Has Dr Copper gone on sabbatical?

Thanks to a subscriber for this report from NAB which may be of interest. Here is a section:

2016 is shaping up to be a crucial year for copper producers and copper markets. Its biggest consumer, China, is going through a period of slower economic growth, with structural transitions under way and a depreciating currency. The end of China’s unprecedented growth rates of infrastructure investment, which pushed up metals demand and prices when it started, is now putting downward pressure on commodity prices, including copper. Copper price is now down over 50% since its peak in 2011, while the Chinese economy has been pushing ahead with slower, yet still impressive growth rates. The price falls have certainly been driven by the demand slowdown, but maybe more so by the supply glut and market sentiment in our view.

One complicating factor is the scale and direction of some large carry trades which use metals (including copper) as collateral to take advantage of China’s domestic to foreign interest rate differential (see Page 3). There is a significant amount of copper tied up in these financing deals, with some estimates putting it at as much as ten per cent of total global copper demand. With the narrowing of the interest differential and a depreciating yuan, these trades are now starting to reverse, potentially releasing significant supply into the market, putting downward pressure on copper prices.

On the supply side, producers responded to the previous high levels of demand and prices with increased exploration efforts and new mine constructions. The International Copper Study Group estimates global mined supply increased by 2.6% p.a. between 2009 and 2015, compared to 1.7% between 2001 and 2008. Last year’s large price declines have prompted some negative supply responses, although the cuts have not been enough to fully offset the new capacity. Existing producers have also managed to cut costs to remain in operation and maintain market share. Looking ahead, more than 4.5 million tonnes of copper mine capacity is scheduled to be added by 2020, the timing of which could be important for copper prices.

Overall, our view on China and its metals demand are not as downbeat with a lot of the downside already priced in. The risks could be more from the supply side and overall market sentiment. As a result, we forecast a largely balanced market for 2016 and 2017 and still depressed price levels, with downside risks remaining around new mine supply growth outstripping demand while the China outlook will remain closely watched.

Here is a link to the full report.

A point we regularly make is that supply represents the strongest influence on how prices evolve. Therefore how China’s commodity collateral agreements are resolved and just how much mine supply is taken out of the market will be important if copper prices are to continue to rally.

Copper found support this week above the $2 area to confirm a first higher reaction low in quite some time. A sustained move above 225¢ would break the medium-term progression of lower rally highs and signal a return to demand dominance beyond the short term.

While copper prices have yet to conclusively break their downtrend tin prices continue to consolidative above the MA having completed a multi-month base in early March.

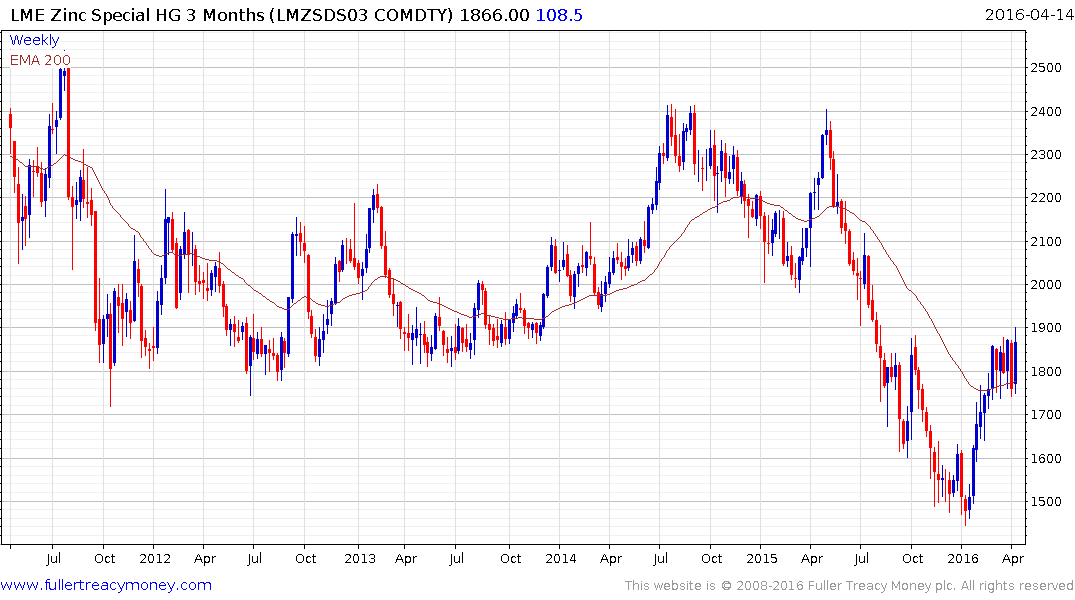

Zinc prices are also consolidating above their MA and a sustained move below it would be required to question potential for additional upside.