Brazil Is Throwing a Big Impeachment Party

This article by Anna Edgerton for Bloomberg may be of interest to subscribers. Here is a section:

Cunha is the showmaster, a Brazilian Democratic Movement Party member who came out against Rousseff last year, around the time that prosecutors revealed he was under investigation for allegedly hiding money related to corruption in a Swiss bank account.

The speaker is just one of many caught up in a long-running anti-corruption blitz that has put top executives and politicians behind bars. And more than half the members of the congressional panel that recommended the impeachment vote take place are under investigation for everything from alleged campaign financing irregularities to environmental offenses.

As for Rousseff, the current impeachment accusation against her is that she used accounting tricks to hide a budget deficit, which she says isn’t a crime that warrants impeachment. The president has denied any wrongdoing. Still, in the view of many Brazilians, she’s guilty of far worse, presiding over an economy that has sunk into a crippling recession.

Unfortunately being bad at your job and taking office just ahead of a major commodity price decline are not impeachable offenses. Rousseff’s close ties with those being investigated for wholesale corruption within Petrobras and a host of other state owned companies is a different matter.

Right now she enjoys protection from prosecution because of her position in government so it is hard to identify just what charges will be levelled against her when she leaves office and who else her potential demise will bring down. The way prosecutors have hounded Lula Da Silva since he left office represents a good example for why the pro-Rousseff camp wish to keep her in office as long as possible.

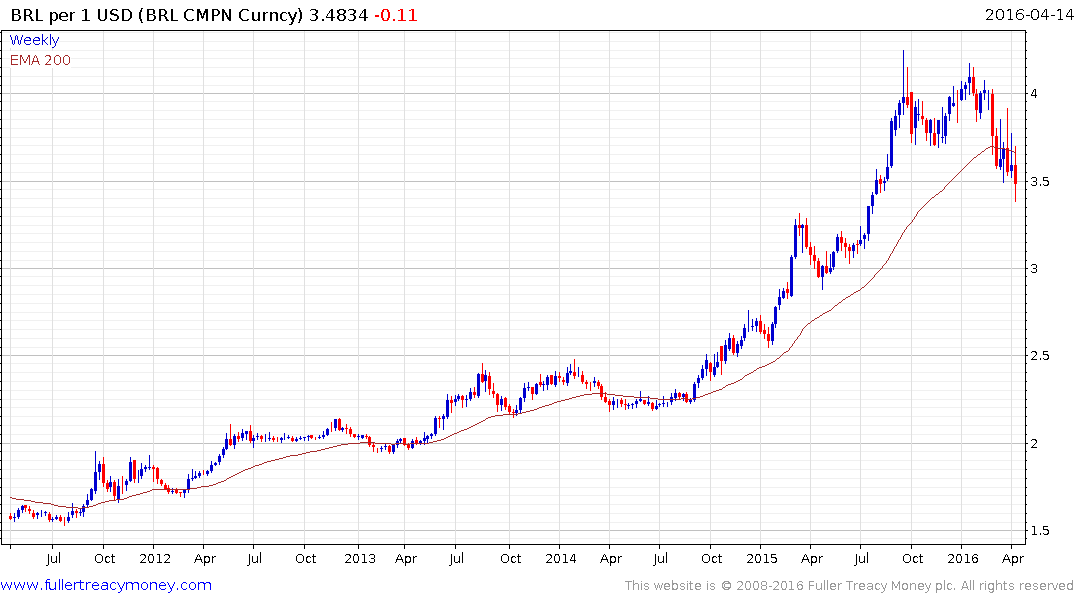

The Dollar hit a medium-term peak against the Real in September and has since fallen by almost 20% to close an overextension relative to trend mean. Additional Real strength in additional to what has already occurred is likely dependent on a new reform minded administration taking over in Brasilia and commodity prices continuing to rebound.

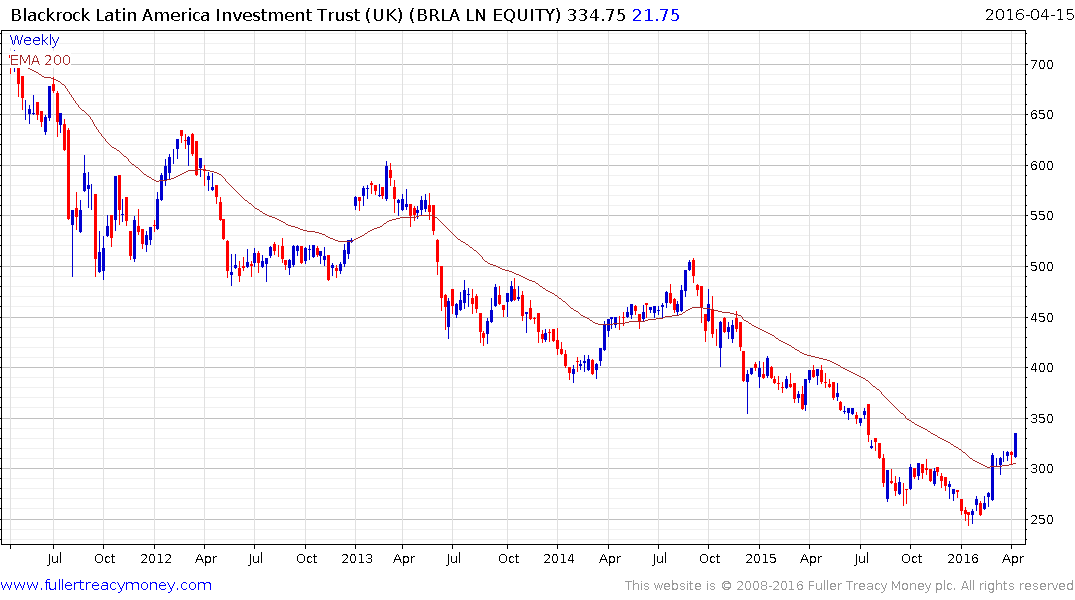

The Blackrock Latin American Investment Trust is currently trading at a discount to NAV of 11.14% and is currently breaking away from the region of the trend mean. It’s weighted about 42% in both Brazil and Mexico.

The iShares MSCI Brazil Capped ETF has a similar pattern.