Iger's Legacy at Stake in Possible Disney Deal for Twitter

This article by Christopher Palmeri for Bloomberg may be of interest to subscribers. Here is a section:

The 65-year-old chairman and chief executive officer of Walt Disney Co. is scheduled to retire in June 2018. He’s already achieved a number of milestones, including Disney’s revival of the “Star Wars” film series and the opening in June of the company’s $5.5 billion Shanghai resort. But one issue bedevils him and most other media executives: how to transition to a world where mobile devices, not TV screens, dominate news and entertainment.

The question underscores Disney’s interest in Twitter Inc. The Burbank, California-based company has hired an investment bank to advise on a possible Twitter merger, Bloomberg News reported Monday. A deal would unite the world’s largest entertainment company, the home of ABC, ESPN and Mickey Mouse, with the technology pioneer that created the 140-character tweet. It could let Iger leave knowing he’s given Disney a big presence in digital media and advertising.

“That would be his final stamp on Disney,” said Tim Galpin, a professor of management at Colorado State University and co- author of “The Complete Guide to Mergers and Acquisitions.” “If he could get that behind him, he could walk off with a final major success story.”

Twitter, whose co-founder and CEO Jack Dorsey sits on the Disney board, has already been dipping his toes in live sports, airing National Football League’s night games. That’s a business that Disney, the parent of the leading sports TV network ESPN, knows well and that clearly intrigues Iger.

The acquisition and successful reboot of Star Wars coupled with the opening of the Shanghai resort were major successes for Disney. However that does not obscure the fact that the company’s broadcasting and cable divisions represent almost half of revenues and face challenges from interlopers like Netflix, Hulu and YouTube. These challenges have yet to be addressed.

Disney exhibited one of the most consistent uptrends of any share between 2011 and August 2015, when the advance was capped with a large downside weekly key reversal. Since then the share has been confined to a volatile range and has exhibited a downward bias for much of this year. It is now testing the lower boundary near $90 and sustained move above the trend mean will be required to check the slide.

Speculation Twitter will become the subject of a takeover offer has reignited interest among some of the more downtrodden social media shares. Twitter had lost downward momentum from early this year and has held a progression of higher reaction lows since June. Last week’s surge sees the share trading above the trend mean for the first time in more than a year and a sustained move below $20 would be required to question upside potential.

Groupon has been ranging above its MA since early August and a sustained move below it would be required to question the medium-term demand dominated environment.

TripAdvisor has been ranging mostly above $60 since a failed break below that level in February. A sustained move to new lows would be required to question medium-term scope for higher to lateral ranging.

Yelp exhibits one of the sectors most successful recovery trajectories; holding a progression of higher reaction lows since early February.

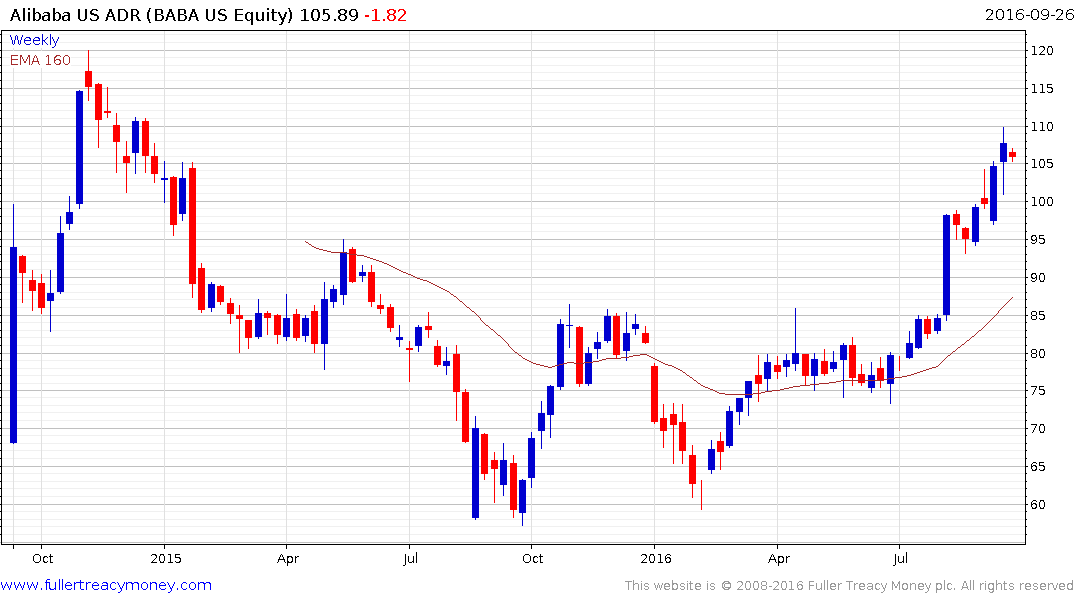

Among US listed Chinese companies, Alibaba rallied in August to break its post IPO progression of lower rally highs and continues to hold a progression of higher lows.

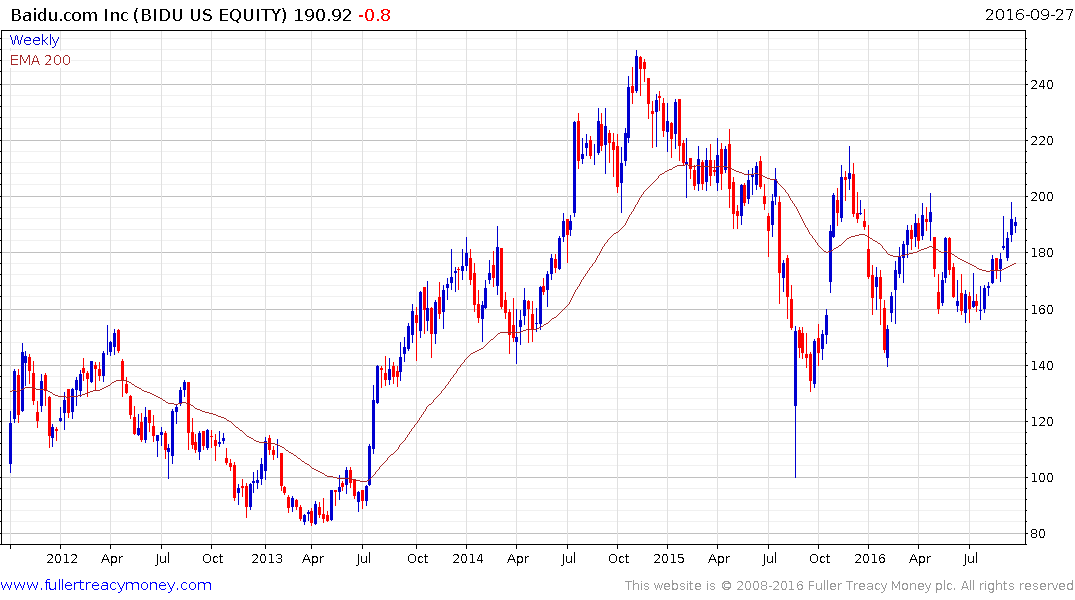

Baidu exhibits a triangular pattern where a sustained move above $200 would signal the lengthy consolidation is being resolved to the upside.