US Economic Outlook Rate hikes coming

Thanks to a subscriber for this wide ranging and well-illustrated chartbook from Deutsche Bank which may be of interest. It has 102 slides and is well worth taking the time to look through

Here is a link to the full report.

The tone of the report is generally bullish and acts as a compliment to the points David made in his lead piece yesterday for why the majority of stock market indices should be given the benefit of the doubt provided they continue to find support in the region of their trend means following reversions.

There are a number of moving parts that are coming into play as the Federal Reserve policy stance evolves and as other major central banks engage in outsized stimulus. Historically, the beginning of a tightening cycle has been positive for equity markets since it comes in response to a strengthening economy deemed fit enough to handle the additional stress. The reliance of market participants on leverage and access to abundant liquidity via extraordinary monetary policy raises questions about how the market will react on this occasion. It is for this reason that monitoring price action is so important because it acts as a reality check against which we can measure the efficacy of arguments.

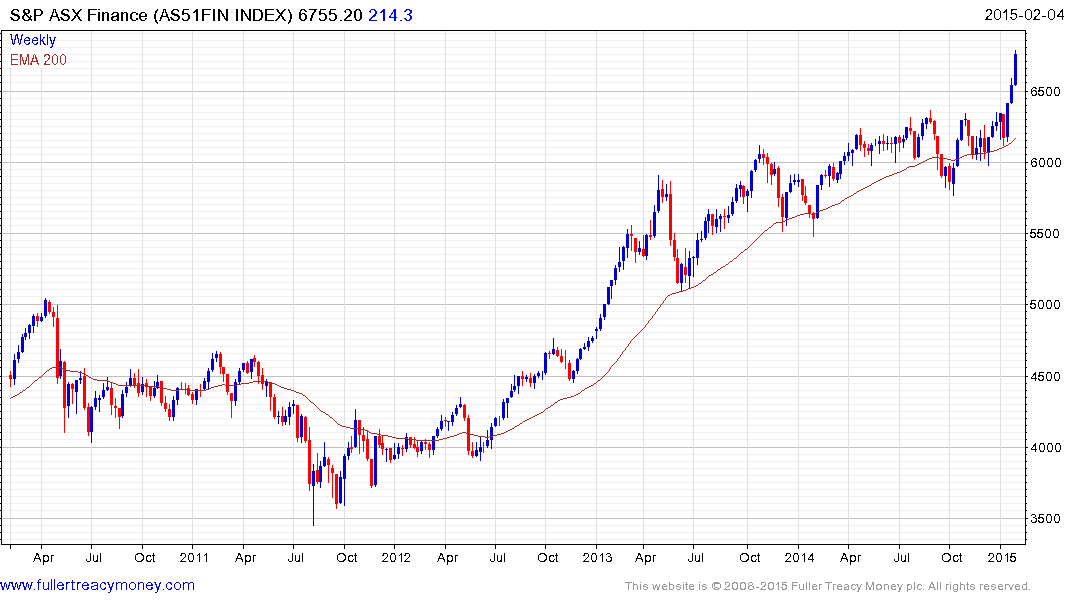

The charts in the report relating to the inflated housing markets of Canada in particular but also Australia represent potential risks for their respective banking sectors. The performance of both these sectors has been flattered by the relative weakness of their respective currencies. The potential for additional monetary easing by their central banks suggests that prices could get even more expensive before an eventual denouement when rates eventually tighten.

The S&P/ASX Financials Index extended its medium-term uptrend again today and a sustained move below 6200 would be required to question potential for additional upside. This article from the Canberra Times may also be of interest. http://canberratimes.domain.com.au/interest-rate-cut-likely-to-turbocharge-sydney-houseprice-growth-20150203-134qd6.html

The S&P/TSX Financials Index continues to firm in the region of the 200-day MA and potential for higher to lateral ranging can be given the benefit of the doubt, at least in nominal terms, provided it holds the 2100 level.