The Revived Bretton Woods System First Decade

Thanks to a subscriber for this fascinating report by Michael Dooley at UCSC, David Folkerts-Landau and Peter Gerber at Deutsche exploring the role of trade-offs between international capital and China’s reserve accumulation. Here is a section on India which may be relevant for the future:

Recent developments outlined above suggest that India is not now on the path to replace China in the system. But looking forward, the Modi government’s plan, if implemented, would reload India into the periphery of a Bretton Woods II system. The 2014 election manifesto of the Bharatiya Janata Party announced several economic goals. A country intending to push an export-driven development policy could hardly describe its policies and goals differently. In sum, the manifesto seems aimed at vigorously implementing this strategy. The manifesto espouses: “A strong manufacturing sector will…create millions of jobs and increase incomes for the working class. Above all, it will increase the revenue for the government and lead to import substitution to bring down the import bill. We will make India a hub for cost-competitive labour-intensive mass manufacturing. (p. 29).”

Specifically, the manifesto proposes several policy goals to boost labor-intensive manufacturing. The current account deficit is to be reduced aggressively by focusing on exports and reducing the dependency on imports (italics ours). A program for ports, roads and rail to the interior, and airports is intended to facilitate international merchandise trade by eliminating severe infrastructural barriers. It also intends to eliminate the artificial bureaucratic barriers to commerce. FDI will be allowed in most sectors, except retail, and investment and industrial regions are to be set up as international manufacturing hubs.

Of course, a political party’s manifesto is a wish list. Full implementation always collides with resource and political constraints. But taking it at face value means that India is readying itself to take up China’s role as the next large periphery in the Revived Bretton Woods system. As we said in Section IV, the key to managing the export-driven strategy at a global macroeconomic scale is the recruitment of FDI. The amount of collateral on hand limits FDI, but a large and persistent current account surplus relaxes the limit. In India, the government is now opening the doors to more FDI; and simultaneously, it intends to reduce the current account deficit. Our caveat is that it cannot expect a China-like attraction of FDI unless it can swing the current account into surplus. The manifesto seems to aim for these conditions, but this is a case of wait-and-see for this next test of the collateral hypothesis.

Here is a link to the full report.

If you have the time I would recommend reading this report in its entirety not least the portion beginning at the end of page 13 focusing on the role of China’s sanitation of currency inflows on the low interest rates that continue to prevail in the USA and Europe.

When we consider India’s role in the global economy, it has many of the characteristics China is seeking to develop and vice versa. India has a vibrant consumer economy, world class corporations successfully competing internationally, property rights, an independent judiciary and respect for minority shareholder interests. It also runs persistent twin deficits, its manufacturing sector is undeveloped, infrastructure has decayed to the point of obsolescence or does not exist, development planning has been haphazard to say the least, bureaucracy is sclerotic and corruption inhibits growth at every turn.

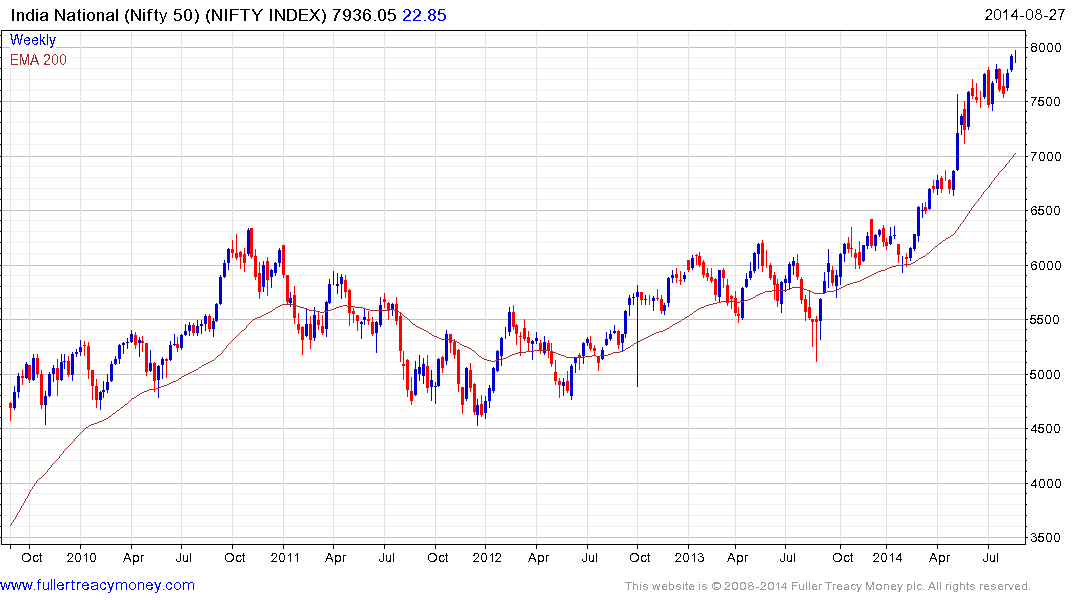

The stock market is beginning to price in the eventuality that the new BJP administration will clear away some of the above obstacles to foreign investment and some progress has already been made. Developing exports of manufactured goods, building roads, ports, railways, airports, sanitation, irrigation, refrigerated warehouses, factories and cities remains a medium-term objective.

Indian 10-year government bond yields spiked higher with the devaluation of the Rupee last year to test the 9% area. The rate has since stabilised near 8.5%.and assuming the new administration lives up to at least some of its promises and the Rupee remains steady, as appears likely, this level probably represents value not least on a relative basis.

Back to top