Tesla's Model 3 Sedan Production Cruises Past the 100,000 Mark

This article by Tom Randall for Bloomberg may be of interest to subscribers. Here is a section:

Expanded production comes with downsides, however. Tesla posted on its website Friday that buyers must place their orders by Oct. 15 to get their car by the end of the year and qualify for the expiring U.S. federal tax credit. Tesla was the first company to sell 200,000 electric cars cumulatively in the U.S., which triggers the gradual phase-out of the subsidy. The $7,500 credit will drop by half for Tesla on Jan. 1.

Musk boasted in 2016 that Tesla would make more than 100,000 Model 3s by the end of 2017. It didn’t work out that way. As often happens on Musk time, Tesla arrived late to an impossible goal. But Model 3 production now appears to be cruising—from the first cars off the line in July 2017, it took about 14 months for the company to build the initial 100,000 Model 3s. At the current rate of production, it will build the second 100,000 in less than six months.

This is a good news story for Tesla. Getting production numbers up is essential if the company is going to reach the economies of scale necessary to ever make a profit. The big question which I have seen addressed is what that number is? Musk has stated on more than one occasion that he wants to get the price of a Model 3 down to around $35,000 but how many of them will the company have to make to make a profit at that price?

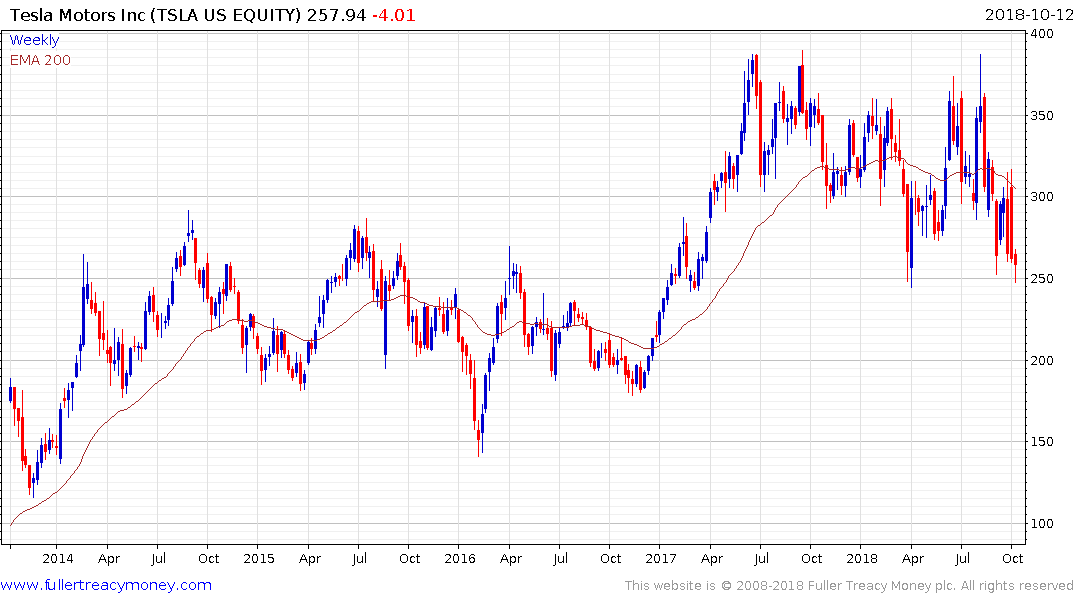

Despite the bounce that occurred on most stock markets today, Tesla was uncharacteristically inert. The share is still pausing in the region of its lows and a sustained move back above the trend mean will be required to question medium-term supply dominance.

This report from UBS, kindly forwarded by a subscriber, opines that the cost of a battery powertrain could be below that of an internal combustion engine by 2025 if global battery production expands as expected globally. Here is a section:

The battery pack, the largest cost item in an electric car, is likely to decline 25% by 2021…bringing the total BEV powertrain cost close to parity with a PHEV by 2021 and below by 2025

Technology costs are declining even faster than anticipated in the EV teardown Q-Series last year

A lot of lithium has come to market this year and that has at least temporarily overcome the supply inelasticity argument for owning the respective miners. It also takes time to build battery factories, Europe is anticipated to represent about 12% of production within the next decade but has zero today. That suggests there is scope for lithium demand growth to pick up again, and potentially from a low level considering the pressure coming to bear on the price at present but it could take a while since the factories need to be built before demand increases.

This additional report from Benchmark Mineral Intelligence may also be of interest.

Back to top