC to their official reports.

AISC metrics provide a more comprehensive look at mine economics than the traditional "cash costs" approach that many companies may interpret arbitrarily – and it includes such important expenses as overhead outlays and capital used in ongoing exploration, mine development and production.

All in sustaining costs are certainly a useful metric for addressing the prospects for any mine. However, when we address the list above what we are presented with are the lowest cost of production mines but they are mostly the legacy properties companies started with before they had to spend more money to acquire additional properties which generally do not have the same attractive cost structure.

For example, Barrick Gold’s reported all in sustaining cost is $750 but the South Arturo, Svetloye and Pueblo Viejo mines have production costs much lower than that, suggesting its other mines have costs a lot closer to spot prices.

For example, Barrick Gold’s reported all in sustaining cost is $750 but the South Arturo, Svetloye and Pueblo Viejo mines have production costs much lower than that, suggesting its other mines have costs a lot closer to spot prices.

Here is a link to an excel sheet I created with the AISC prices for the constituents of the GDX and GDXJ ETFs. Please note the costs quoted are in local currencies.

Among those with interesting chart patterns.

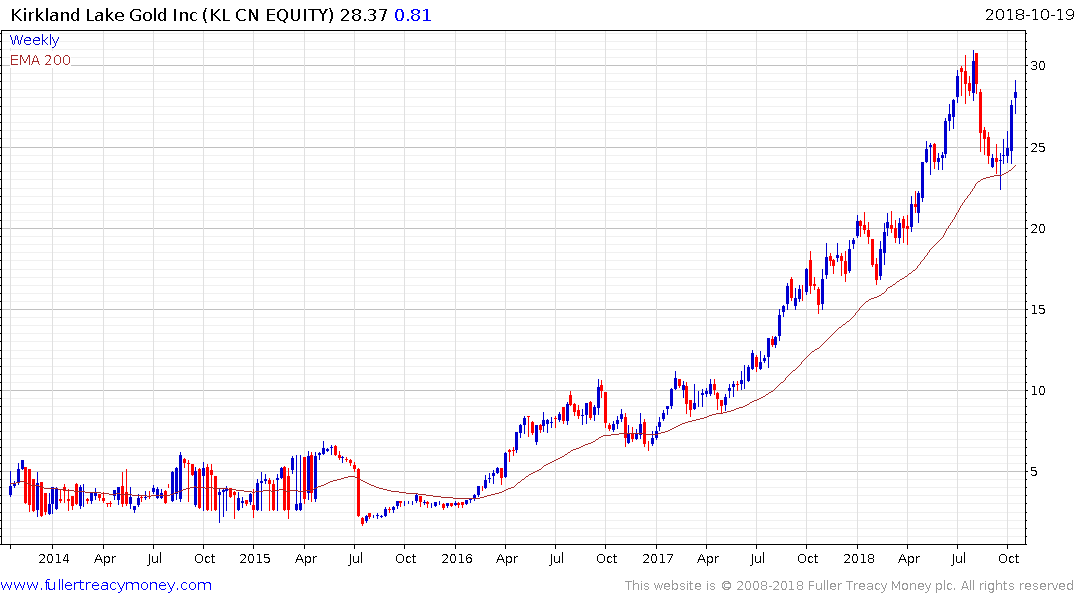

Kirkland Lake Gold has been a clear outperformer and is bouncing from the region of its trend mean.

Polymetal International halved from the 2016 peak and rallied over the last tween weeks to break the two-year downtrend.

Barrick Gold rallied this week to push back above the trend mean for the first time in a year as it tests the medium-term sequence of lower rally highs.

Goldcorp posted an upside weekly key reversal last week from the region of the 2016 low.