Email of the day on gold and UK listed gold miners

With gold sustaining its position above $1300, and also holding its own against the other major currencies, as you have highlighted in recent audios, can you please comment on the UK listed gold miners and their potential for some improvement p.s. the service has its finger on the market pulse, and the written and audio delivery is spot on.

Thank you for your kind words and this email which I believe will be of interest to subscribers. Barrick Gold acquired Randgold Resources recently so that removes one of the more attractive gold miners from the universe of UK listed miners. Of course, the UK is one of the most active markets for resources shares so there are plenty of others to choose from.

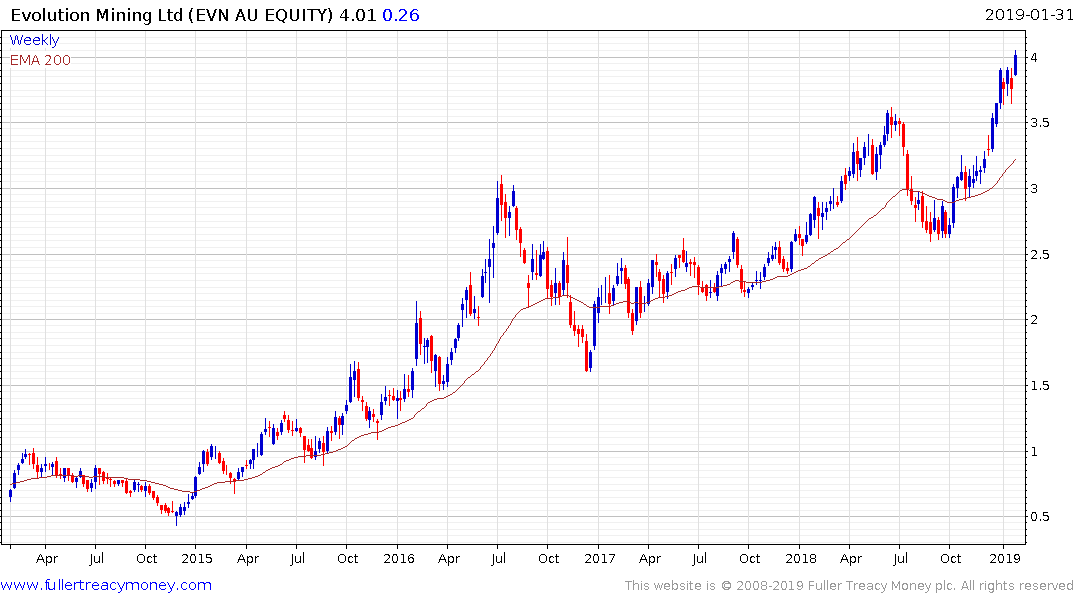

The weakness of the Australian Dollar over the last year has been a significant tailwind for Australia gold miners not least since the price of the metal in Australian Dollars is at an all-time high. The current rebound is AUD represents a headwind for shares like Evolution Mining which exhibit short-term overbought conditions.

Meanwhile the price of gold in Pounds spent much of its time between mid-2016 and late 2018 trending downwards. It rallied to break the succession of lower rally highs in December and is now firming from the psychological £1000 level. A sustained move below the trend mean would be required to question medium-term scope for additional upside.

There are 53 precious metals companies listed in the UK. These range from minnows to five with a market cap of over £1 billion.

Fresnillo (Est P/E 25.07, DY 2,96%), one of the world’s largest producers of silver, gave up all of its 2016 advance but has rallied over the last week to break the sequence of lower rally highs and is now trading above the trend mean.

Polymetal (Est P/E 13.37, DY 4.07%), with assets concentrated in Russia, is outperforming as it continues to extend its rebound.

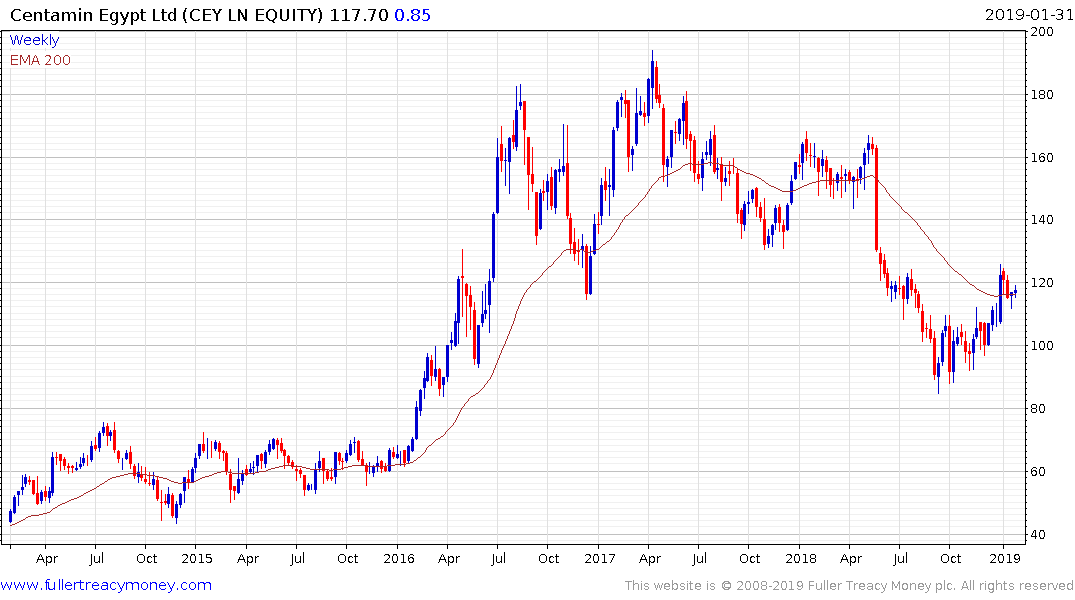

Centamin (Est P/E 23.05, DY 7.66%) collapsed in June following missed production targets but the share has rebounded and is currently testing the region of the trend mean.

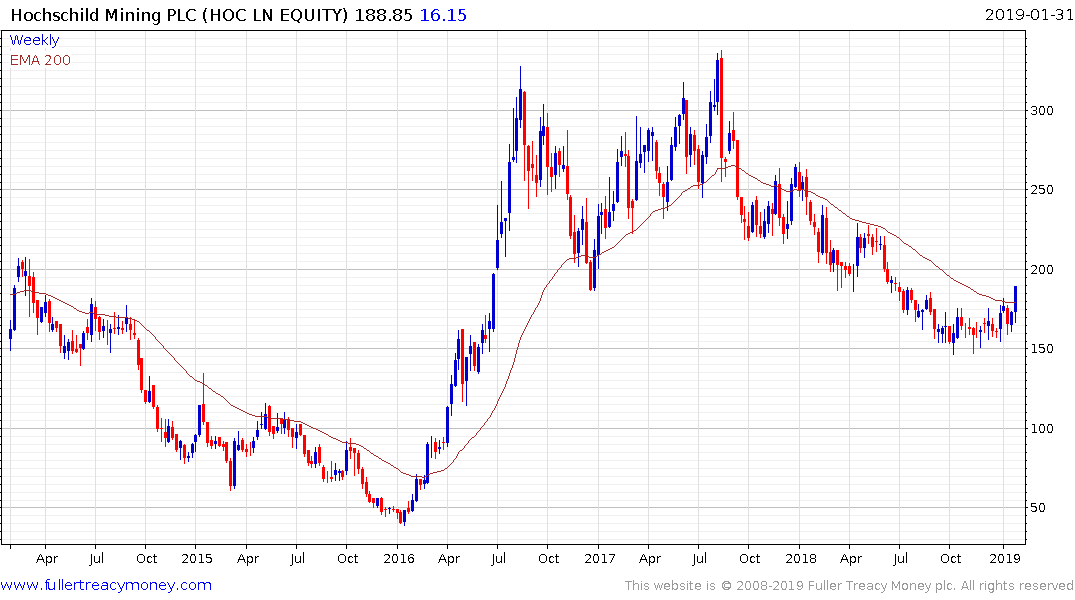

Hochschild Mining (Est P/E 130.43, DY 1.57%), another silver miner, completed a six-month base formation today, to close back above the trend mean for first time in more than a year.

Acacia Mining (Est P/E 17.3, DY N/A) is currently firming from the region of the trend mean.

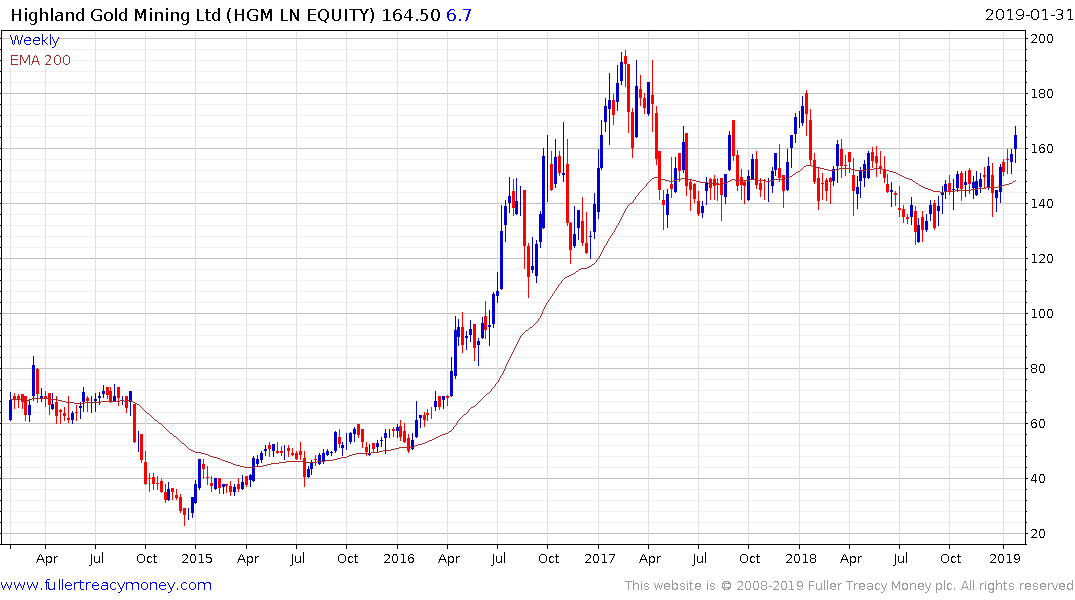

Highland Gold Mining (Est P/E 9.81, DY 6.69%) held just about all of its 2016 advance is currently firming from the lower side of its range.

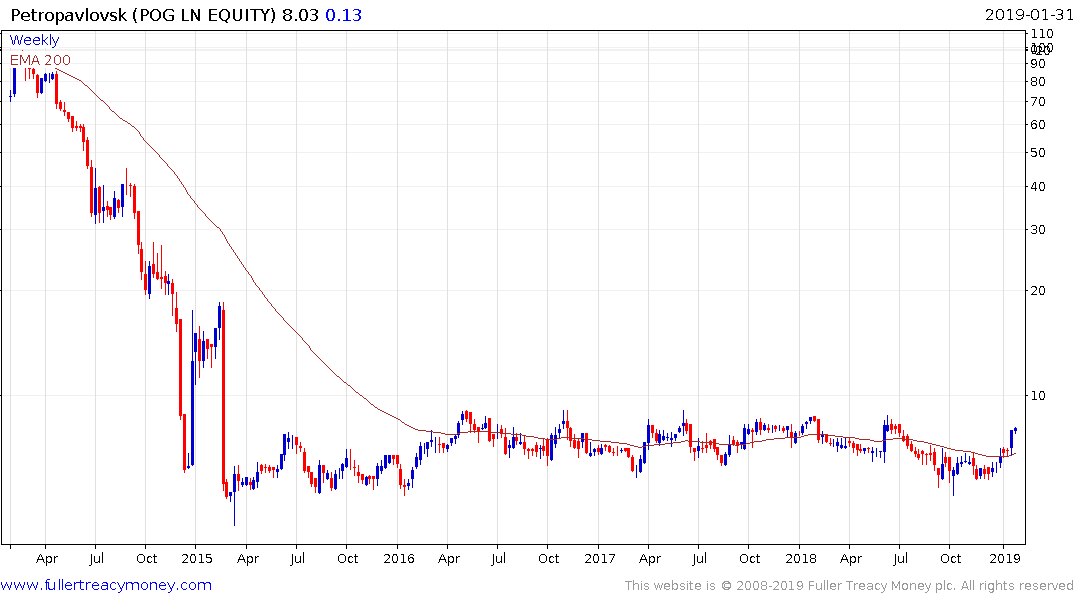

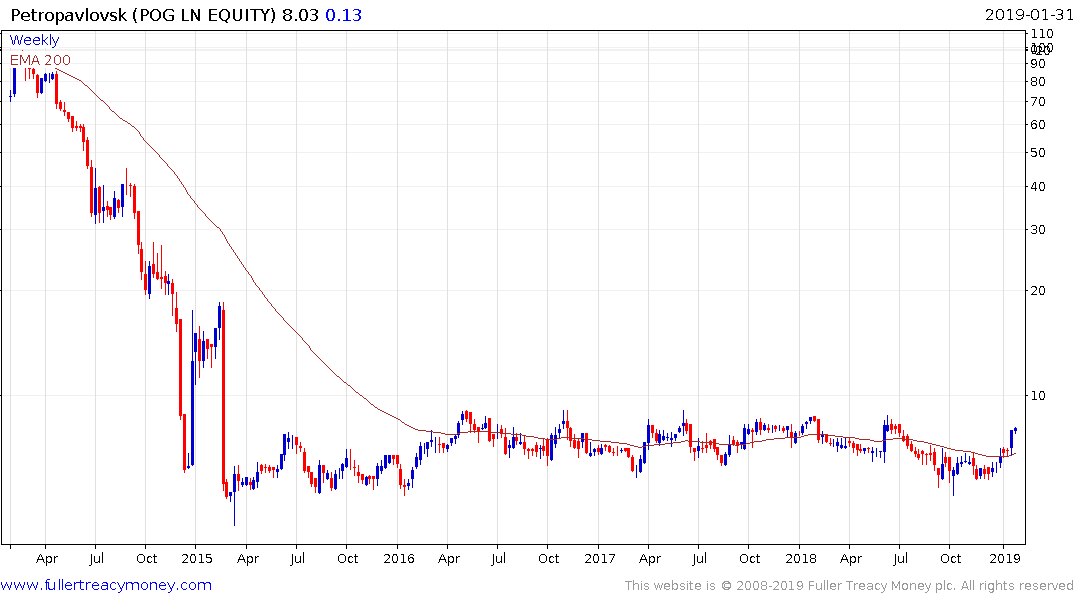

Petropavlovsk (Est P/E 8,78, DY N/A) is firming within a four-year base formation.

.png)

Pan African Resources (Est P/E 7.72, DY N/A) has held a succession of higher reaction lows for a year and the pace of the advance is now picking up.

The commonality evident among the UK’s largest listed gold miners is a clear indication of renewed investor interest in the gold mining sector which is a being supplemented by the metals firmness in British Pounds.

Back to top