Morgan Stanley Quarterly Profit Beats Estimates on Cost Cuts

This article by Hugh Son for Bloomberg may be of interest to subscribers. Here is a section:

First-quarter net income fell 53 percent to $1.13 billion, or 55 cents a share, from $2.39 billion, or $1.18, a year earlier, the New York-based company said Monday in a statement.

Profit surpassed the 47-cent average estimate of 22 analysts surveyed by Bloomberg. The decline in trading revenue was smaller than some analysts predicted.

While Chief Executive Officer James Gorman has been shrinking the fixed-income trading division to emphasize the less-volatile wealth-management business, Morgan Stanley is still exposed to slumping markets that hurt results across Wall Street. The firm follows JPMorgan Chase & Co., Bank of America Corp. and Citigroup Inc. in lowering expenses to compensate for falling revenue. Goldman Sachs Group Inc., which reports results Tuesday, is embarking on its biggest cost-cutting push in years, people with knowledge of the effort said last week.

“If these markets were to continue as is, our goals will be extremely difficult to achieve, and we would therefore take additional appropriate actions,” Gorman said in a conference call with analysts. The company is reviewing every product and business to “convince ourselves that we need our footprint as it’s currently configured,” he said.

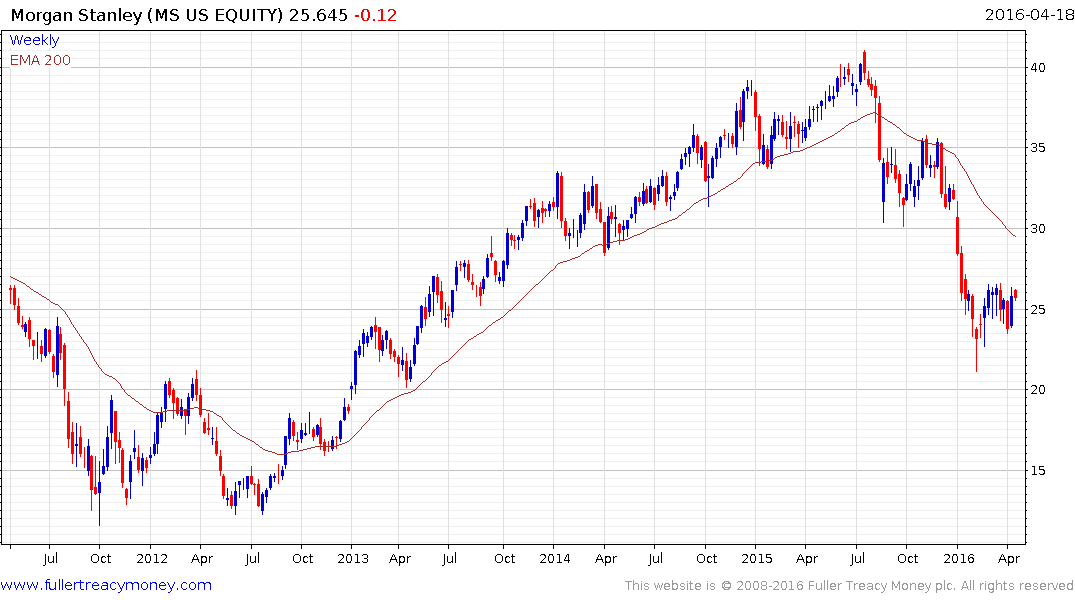

The fact the major investment banks are reporting earnings that are lower than last year but above analyst expectations helps to illustrate just how bearish sentiment has been. While the case for significant additional upside might be hard to rationalise there is scope for reversionary rallies across the sector.

The S&P500 Diversified Financials Index has been led higher by the performance of asset managers. The major banks and investment banks have lagged but continue to shows signs of a reversionary rally.