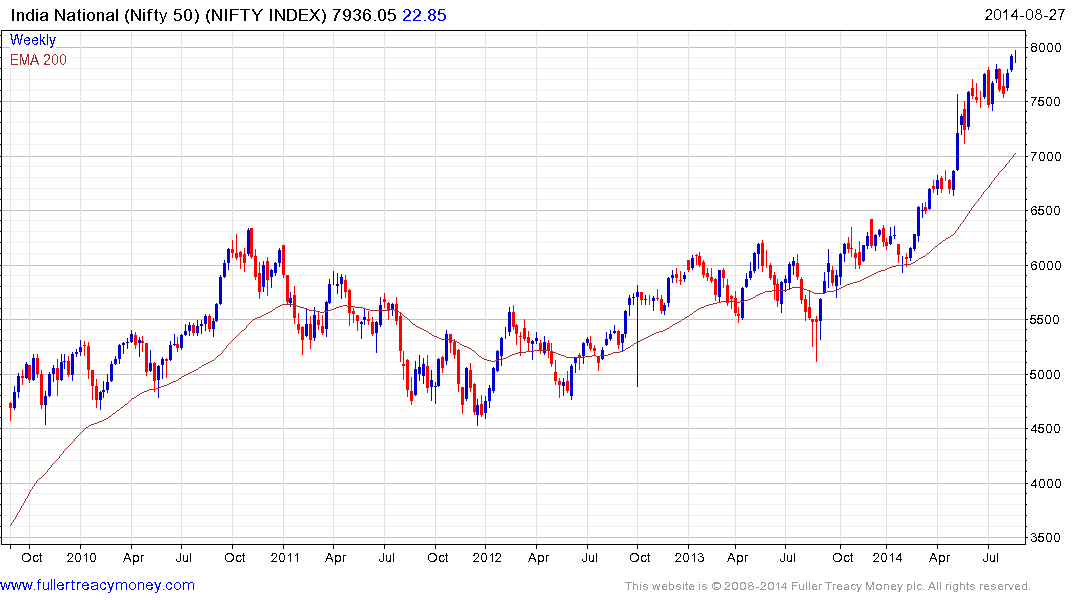

ndian Stocks Rebound From Two-Month Low as Industrials Advance

This article by Santanu Chakraborty for Bloomberg may be of interest to subscribers. Here is a section:

Eoin Treacy's view -“The market rebounded from an oversold territory as investors used the panic to add to their portfolios,” Jitendra Panda, chief executive officer at Peerless Securities Ltd., said by phone from Kolkata. “There’s speculation that moderating inflation will enable the Reserve Bank of India to lower rates next quarter.”

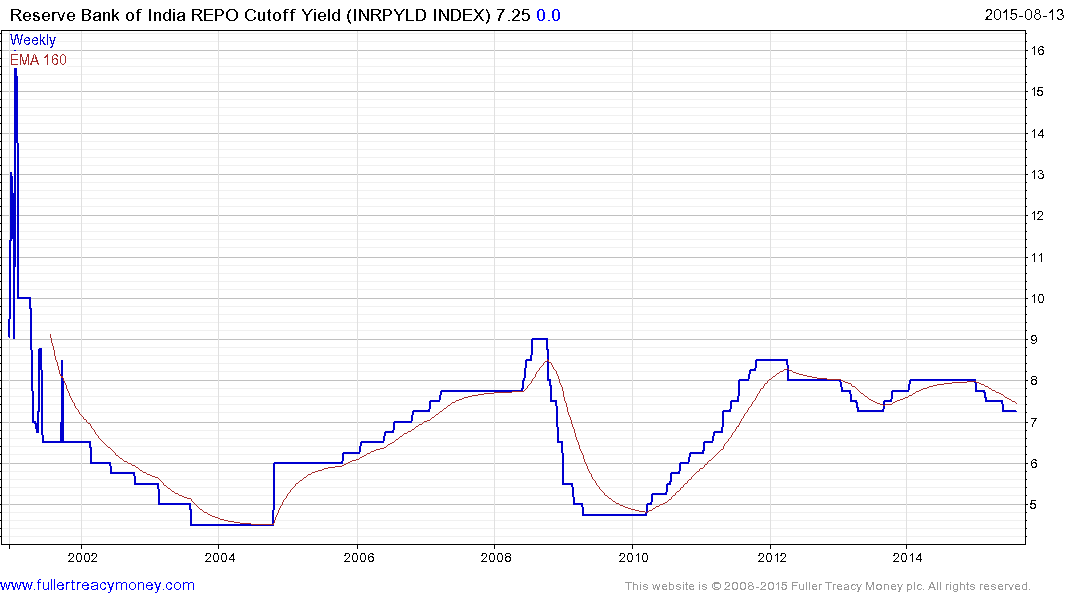

India’s wholesale prices fell for a 12th straight month even while the pace of deflation eased. Consumer prices -- the central bank’s benchmark -- rose 5 percent last month from a year earlier after a 4.41 percent climb in September. RBI Governor Raghuram Rajan has said he can reach his 5 percent CPI target for March 2017 with the current monetary stance. He reviews rates again on Dec. 1, having cut four times this year.

“We expect more than 200 basis points of rate cuts in 2015-2016,” Christopher Wood, chief equity strategist at CLSA Asia Pacific Markets, told reporters in Gurgaon, near New Delhi on Monday. “While earnings growth continues to be downgraded, the offsetting positive is the significant rate cuts.” The brokerage remains “overweight” on Indian equities because the country benefits more than its regional peers from lower oil and commodity prices, he said.

Few countries benefit more from low energy prices than India because it has very little in the way of domestic supply. While other countries are worried about deflationary forces India continues to benefit from disinflation as import prices decline. The current low oil price environment also benefits the government by allowing it leeway to reform the subsidy system without an immediate deleterious effect on the economy.

This section continues in the Subscriber's Area. Back to top

.png)