Get set, Go

Thanks to a subscriber for this interesting report from Deutsche Bank covering the India iron and steel sector. Here is a section:

The Modi administration’s policy initiatives clearly point to India embarking on an East Asian economic model. We expect the steel sector to be a direct beneficiary of the two most important elements of the East Asian model (1) the move to materials intensive growth from an aggressive focus on heavy infrastructure build out and revitalizing manufacturing, and (2) a conscious attempt to keep the currency weak. Importantly, India’s transition to materials intensive growth will coincide with a period of subdued raw material prices.

?Our comprehensive 2020 analysis throws up three non consensus takeaways (1) Indian steel consumption growth to reach an inflection point of 15% YoY in FY18, (2) Domestic production will significantly lag consumption despite large expansions by incumbent companies. India to emerge as a large net importer of steel by FY18 with imports constituting 17% of total consumption by 2020, (3) iron ore imports should peak in FY15 at an historic high of 15.5mt. Abating regulatory headwinds over next 2 years should ensure that India not only remains self sufficient in iron ore but also reverts back to being a net exporter from FY16, though at far lower levels compared to its historical averages. Virtuous cycle of cash flow, profitability and balance sheet improvement

Our comprehensive 2020 analysis of steel stocks under coverage suggests (i) the combination of materials intensive growth, INR depreciation and a subdued raw material pricing outlook will expand RoEs (by 870bps to a sector average of 16.2%) and significantly improve cash flows of incumbent companies over the next 5 years resulting in material improvement in balance sheets which have been a key concern, (ii) we see compelling shareholder value creation over FY14-20 in SAIL, Tata Steel, and JSW Steel driven by volume growth, product mix improvement and balance sheet deleveraging.

Here is a link to the full report.

India has a large young population, with half of the 1.25 billion people under 25. A challenge for the new administration will be to deliver upon the improving standards of living this 600 million strong demographic demands. That means jobs, education, infrastructure and consumer goods. Achieving these goals will be a lot more difficult without infrastructure development and a much stronger manufacturing sector. Modi’s administration knows this as well as anyone which is why he has vocally called for reforms to promote both.

This is good news for the banking, cement, steel and housing markets. In many respects India already has a vibrant consumer base and world class private sector companies. It needs the types of industries China has succeeded in developing over the last thirty years. Therefore we can use China’s development as a template as India enters a period of investment led growth. From India’s perspective its development timeline couldn’t happen at a better time from the perspective of bulk commodity pricing.

Tata Steel’s London listed GDR hit a medium-term low in August 2013 and continues to hold a progression of higher reaction lows. It has stabilised in the region of the 200-day MA over the last few weeks and a sustained move below $7 would be required to question medium-term scope for additional higher to lateral ranging.

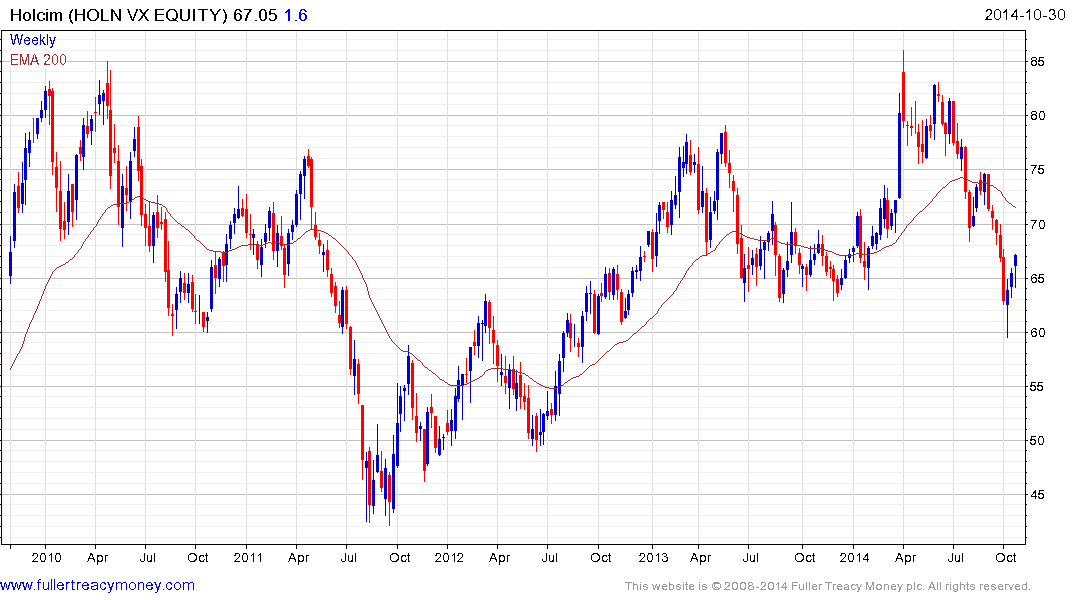

Swiss listed Holcim Cement is the parent company of Ambuja Cement, one of India’s largest cement companies. 35.9% of revenues in 2013 originate in Asia Pacific. The share is currently bouncing from the CHF60 area and a sustained move below that level would be required to question potential for additional higher to lateral ranging.

Ultratech Cement’s Luxembourg listed GDR has also returned to find support in the region of the 200-day MA.

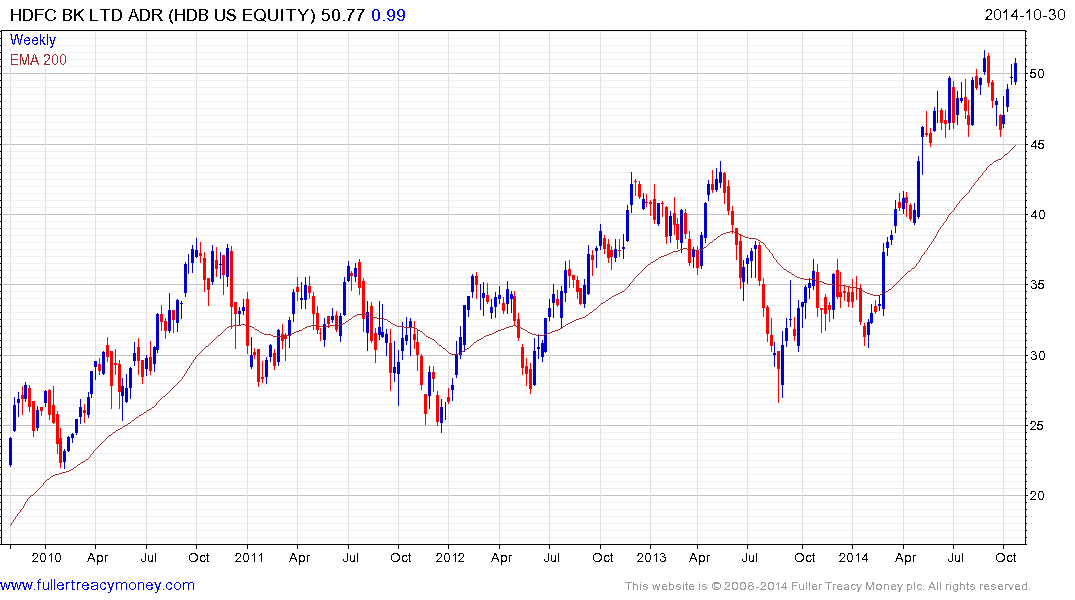

HDFC Bank’s US listed ADR found support earlier this month in the region of the 200-day MA and a sustained move below $45 would be required to question medium-term scope for additional upside.

Axis Bank’s London listed GDR has been consolidating in the region of the 2011 highs since June and a sustained move above $35 would reassert medium-term demand dominance.

ICICI Bank’s US listed ADR is also pressuring the region of its 2011 peak.

Back to top