Visa Jumps on Plans to Increase Processing Fees

This article by Elizabeth Dexheimer for Bloomberg may be of interest to subscribers. Here is a section:

Visa said yesterday that revenue growth, adjusted for currencies, will be in the “low double digits” for the current fiscal year, helped by changes the company plans to make to some of its processing fees beginning in April.

“With guidance out of the way and pricing coming back, we expect better share performance,” Tien-tsin Huang, a JPMorgan Chase & Co. analyst, said in a research note.

Chief Executive Officer Charlie Scharf, 49, has grappled with a strengthening U.S. dollar, geopolitical tensions and low currency volatility that crimped business overseas earlier this year. Visa said yesterday some of those conditions improved in the quarter, prompting an increase in customer spending outside the U.S.

As the world’s largest payments network Visa might be considered a barometer for the health of the global consumer considering it takes a slice of a large proportion of every online and retail transaction. The fact that the company feels able to raise prices again is a positive development from a macro perspective.

The loss of momentum from late last year represented an inconsistency but the share found support where it needed to two weeks ago in order to confirm demand returning to dominance at the lower side of the range. Today’s upward dynamic to new highs is an emphatic vote of confidence. Some consolidation is possible following such a large move but a sustained move below $200 would be required to question medium-term potential for additional upside.

Mastercard has a high degree of commonality with Visa.

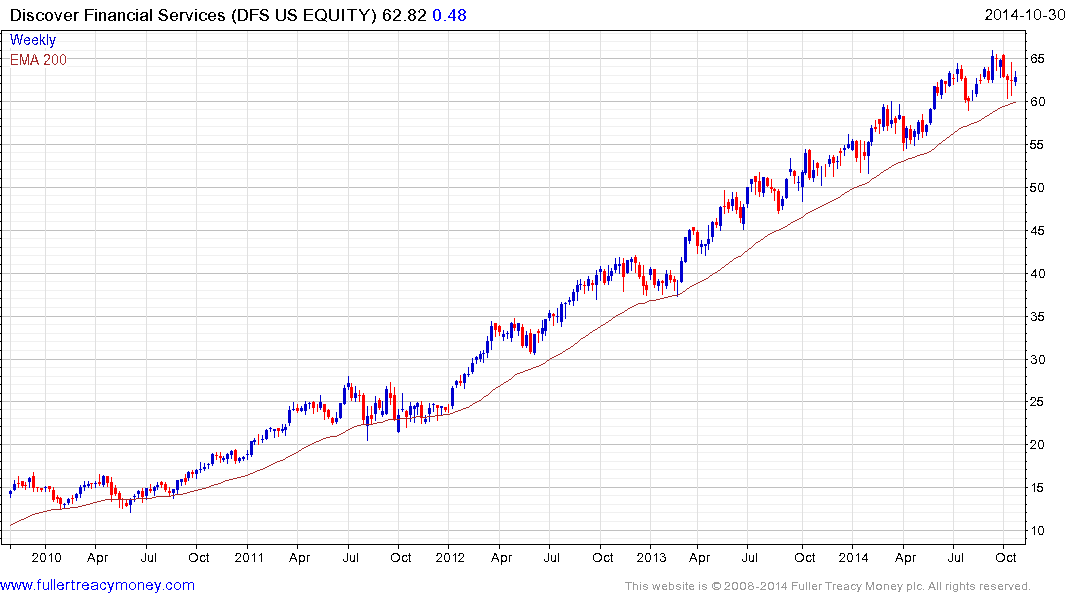

Discover Financial remains in a consistent rhythmic uptrend.

The positive reception of Apple’s upcoming Apple Pay product is at least part of the reason the share has been able sustain the breakout to new highs.

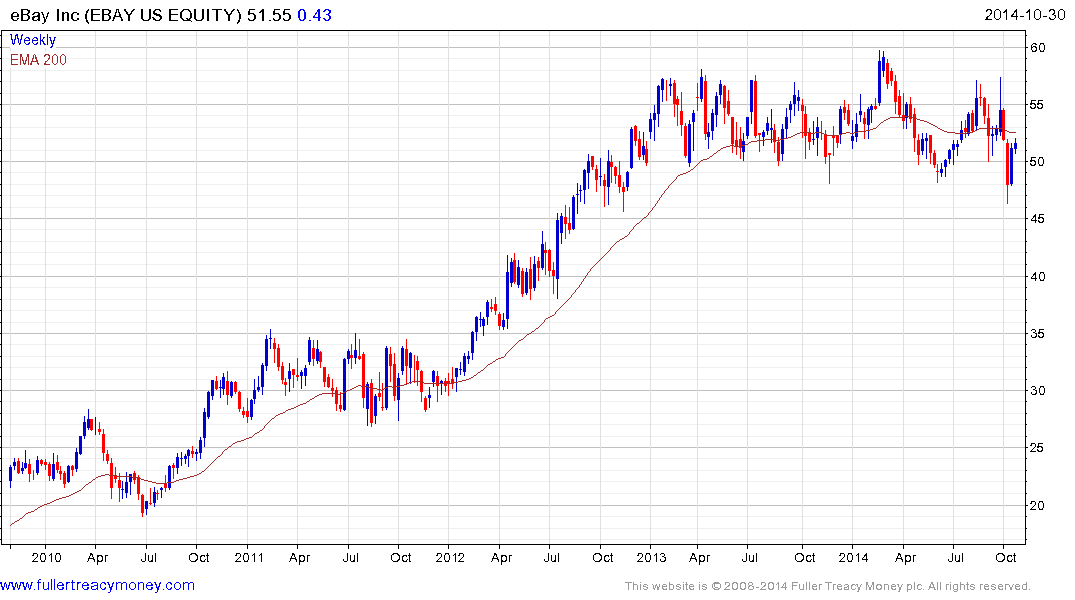

Ebay’s proposed spin-off of PayPal should help to at least stabilise pricing ahead of the demerger.

Back to top