Ruble Bears Burned After Ignoring Rally Signals: Market Reversal

This article by Vladimir Kuznetsov and Matthew Brown for Bloomberg may be of interest to subscribers. Here is a section:

Traders are cutting short positions before the Bank of Russia holds an interest-rate meeting tomorrow, according to ZAO Citibank. The ruble is still the third-most oversold currency in emerging markets amid speculation that the central bank will speed through the planned adoption of a free float after spending about $68 billion of its reserves this year to slow the depreciation.

?“Today cost the rumor-followers dearly,” Vladimir Miklashevsky, an economist at Danske Bank in Helsinki, said by e-mail. “On one hand, it makes perfect sense to go short ruble on yesterday’s rumors on the free float. On the other hand, it’s dangerous if you think the central bank is capable of a 200 basis-point rate hike.”

Forty percent of fixed-income and rates traders expect Russia’s central bank will increase the key rate by 100 to 150 basis points tomorrow, according to a poll released by brokerage Tradition yesterday. The median estimate of 31 analysts in a Bloomberg survey is for an increase of 50 basis points to 8.5 percent.

The Ruble has been accelerating lower and today’s upward dynamic suggests short covering ahead of tomorrow’s interest rate decision. The country still faces a bleak outlook as sanctions bite and oil prices remain weak but the accelerating trajectory of the Ruble priced in at least some of these factors. Even if one holds a bearish medium-term view, the short-term outlook is for some steadying and potentially a reversion towards the mean.

The US Dollar denominated Russia Traded Index found at least short-term support today in the region of the March lows increasing potential for a reversionary rally back up towards the 200-day MA.

.png)

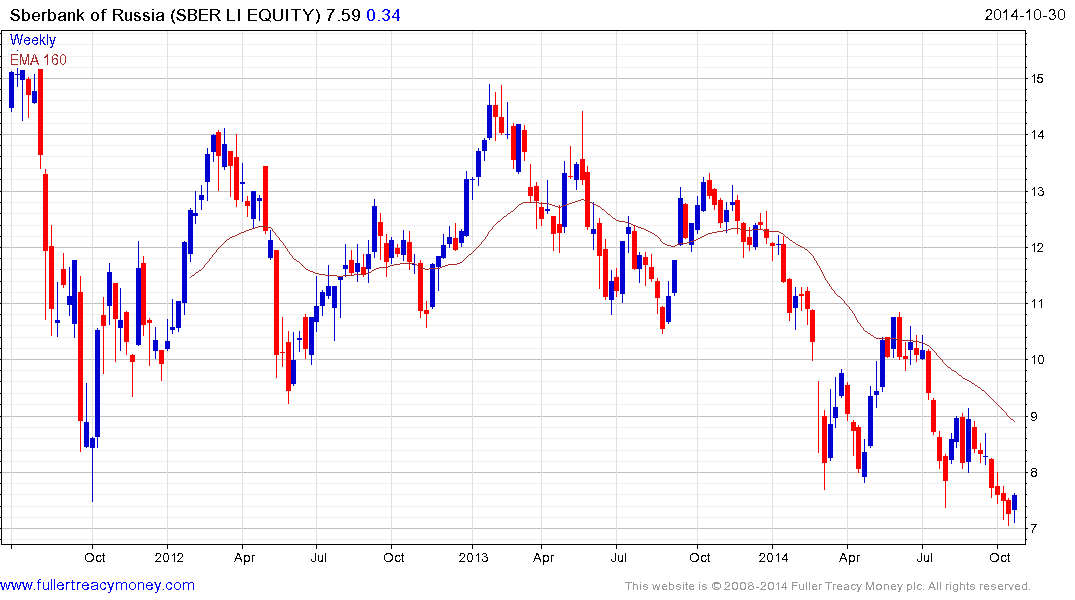

Sberbank remains Russia’s largest lender by far. The company’s London listed GDR firmed today in the region of the 2011 lows and potential for a reversion back up towards the 200-day MA has increased.