Brazil Coffee Supplies Swell After Ships for Exports Dwindle

This article by Fabiana Batista for Bloomberg may be of interest to subscribers. Here is a section:

Brazil’s coffee growers just can’t catch a break.

In May, a national strike by truckers stranded beans on the farm, and prices last month tumbled to a 12-year low amid a global glut. Now, a dearth of container ships at Brazil’s top ports is stalling exports of a bumper coffee crop.

For the world’s top exporter, a shift in the global freight market means container ships arrive at ports less frequently, limiting space for less-appealing commodity cargoes including coffee, and warehouses are bulging with bean inventory.

“Shipments have been postponed for days or weeks,” Nelson Carvalhaes, the president of export group CeCafe in Sao Paulo, said in a telephone interview.

Luiz Alberto Azevedo Levy Jr., the superintendent director at Minas Gerais-based Dinamo, one of the largest warehouse operators, said, “If shipments won’t flow faster, we’ll see storage issues escalating in the next 30 days” at terminals scattered across the country, he said. “The harvest has been finished, but most of the beans are still being dried and prepared,” leaving a “huge volume” heading for depots in the coming months, he said in a phone interview.

There is no shortage of coffee but bottlenecks in the supply chain from the rising cost of fuel for truckers to the dearth of ships is contributing to a lack of available supply which is finally beginning to pressure shorts.

The Arabica coffee price has been steadying in the region of $1 since August and broke out of its one-month range to day to break the short-term downtrend which improves potential for at least a reversion back up towards the trend mean.

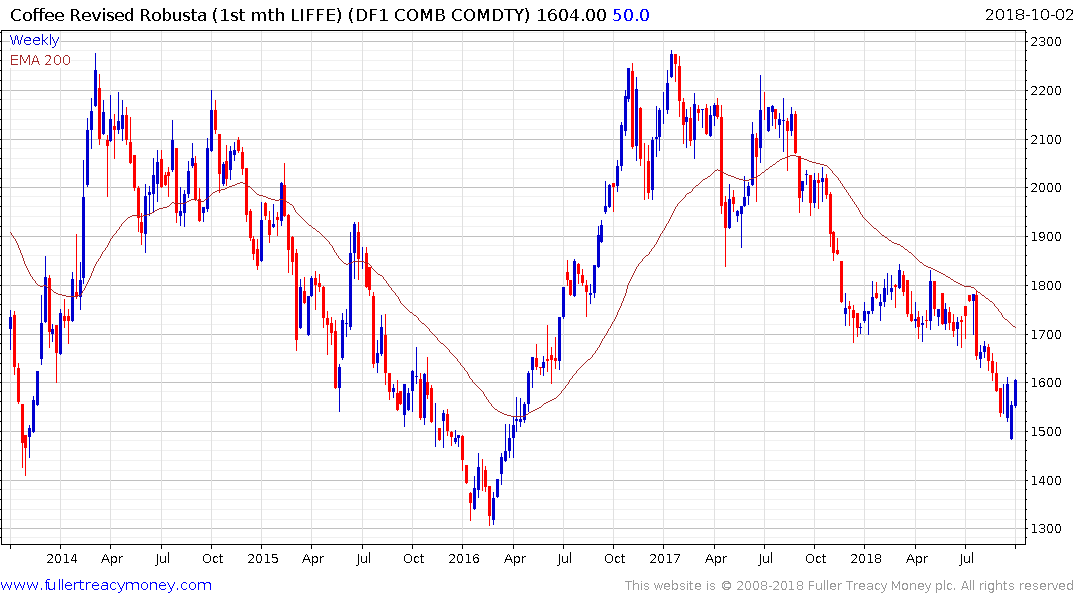

The Robusta coffee price has stabilised since the change into the November contract and is rallying in a similar manner to the arabica price.

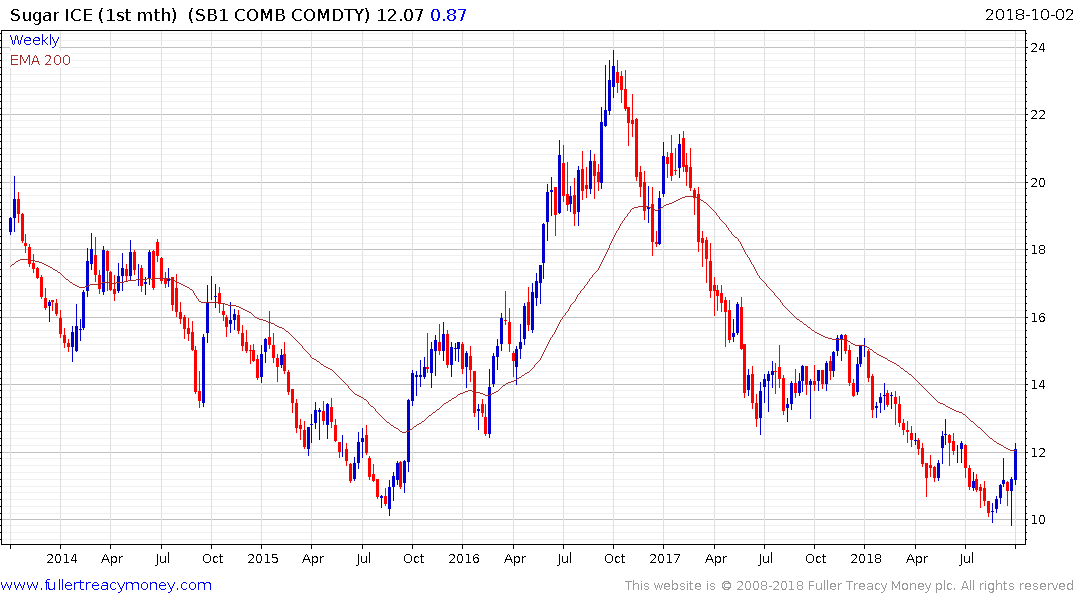

Sugar, another important Brazilian export, rallied yesterday, following the change in the March contract and extended the advance today.

Perhaps the most important point is that these are the first upward dynamics of any substance we’ve seen in the commodities complex in months and that suggests lows of at least near-term and potentially medium-term significance have been found.

Back to top