Neutral Fed Funds, Dead Ahead

This article from Bloomberg’s economists may be of interest to subscribers. Here is a section:

Given the lagged and variable impact of monetary policy on economic conditions -- further complicated in the current cycle by the Fed’s balance-sheet unwind -- policy makers will need to navigate with caution when in the proximity of neutral. Fed Chairman Jerome Powell, in his Jackson Hole speech, sounded dual warnings about this: First, he stressed economists’ inability to estimate the neutral level of interest rates in real-time and cautioned against the “mistake of overemphasizing imprecise estimates of the stars”; second, he invoked the Brainard principle, which advocates moving conservatively on policy when the effects of action are unknown.

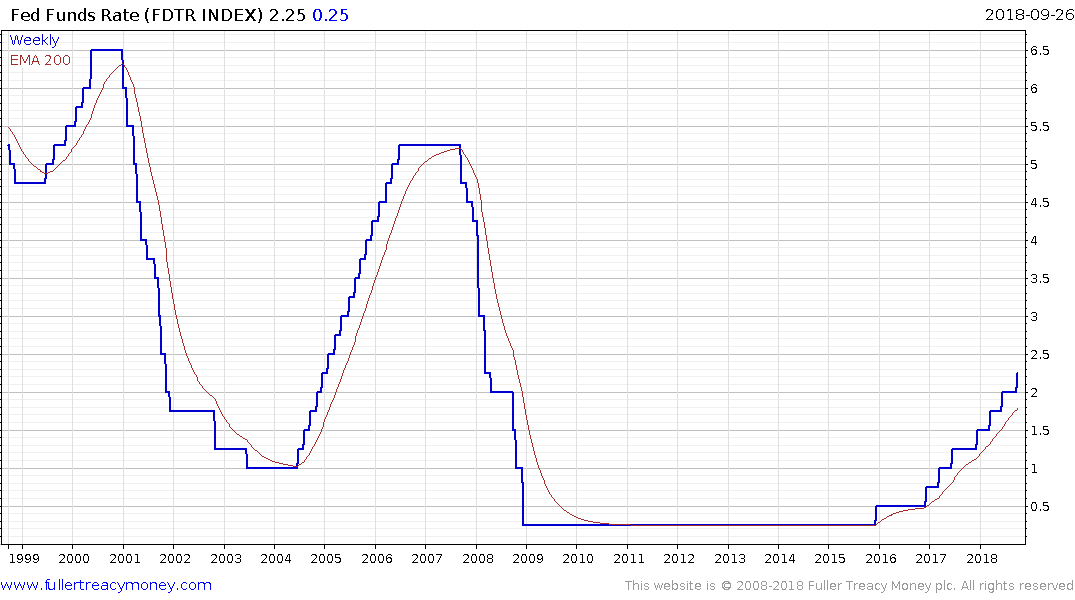

If growth is moderating toward trend and inflation appears to be centering around policy makers’ objective as the fed funds rate probes neutral territory, a significant portion of the FOMC should be willing to slow -- if not pause -- the pace of interest-rate increases in order to assess economic conditions. Policy makers may not be able to precisely identify the neutral policy rate in real time, but a continual decline in the terminal fed funds rate over the past several tightening cycles (shown below) serves as a cautionary reminder that, as Powell quipped at Jackson Hole, a “smaller dose” of normalization may prove adequate.

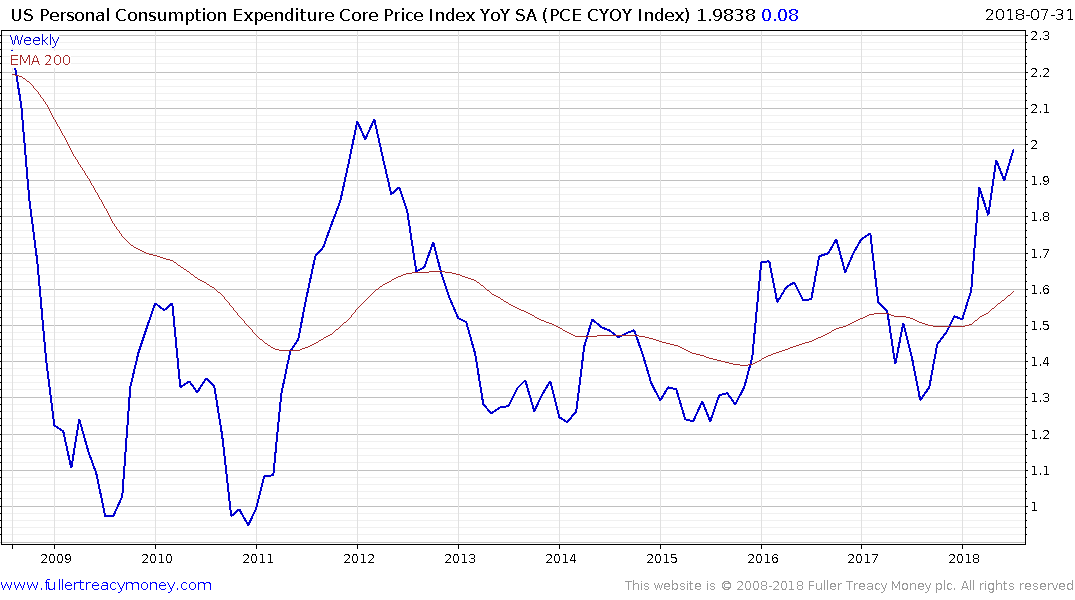

The PCE Core inflation gauge, which is the Fed’s preferred measure currently stands at 2%. Chained PCE inflation is at 2.3%. The Fed’s Funds rate is now 2.25% so it is becoming increasingly clear that after 8 rate hikes policy is moving from accommodative to neutral.

The PCE Core Inflation Index will next be updated on September 28th. The Index has held a progression of higher reaction lows since 2010 and 2% represents the upper boundary of the range which has persisted since 2012. If inflation breaks on the upside then the calculation of whether the Fed’s policy is in fact now neutral will need to be revisited.

The 10-year Treasury future is short-term oversold and testing the May lows. It steadied today but upside follow through will be required to signal a return to demand dominance.

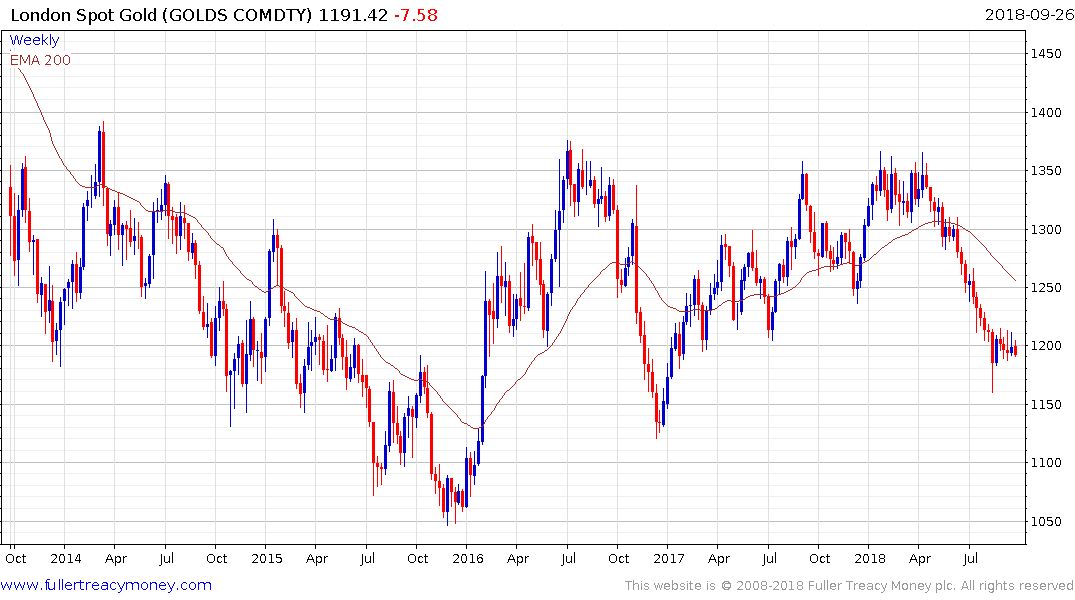

Gold continues to hold in an inert manner near $1200. That condition is not going to persist indefinitely for what has historically been a volatile price series.