Under "Basel III" Rules, Gold Becomes Money!

Thanks to a subscriber for this article from Zero Hedge which may be of interest. Here is a section:

If banks own and possess gold bullion, they can use that asset as equity and thus this will enable them to print more money. It may be no coincidence that as March 29th has been approaching banks around the world have been buying huge amounts of physical gold and taking delivery. For the first time in 50 years, central banks bought over 640 tons of gold bars last year, almost twice as much as in 2017 and the highest level raised since 1971, when President Nixon closed the gold window and forced the world onto a floating rate

And

The only way governments can manage the levels of debt that threaten the financial survival of the Western world is to inflate (debase) their currencies. The ability to count gold as a reserve from which banks can create monetary inflation is not only to allow gold to become a reserve on the balance sheet of banks but to have a much, much higher, gold price to build up equity in line with the massive debt in the system.

The Federal Reserve values the gold certificates it holds from the Treasury at $42 an ounce which is the statutory gold price set in 1973. It is unlikely that any change to the way the Bank of International Settlements treats gold will alter that valuation. https://www.federalreserve.gov/faqs/does-the-federal-reserve-own-or-hold-gold.htm

However, for Russia, China, Turkey, Argentina where for whatever reason investors have less faith in their domestic currency, there is a clear benefit to having gold classed on a mark to market basis on their balance sheets. That raises the question of whether the total reported for central bank balance sheets will take a significant leg up at the end of the month.

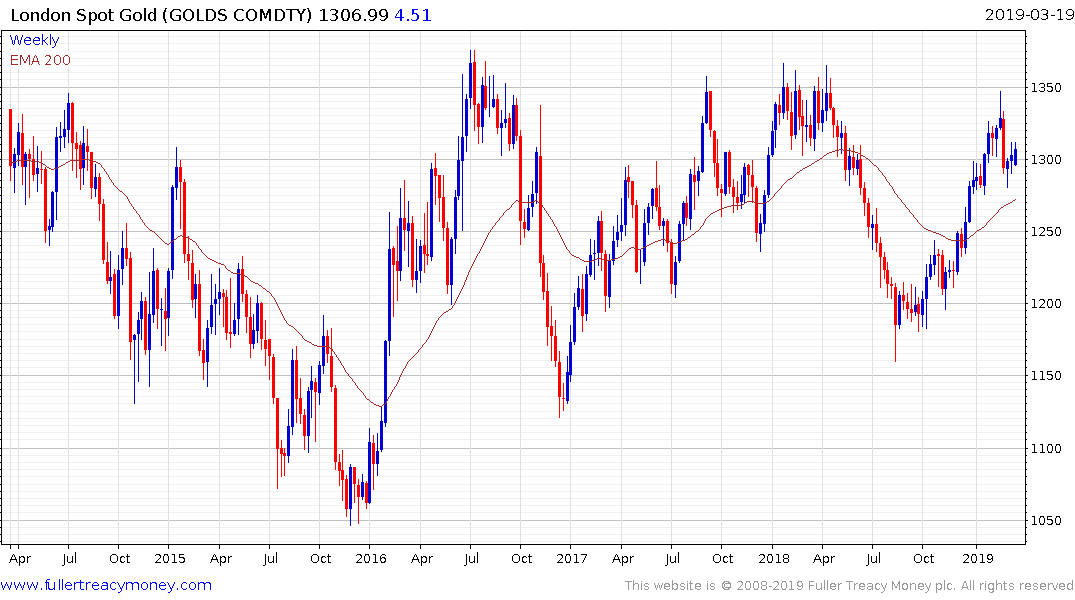

Gold remains steady in the region of the trend mean but will need to sustain a move above $1380 to clearly confirm a base completion.

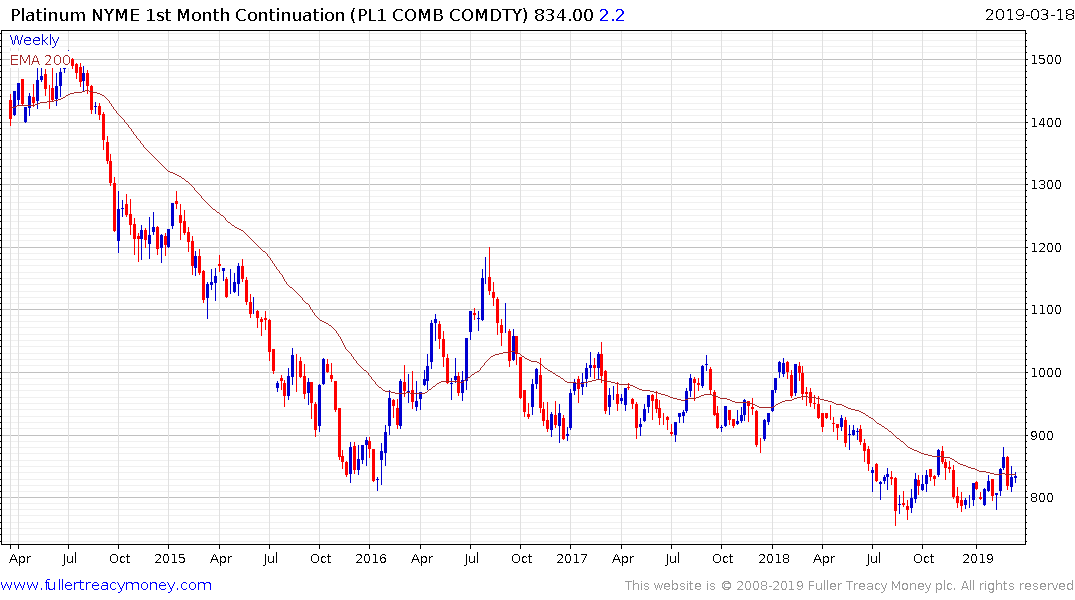

Platinum continues to firm from the $800 area.