North American Gold Q4 Preview What We Expect

Thanks to a subscriber for this report from Morgan Stanley which may be of interest to subscribers. Here is a section:

Market Reaction So Far Showing Little Tolerance for Guidance

Disappointments or Surprises With several companies having announced their 2015 outlook along with pre-released operating results, the market has shown little appetite for disappointments or surprises. AGI and EGO have seen shares materially impacted after reporting disappointing guidance, declining 26% and 21%, respectively, vs the HUI which is up 23% YTD. EGO was further impacted by heightened uncertainty in Greece. N. Am gold cos still to report guidance incl. ABX, AEM, IAG, KGC, NEM, NGD, SMF-T, FNV, SLW.Budgets Made During Lower Gold/ Higher Fuel Environment Could Provide for Upside Surprises in 2015 With 2015 budgets done early in 4Q - during a lower gold and higher oil price environment, we suspect budgets could prove to be conservative in 2015.

Write Downs Anticipated ABX and GG have already announced that they expect to report impairment charges. ABX's Lumwana mine is expected to transition to care and maintenance by mid 2015 - it currently has a carrying value of ~$1bn. And GG's recently ramped up Cerro Negro mine is expected to take a $2.3-$2.7bn charge. Others could be announced, but we suspect they will be more minor.

Resources Could Decline as a Result of Shrinking Exploration Spend

2013's yr end gold price assumptions look fair, in most cases, relative to spot prices. We highlight GG, IAG and NGD as having some risk of revisions, as all use $1,300/oz or higher. Further reserve declines could occur as slashed exploration budgets show the challenges of balancing capital discipline with replacing ounces mined. We note EGO recently indicated that Kisladag could see a reduction due to deferring expansion plans.

Here is a link to the full report.

Reasonably steady gold prices and weak oil could combine to form a potentially powerful bullish catalyst for gold miners. The majority of miners have gone through painful reorganisations, refocusing on delivering free cash flow in order to attract investors. This has been essential in the face of completion from ETFs which sapped demand for mining shares. As a result many are running leaner operations than at any time since the credit crisis.

Gold miners are increasingly being valued on the all-in cost of production measured in troy ounces. One might reasonably ask why this was not always the case but regardless it is good news and lower energy prices are a benefit. The NYSE Arca Gold BUGS Index returned to test its 2000 low relative to the gold price towards the end of last year and has since bounced. This suggests that the sector now has the potential to offer leverage to the gold price. Provided the gold price remains stable or rises, it should be positive for gold miners.

While the sector generally may be bottoming, the lowest risk proposition remains to focus on relative outperformance. After all, leaders lead for a reason.

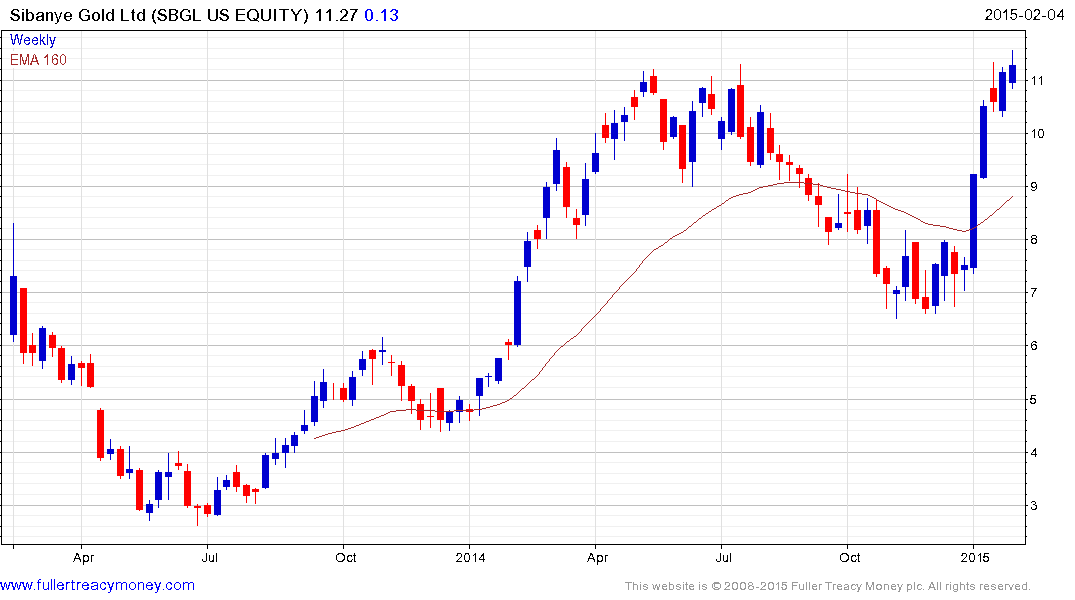

Sibanye Gold with its commitment to increasing dividends is an example. The share has rebounded from the $7 area to retest its peak near $11 and some consolidation of this powerful gain is looking likely. However a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

Zijin Mining encountered at least short-term resistance in the region of HK$2.60 at the end of January and a reversion towards the mean is now underway. Ideally it would find support in the region of HK$2.60 while a deeper decline would likely delay recovery prospects.

Goldfields broke out of a yearlong base in January and a sustained move below $4.70 would be required to question medium-term recovery potential.

Canadian listed Centera Gold broke out of an almost two-year base last week and will need to hold the gain if recovery potential is to be given the benefit of the doubt.