Twilight of the Central Bankers

Thanks to a subscriber for this article by Tad Rivelle for TCW which may be of interest to subscribers. Here is a section:

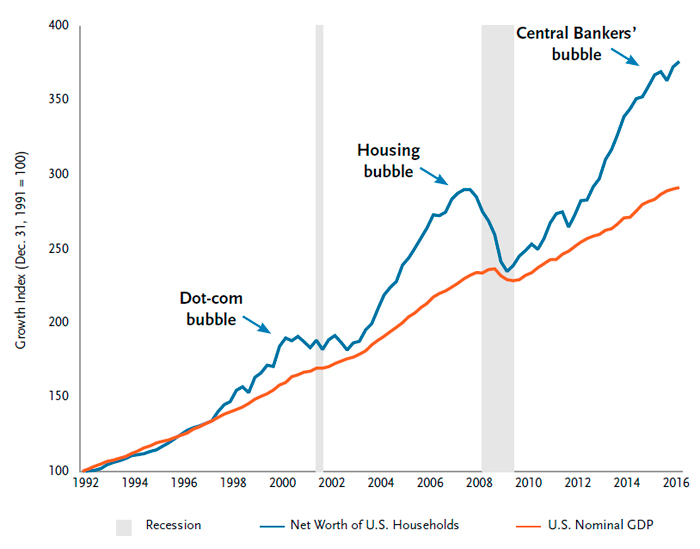

It’s back to the future – again. Leverage has returned, most notably in the corporate sector where debt metrics have not just roundtripped but indeed are now in excess of the levels experienced before the Great Recession.

And while the Fed clings to the fiction that it is “data dependent,” its response function – cowering in the face of every market “tantrum” – reveals monetary policy to be what it really is: a put on financial prices. But can the Fed, Canute-like, hold back the future tides of de-leveraging? No, though we expect that they, like their comrades in arms at the ECB and BOJ, will keep trying. Indeed, negative rates can be best understood as merely the latest attempt to forestall the failures of policies past. But, is anyone helped by establishing negative “hurdle” rates to incentivize “investment?” If a commitment of capital requires a negative opportunity cost, then whatever activity that might be launched will assuredly be productivity destroying. Negative rates have all the economic “logic” of destroying the village so as to rebuild it. It is monetary madness and while it might hold back the flood for a time, it fairly well guarantees that when the flood comes, it will be worse than it would otherwise.

Face it: the central banking Emperors have no clothes. But, might the Fed come up with new artifices to prop up the towers of leverage they have built? They might, though it would be folly. Yet, underestimating folly is, I suppose, a folly of its own. The Fed could continue to use its printing press to falsify capital market signals, but to what end? When a central bank buys an asset with an electronically printed dollar, a “something for nothing” trade has taken place. Unless everything we understand about economics is plain wrong, the Fed cannot go on blithely adding printing press dollars to the system and expect no ill effects. Essentially, inflationist monetary policies cannot be the answer to the problems caused by inflationist monetary policy.

And this is precisely our point: when the supposed “solutions” to the Fed’s dilemma are merely new “problems,” you know you are approaching the cycle’s end. Our counsel remains as it has been: avoid those assets that will be broken in the coming de-leveraging while keeping a “steady as she goes” attitude towards the future purchase of those assets that will merely bend when the flood comes

Friends of ours are moving out of LA because they find the cost of living and the pace of life too hectic. Wishing to spend more time with their kids they are moving to Savannah Georgia. Thinking it would take time to sell their house they asked for a start time of January at their new employment. They were pleasantly surprised, to say the least, to find they received 3 offers within 24 hours of the house hitting the market.

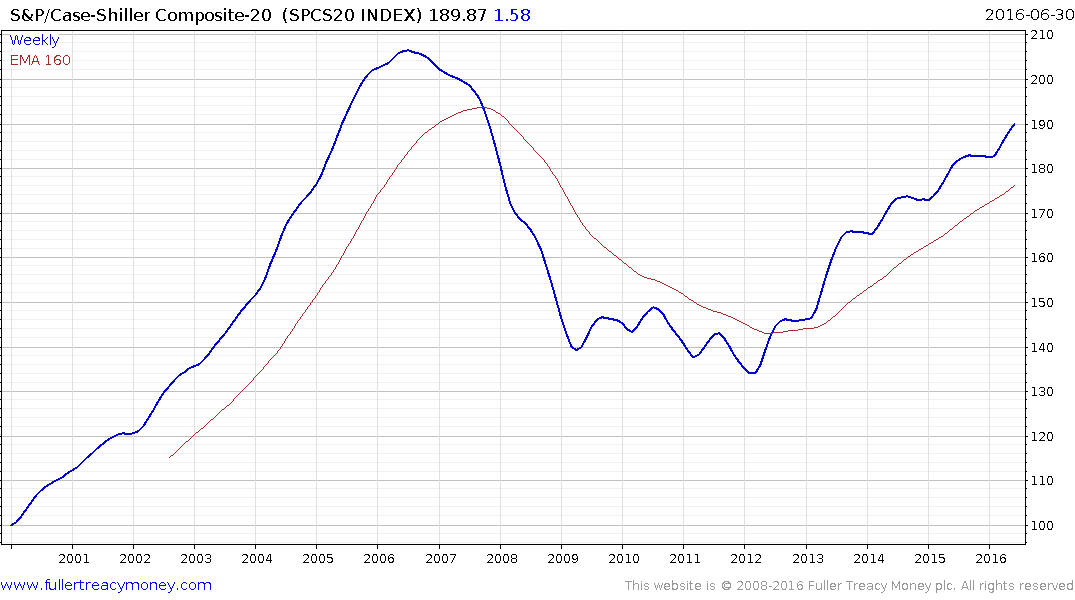

The Case Shiller 20 Index rallied 5% year on year but that does little to highlight just how hot the property market is in some of the USA’s major cities where prices for desirable locations are well above the 2007 peak.

Anecdotal as this evidence might be it is reflective of the fact that very low interest rates for an extended period of time inflate asset prices and encourage leverage. Little wonder then that an increasing number of bond investors are sounding alarm bells at the prospect of the Fed raising interest rates. I posted one such report from DoubleLine yesterday and here is an article quoting Blackrock which is also voicing a cautious tone.

.png)

US 10-year Treasury yields hit a new all-time low in July and quickly retraced much of the accelerated decline to close an overextension relative to the trend mean. The yield has at least paused in the region of the MA and is now testing the short-term progression of higher reaction lows. It will need to find support near 1.5% to signal a return to supply dominance.

This overlay chart of the S&P500 with US Treasury yields illustrates just how distorting extraordinary monetary policy has been on the relationship between bonds and equities. In previous cycles when equity prices rose bond yields followed suit. This time around has been completely different, central bank bond buying has inflated the price of property, equity and bonds simultaneously. Therefore what happens in the bond market is likely to have a material effect on the equity markets and both require close scrutiny.

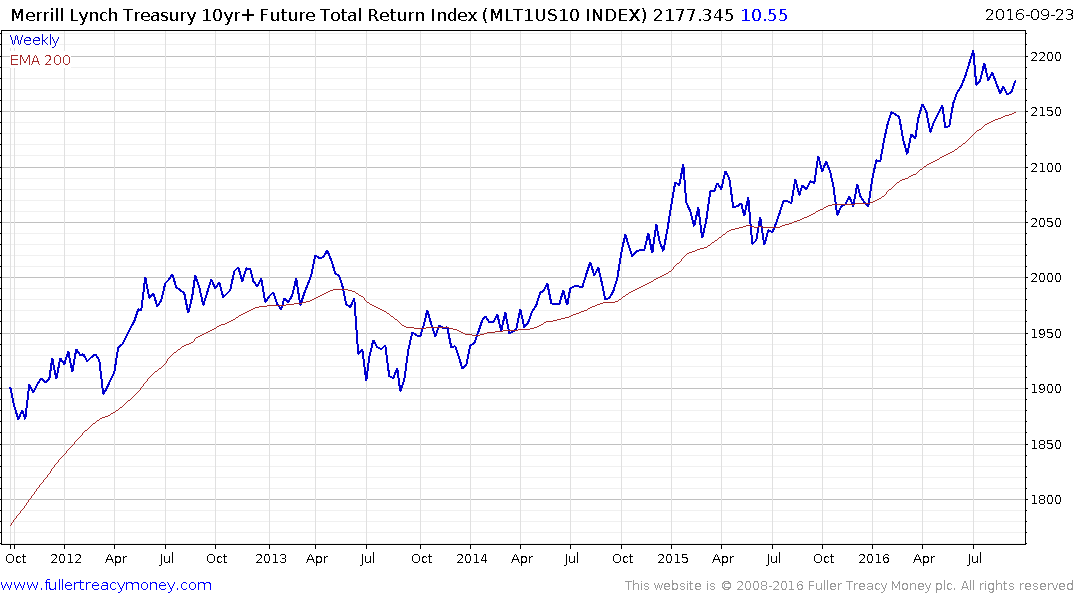

The Merrill Lynch 10-year US Treasury Futures Total Return Index remains one of the most useful measure of the consistency of the trend in Treasures. It has just bounced from the region of the trend, while a sustained move below it would be the minimum required to signal a change to the long-term uptrend. Considering this trend remains reasonably consistent, the concerns being voiced by bond market analysts, serious as they are, might be considering to be more medium-term in nature.